Is Landlord Insurance More Expensive Than Home Insurance

Is Landlord Insurance More Expensive Than Home Insurance?

What is Landlord Insurance?

Landlord insurance is an insurance designed to protect landlords from the financial risks associated with renting out their properties. This type of policy usually covers damage to the physical structure of the property, as well as liability for any accidents or injuries that occur on the premises. It can also cover legal fees in the event of a tenant dispute. While landlord insurance is not legally required, it is highly recommended for any landlord who is renting out a property.

What is Home Insurance?

Home insurance, also known as homeowners insurance, is a type of insurance policy designed for people who own their own home. This type of policy usually covers damage to the structure of the home, as well as liability for any accidents or injuries that occur on the premises. Home insurance can also cover personal belongings and legal fees in the event of a dispute. Home insurance is required by lenders in most cases, and it is highly recommended for any homeowner.

The Difference Between Home Insurance and Landlord Insurance

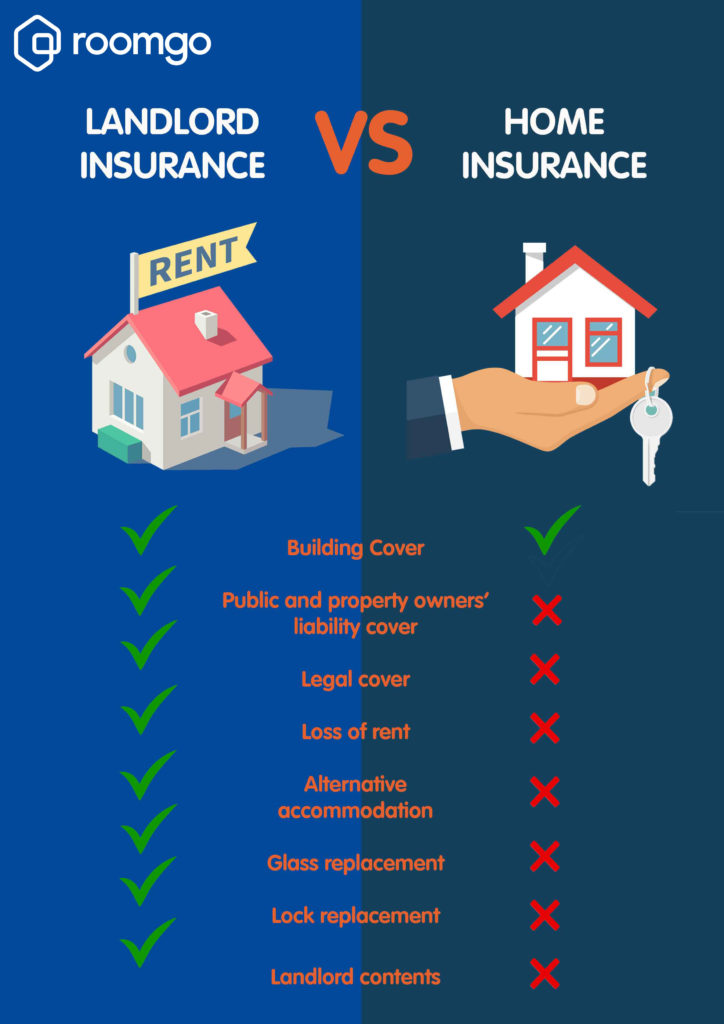

The main difference between home insurance and landlord insurance is that home insurance focuses on protecting the homeowner, while landlord insurance focuses on protecting the landlord. Home insurance typically includes coverage for damage to the structure of the home, as well as liability for any accidents or injuries that occur on the premises. Landlord insurance typically includes additional coverage for damage to the property caused by tenants, as well as liability for any accidents or injuries that occur on the premises.

How Much Does Landlord Insurance Cost?

The cost of landlord insurance can vary greatly depending on the type of coverage you choose and the size of the property. Generally speaking, the average cost of landlord insurance is between $500 and $2,000 per year, but this can vary depending on the type of coverage and the location of the property. It is important to compare quotes from different insurers to ensure you are getting the best rate.

Is Landlord Insurance More Expensive Than Home Insurance?

In general, landlord insurance is more expensive than home insurance. This is because landlord insurance covers more than home insurance, including damage to the property caused by tenants, as well as liability for any accidents or injuries that occur on the premises. Landlord insurance also typically includes additional coverage for legal fees in the event of a tenant dispute. However, the cost of landlord insurance can vary greatly depending on the type of coverage you choose and the size of the property.

Conclusion

Overall, landlord insurance is more expensive than home insurance. This is because landlord insurance covers more than home insurance, including damage to the property caused by tenants, as well as liability for any accidents or injuries that occur on the premises. While the cost of landlord insurance can vary greatly depending on the type of coverage you choose and the size of the property, it is still highly recommended for any landlord who is renting out a property.

Landlord Insurance: is it More Expensive Than Homeowners? | Landlord

What Is Landlord Insurance and what does it cover - Roomgo

Insurance 101: Home Insurance vs. Landlord Insurance | HomeUnion Blog

Topiclocal.com | Popular landlord insurance quotes

Ceta Insurance expands landlord panel | BestAdvice