Does Renters Insurance Cover Car Theft

Does Renters Insurance Cover Car Theft?

What Is Renters Insurance?

Renters insurance is a type of insurance policy designed to protect renters from losses that may occur in the rental property. It is similar to a homeowners insurance policy, but it does not cover the physical structure of the rental property itself. Renters insurance typically covers personal property, liability, and sometimes additional living expenses. The coverage amounts and types vary from policy to policy and from state to state.

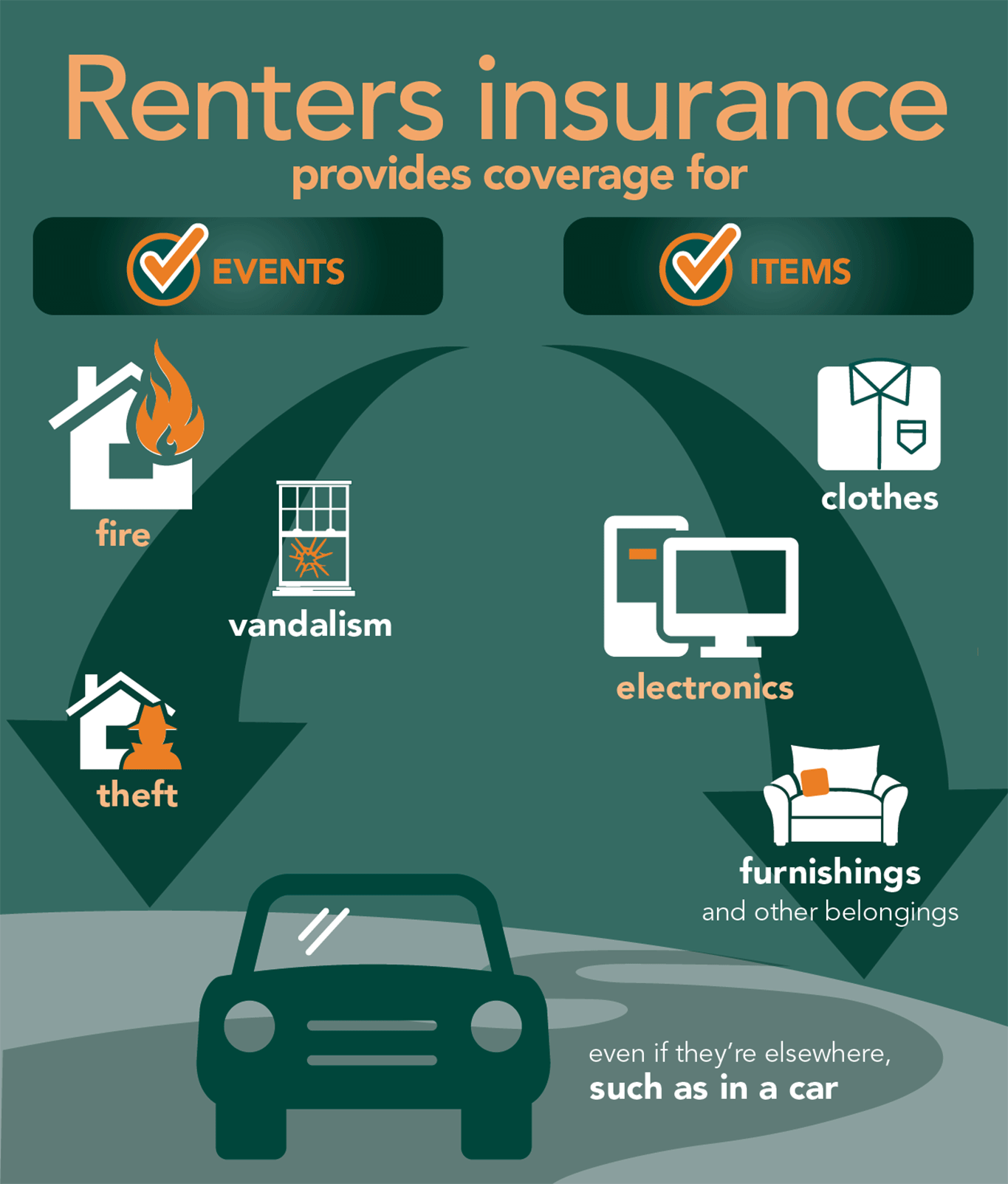

What Does Renters Insurance Cover?

Renters insurance typically covers personal property and liability. Personal property coverage typically includes items such as furniture, clothing, electronics, and appliances, and can also include other items like jewelry, art, and collectibles. Liability coverage usually pays for medical bills and legal costs if someone is injured in the rental property. It also covers damage to another person's property caused by the renter.

Does Renters Insurance Cover Car Theft?

No, renters insurance does not typically cover car theft. Car theft is generally covered under a separate auto insurance policy. Auto insurance policies typically include coverage for theft, liability, and collision, as well as other types of coverage depending on the policy. If you own a car and rent a residence, you should consider purchasing both renters insurance and auto insurance.

What Other Types of Coverage Are Available?

In addition to personal property and liability coverage, renters insurance can also provide coverage for additional living expenses. This coverage pays for additional expenses if the rental property becomes uninhabitable due to a covered loss such as a fire or severe weather. This coverage can help cover the cost of hotel bills, meals, and other living expenses while the rental property is being repaired.

How Much Does Renters Insurance Cost?

The cost of renters insurance varies, depending on the coverage amounts and type of policy you choose. Generally, renters insurance policies cost between $15 and $30 per month, although it may be more or less depending on the coverage amounts and other factors. It is important to compare quotes from different insurance companies to find the best coverage and price for your needs.

Conclusion

Renters insurance is an important form of insurance for renters, as it can provide coverage for personal property and liability. However, it does not typically cover car theft, which is usually covered under a separate auto insurance policy. It is important to understand what type of coverage is included in your renters insurance policy and to compare quotes from different insurance companies to find the best coverage and price for your needs.

Does renters insurance cover theft - insurance

Renting in America | Amica

Does Renters Insurance Cover Theft? | Protective Agency

Does Renters Insurance Cover Burglary | RentPrep

41 What Does Renters Insurance Cover And Do I Need It - The Ross Maghan