Does Renter Insurance Cover Car Theft

Saturday, April 22, 2023

Edit

Does Renter Insurance Cover Car Theft?

What is Renter Insurance?

Renter insurance, also known as tenant insurance, is a type of insurance policy that provides coverage for the renter's personal belongings and liability for damage to the rental property. This type of insurance is not typically required by landlords, but it can be a great way to protect yourself in the event of an accident or theft. Renter insurance is typically affordable and provides a wide range of coverage options, including coverage for car theft.

What Does Renter Insurance Cover?

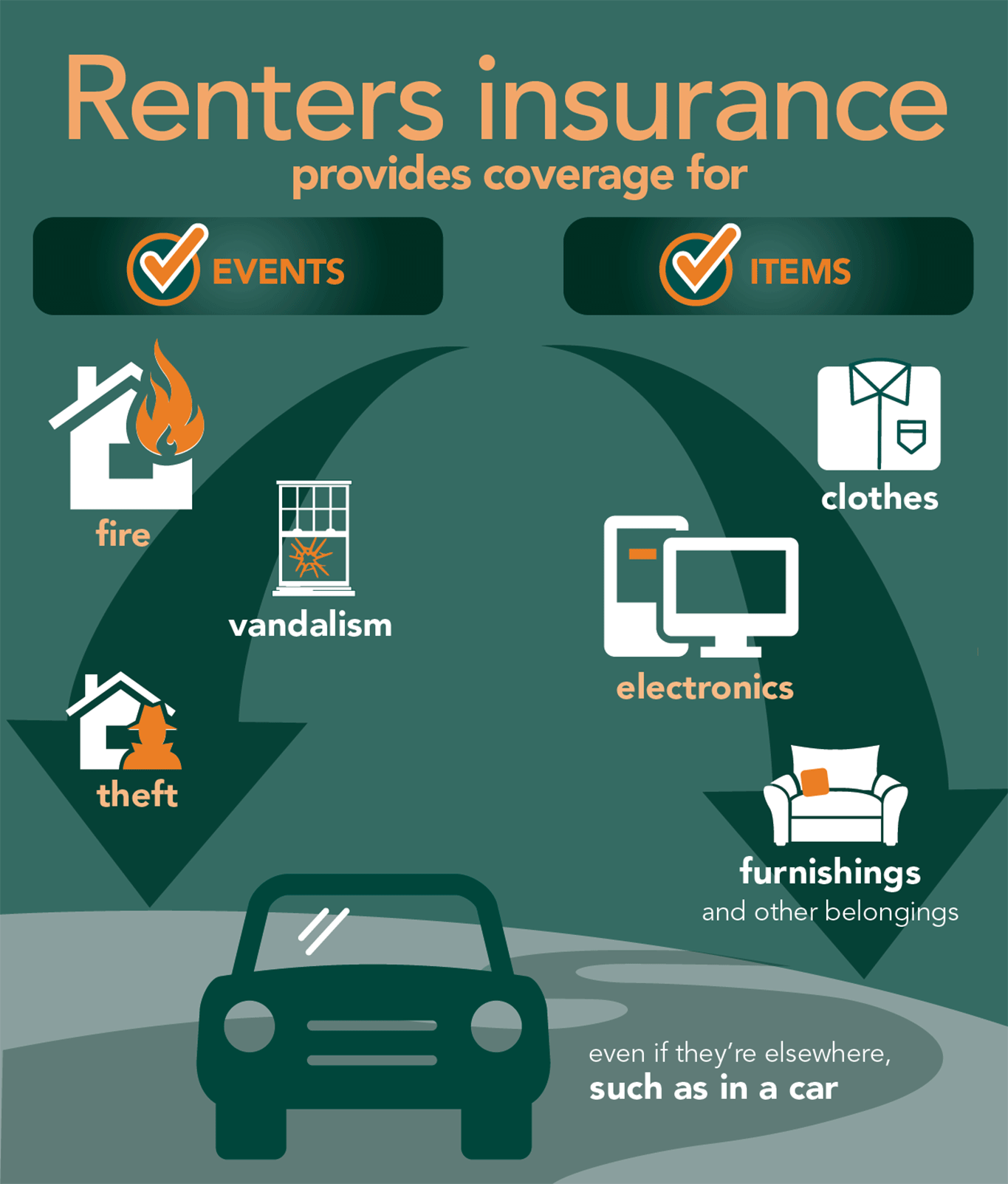

Renter insurance policies typically cover your personal property in the event of theft or damage from a variety of causes, such as fire, theft, vandalism, smoke, wind, and hail. In most cases, the policy will also cover personal liability for any accidents or injuries that occur on the property or to people visiting the property.

Depending on the policy, renter insurance may also cover additional items such as expensive jewelry, musical instruments, or other items of significant value. Additionally, some policies may provide coverage for additional living expenses if the rental property becomes uninhabitable due to a covered event.

Does Renter Insurance Cover Car Theft?

In some cases, renter insurance policies may provide coverage for car theft. However, the coverage is typically limited to a specific amount and may not cover the full cost of replacing the car. Additionally, many policies will require some form of proof that the car was stolen before they will pay out the claim.

It is important to note that renter insurance policies typically do not provide coverage for damage to the car itself. If the car is damaged due to a covered event, such as a fire or a natural disaster, the renter insurance policy may provide coverage for the cost of repairs.

How to Get Renter Insurance

Renter insurance policies are typically available from a variety of sources, including insurance companies, banks, and credit unions. The cost of the policy will vary based on the coverage amount and the deductible. When shopping for a policy, it is important to compare the coverage offered by different companies and to read the fine print to make sure the policy provides the coverage you need.

Conclusion

Renter insurance is a great way to protect yourself and your belongings in the event of an accident or theft. In some cases, the policy may provide coverage for car theft, but the coverage is typically limited and may not cover the full cost of replacing the car. It is important to read the fine print of the policy to make sure it provides the coverage you need.

Does renters insurance cover theft - insurance

Renting in America | Amica

Does Renters Insurance Cover Theft? | Protective Agency

What does usaa renters insurance cover - insurance

41 What Does Renters Insurance Cover And Do I Need It - The Ross Maghan