Cheap 7 Day Insurance In Michigan

Thursday, November 7, 2024

Edit

Cheap 7 Day Insurance In Michigan

What is Seven Day Insurance?

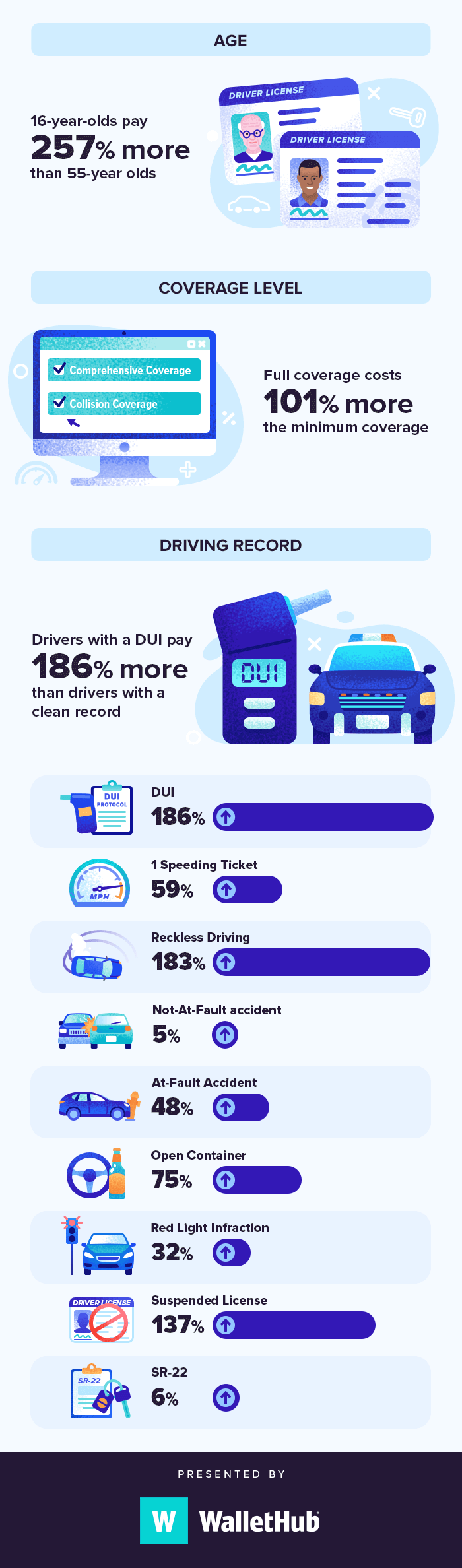

Seven day insurance is a type of auto insurance policy designed to provide coverage for seven days at a time. This type of policy is notably different from traditional auto insurance policies that are designed to provide coverage for a much longer period of time. In order for an individual to obtain seven day insurance in Michigan, they must meet certain eligibility requirements. These requirements vary from company to company, however, the general requirements are that the individual must have a valid driver's license, be over the age of 18, and have a valid form of identification.

What are the Benefits of Seven Day Insurance?

There are a number of benefits associated with seven day insurance in Michigan. One of the primary benefits is the cost savings associated with this type of policy. Seven day insurance policies are typically much less expensive than traditional auto insurance policies. This makes it ideal for those who are looking to save money on their auto insurance. Additionally, seven day insurance policies often provide more flexible coverage options than traditional policies. This means that individuals can customize their coverage to meet their specific needs.

What Coverage Does Seven Day Insurance Provide?

Seven day insurance policies typically provide the same coverage as traditional auto insurance policies. This includes liability coverage, which is designed to protect the policyholder from any financial losses that may occur as a result of an accident or other incident. Additionally, seven day insurance policies may also provide coverage for uninsured or underinsured motorists, as well as coverage for medical expenses and property damage.

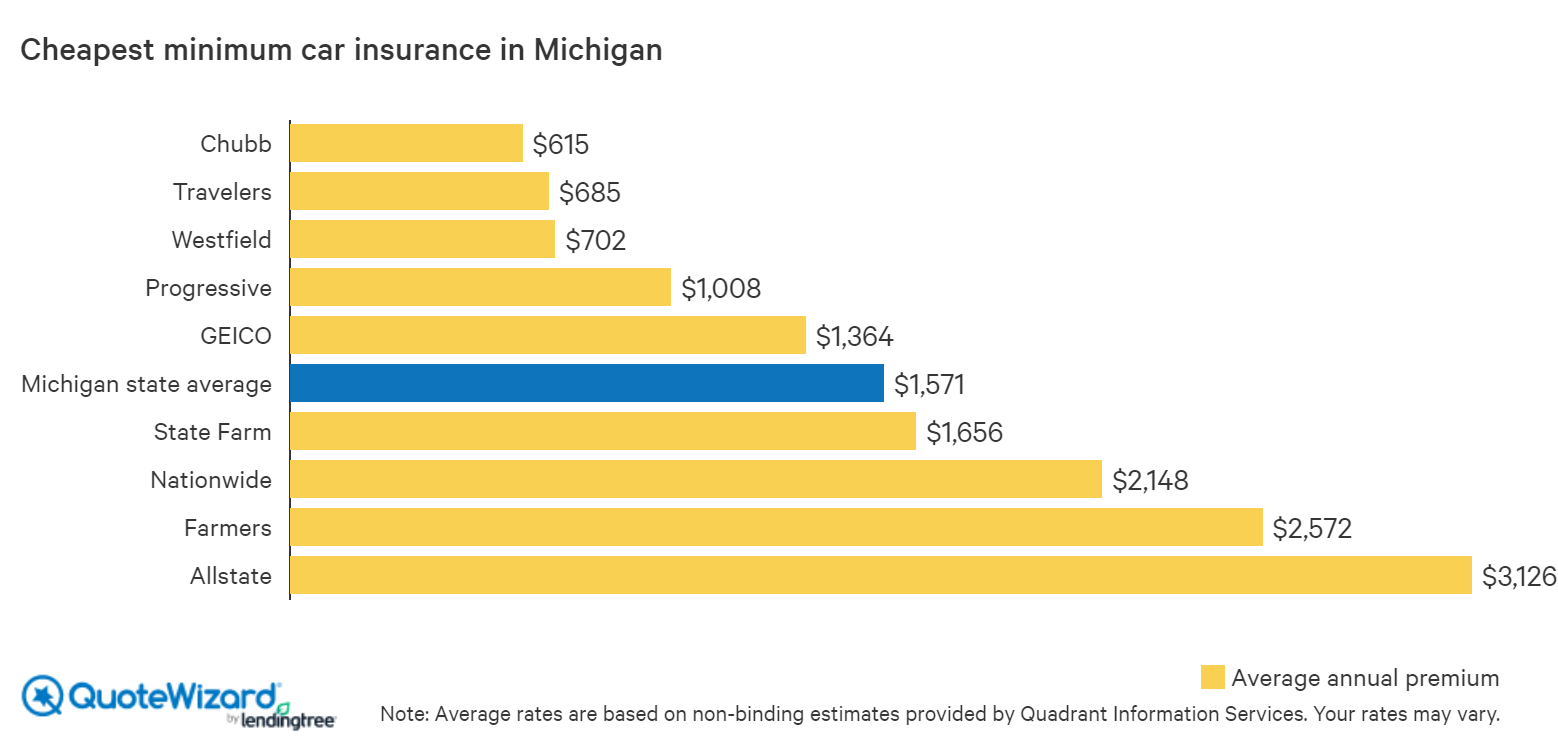

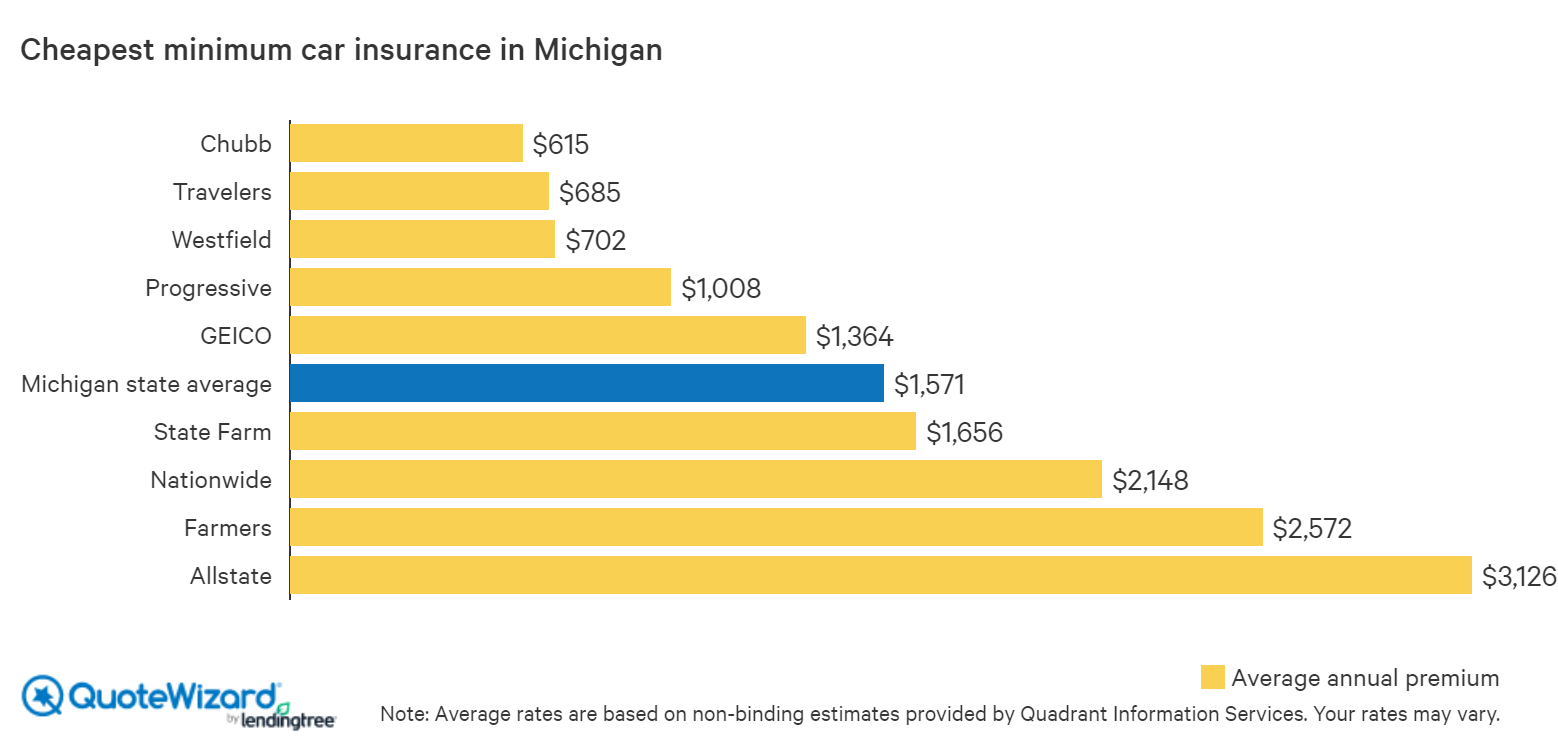

How to Find Cheap Seven Day Insurance in Michigan

Finding cheap seven day insurance in Michigan can be challenging. However, there are a few steps that individuals can take to ensure that they are getting the best possible rate. First and foremost, individuals should shop around and compare rates from different companies. Additionally, individuals should also consider utilizing online resources to compare rates from different companies. This can help individuals to save time and money when looking for the best possible rate.

What are the Requirements for Obtaining Seven Day Insurance in Michigan?

In order to obtain seven day insurance in Michigan, individuals must meet certain eligibility requirements. These requirements vary from company to company, however, the general requirements are that the individual must have a valid driver's license, be over the age of 18, and have a valid form of identification. Additionally, individuals must also provide proof of prior auto insurance coverage, if applicable.

Conclusion

Seven day insurance in Michigan is a great option for individuals who are looking to save money on their auto insurance. This type of policy can provide coverage for seven days at a time, which can save individuals significant amounts of money compared to traditional auto insurance policies. Additionally, seven day insurance policies often provide more flexible coverage options than traditional policies, which can be beneficial for individuals who need to customize their coverage. Finally, individuals should take the time to shop around and compare rates from different companies to ensure that they are getting the best possible rate for their seven day insurance policy.

Cheapest Car Insurance in Michigan | QuoteWizard

Free Michigan 7 Day Notice to Pay or Quit | PDF

2020 Michigan Car Insurance Report

Best Full Coverage Car Insurance For College Students

Cheap Car Insurance in Flint $34/Mo - Lowest Rates in MI!