Renters Insurance Cover Car Theft

Renters Insurance Cover Car Theft: What You Need to Know?

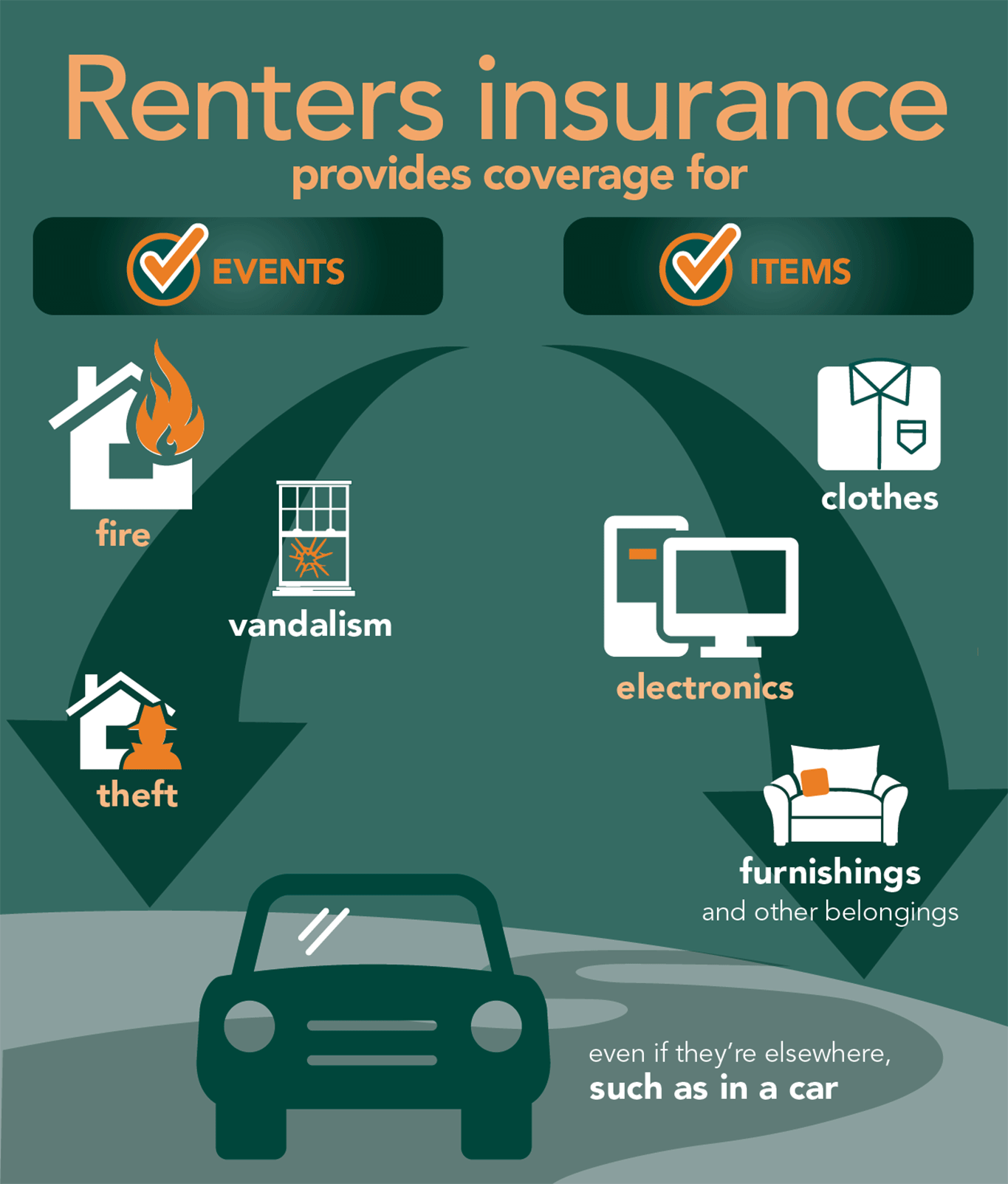

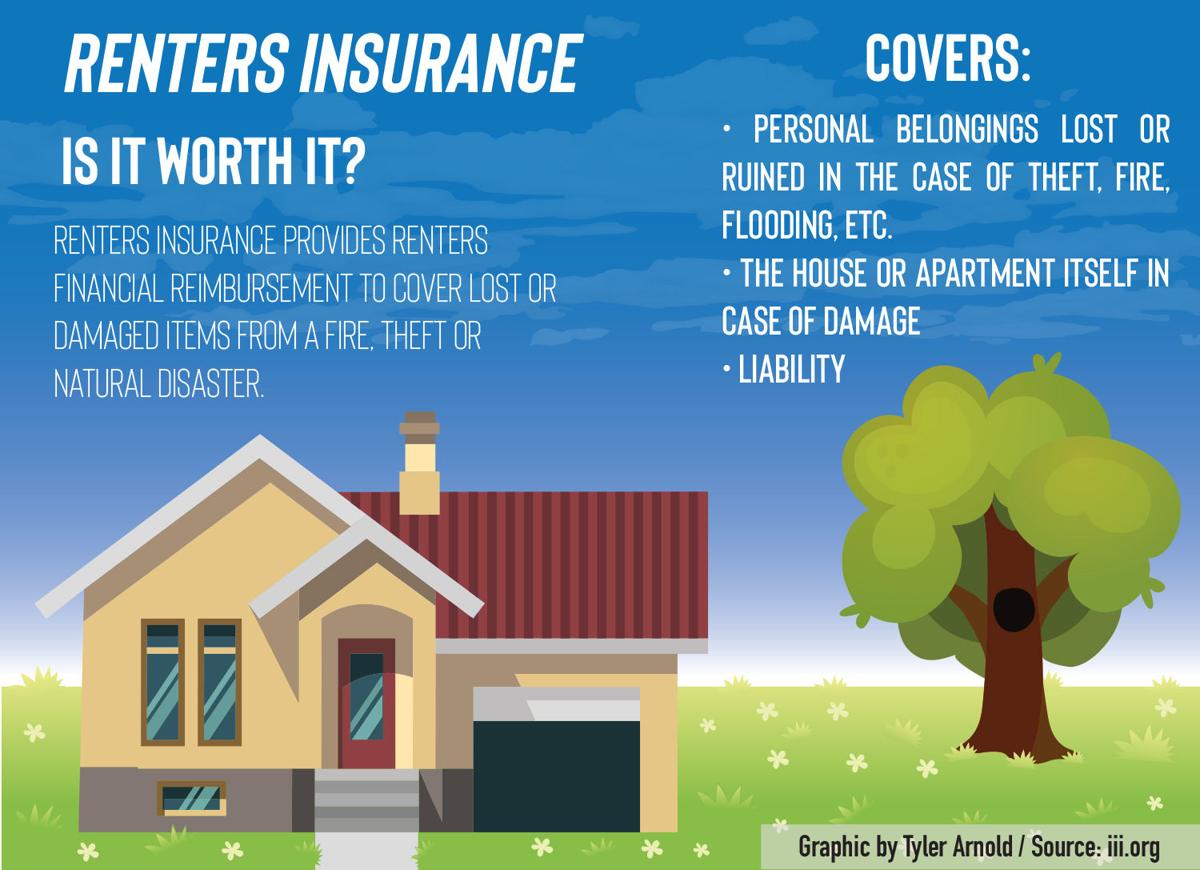

Renters insurance is a type of insurance policy that covers your personal items and belongings, such as furniture, electronics, and clothing, if they are lost, damaged, or stolen. Most renters insurance policies also cover liability in case someone is injured on your property. But what about car theft? Does renters insurance cover car theft?

The short answer is, it depends. Renters insurance policies differ from company to company, so it's important to check your specific policy to see if it covers car theft. Generally speaking, if you have a renters insurance policy that includes personal property coverage, it will likely cover car theft as well. However, it may not cover the full replacement cost of the car, so it's important to read the fine print and understand the full scope of your policy.

What Does Renters Insurance Cover in Case of Car Theft?

Renters insurance typically covers the cost of replacing your car if it is stolen. However, there are some caveats. First, the policy may only cover the depreciated value of the car, which means you won't get the full replacement cost. Second, the policy may have a deductible that you need to pay before the coverage kicks in. Third, the policy may have a limit on the amount it will cover, so you may not be able to replace your car with the same make and model. Finally, the policy may require you to have comprehensive and collision coverage on your car in order to be eligible for coverage.

What Other Types of Coverage are Available?

In addition to personal property coverage, there are other types of renters insurance that may be available to you. For example, if you rent a car, you may be able to get rental car coverage, which will cover the cost of repairs if the car is damaged or stolen. You may also be able to get liability coverage, which will pay for any medical bills or legal costs if you are found liable for an accident. Finally, you may be able to get coverage for lost wages if you are unable to work due to an accident.

Do I Need to Get Renters Insurance?

The answer to this question depends on your individual situation. If you are renting an apartment or house, it is typically a good idea to get renters insurance. This type of insurance can provide peace of mind, knowing that your belongings are protected in case of theft or damage. It can also provide financial protection in case you are found liable for an accident. Finally, it can provide coverage for car theft, which can be a valuable asset if you are ever in the unfortunate situation of having your car stolen.

Renters insurance is an important part of financial security, and it can provide much-needed protection for your belongings. Knowing what your policy covers in case of car theft can help you make an informed decision about whether or not to get renters insurance. It's important to read the fine print and understand the full scope of your policy so that you are aware of the coverage you are getting and the limits of that coverage.

Does renters insurance cover theft - insurance

Renting in America | Amica

Does Renters Insurance Cover Theft? | Protective Agency

What Does Renters Insurance Cover ~ news word

Home - The Latest News | Car covers, Theft, Insurance