Bank Of Scotland Car Insurance Documents

Everything You Need to Know About Bank of Scotland Car Insurance Documents

What is Bank of Scotland Car Insurance?

Bank of Scotland car insurance is a type of insurance policy provided by the Bank of Scotland in the United Kingdom. It provides financial protection against any damage, loss or liability that may arise from an accident or other incident involving a car. It can also provide cover for repair and replacement costs, as well as legal fees and costs associated with any claims. Bank of Scotland car insurance policies typically include comprehensive, third-party, fire and theft, and public liability cover.

What Documents Are Needed to Get Bank of Scotland Car Insurance?

When applying for Bank of Scotland car insurance, you will need to provide certain documents to prove your identity, address and vehicle information. These documents include a valid driver’s license, proof of address, vehicle registration documents, and a valid MOT certificate. Additionally, you may need to provide additional documents such as a recent utility bill, bank statement or payslip to prove your identity. Bank of Scotland may also ask for additional documents such as proof of no claims bonus or proof of residence.

How Can I Get Bank of Scotland Car Insurance Documents?

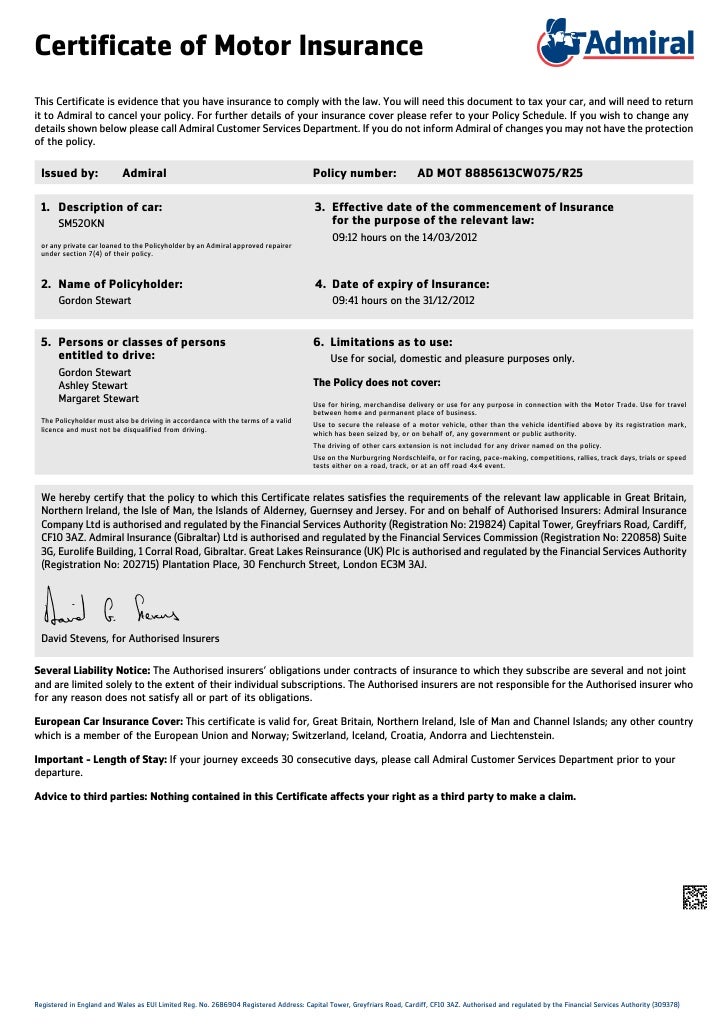

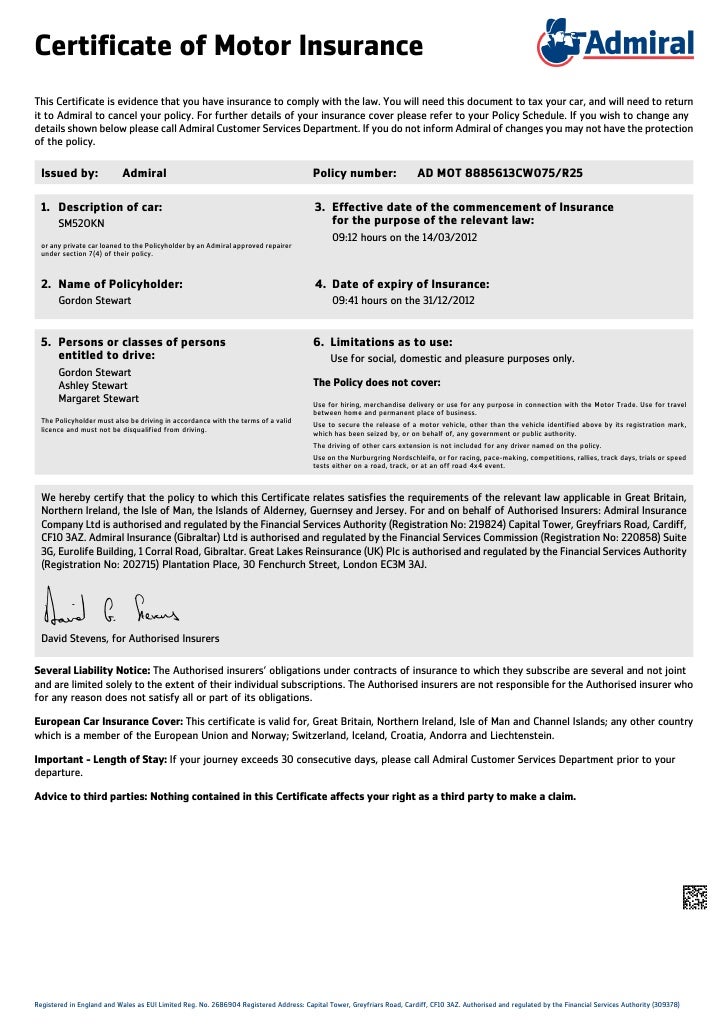

Once your Bank of Scotland car insurance application has been approved, you will receive a policy document, which will provide details of the cover you have chosen, the terms and conditions of the policy, and the premium you have agreed to pay. You should review this document carefully and make sure you understand all of the information contained within it. Once you have read and accepted the policy, you will receive your policy documents, which will include your insurance certificate and a copy of your policy booklet.

What Should I Do if I Have Questions About Bank of Scotland Car Insurance Documents?

If you have any questions or concerns about the Bank of Scotland car insurance documents you have received, you can contact the Bank of Scotland customer service team by phone, email or online chat. The team will be able to provide advice and answer any questions you may have. You can also use the Bank of Scotland website to view and download your policy documents, and to make changes to your policy if required.

What Are the Benefits of Bank of Scotland Car Insurance?

Bank of Scotland car insurance provides comprehensive cover for your car, including cover for damage, theft and legal liability. It also provides a range of additional benefits, such as breakdown cover, personal injury cover and courtesy car cover. You can also save money on your policy with a range of discounts, including no claims bonus and multi-car discounts. Bank of Scotland car insurance is also backed by a 24-hour claims helpline, so you can get assistance when you need it.

Conclusion

Getting Bank of Scotland car insurance is a great way to protect your vehicle and get the financial protection you need. To get the most out of your policy, make sure you have all of the necessary documents and understand the terms and conditions of your policy. If you have any questions, you can contact the Bank of Scotland customer service team for advice.

Secure downloader

Vehicle Insurance Policy Format | Vehicle Insurance | Liability Insurance

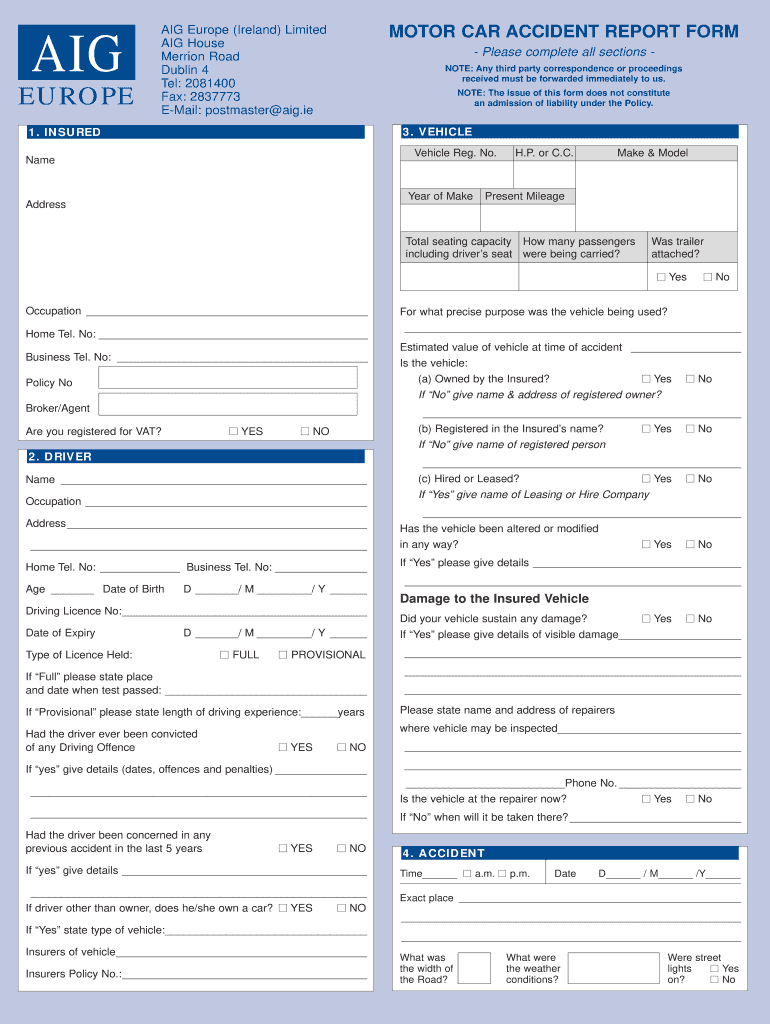

Ireland Aig Motor Accident Report Form - Fill Online, Printable

Buying in Italy.

Proof Of Insurance Template - payment proof 2020