Non Vehicle Owner Sr22 Insurance

Non Vehicle Owner SR22 Insurance: A Comprehensive Guide

What is Non Vehicle Owner SR22 Insurance?

Non vehicle owner SR22 insurance is a special type of motor vehicle liability insurance that is required by a state for individuals who don’t own a vehicle. SR22 insurance is most commonly required for individuals who have had their driver’s license suspended or revoked due to a DUI or other moving violation such as reckless driving. SR22 insurance is a way to prove to the state that the individual is financially responsible and will be able to pay for any damages caused by their negligence in the event of an accident.

Non vehicle owner SR22 insurance is a type of insurance that is purchased by an individual who does not own a vehicle but is required to maintain a certain amount of financial responsibility in order to legally drive. This type of insurance is most commonly required after an individual has had their driver’s license suspended or revoked due to a DUI or other moving violation. Non vehicle owner SR22 insurance is different from regular auto insurance in that it does not cover any actual vehicles, but rather provides financial responsibility coverage for the driver in case of an accident.

Who Needs Non Vehicle Owner SR22 Insurance?

Non vehicle owner SR22 insurance is required by a state for individuals who don’t own a vehicle but are required to maintain a certain amount of financial responsibility in order to legally drive. This type of insurance is most commonly required after an individual has had their driver’s license suspended or revoked due to a DUI or other moving violation. In some cases, an individual may also be required to show proof of non vehicle owner SR22 insurance in order to reinstate their driver’s license.

In addition to DUI and other moving violations, non vehicle owner SR22 insurance may also be required if an individual has been convicted of certain traffic-related offenses such as driving without insurance, driving without a license, or driving with a suspended or revoked license. The individual may also be required to show proof of non vehicle owner SR22 insurance in order to reinstate their driver’s license or in order to obtain a new driver’s license in another state.

How Does Non Vehicle Owner SR22 Insurance Work?

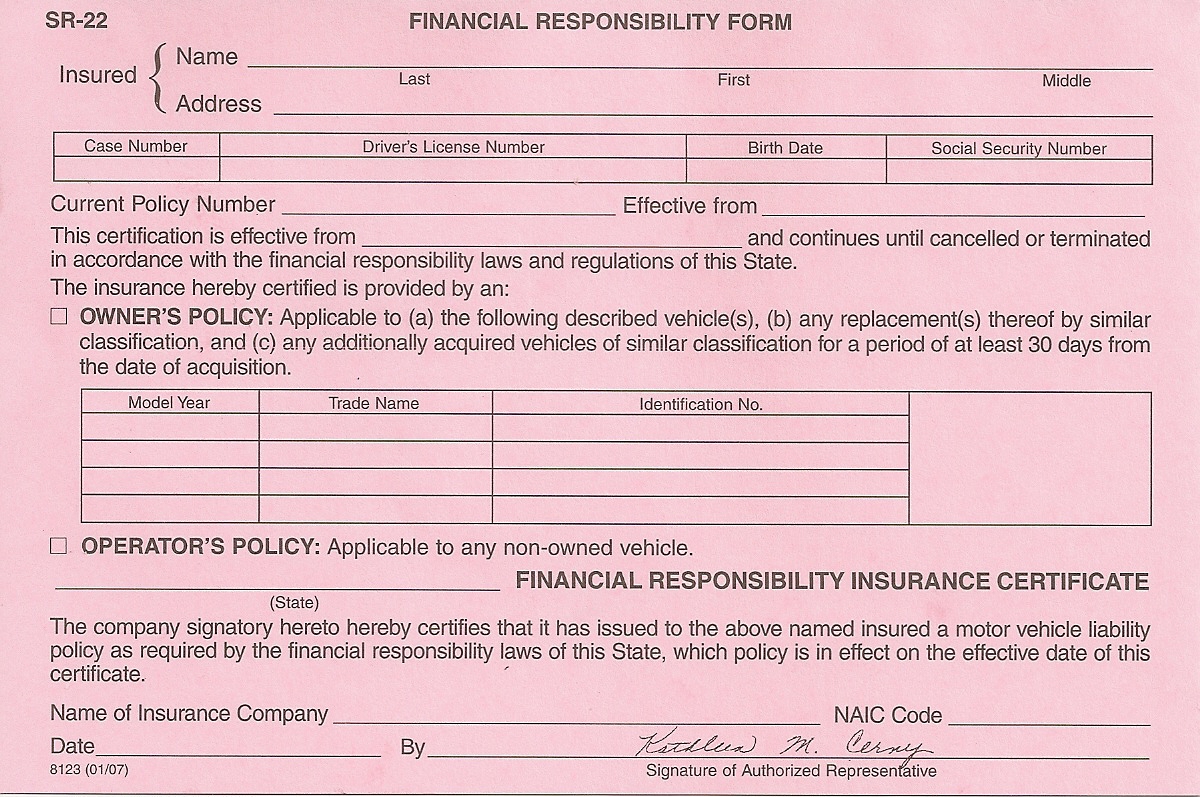

Non vehicle owner SR22 insurance is a type of financial responsibility insurance that provides coverage for the driver in the event of an accident. This type of insurance is purchased by an individual who does not own a vehicle, but is required to maintain a certain amount of financial responsibility in order to legally drive. The insurance company issues an SR22 certificate, which is then filed with the state. This certificate is proof of the individual’s financial responsibility and is required in order to reinstate their driver’s license or obtain a new driver’s license in another state.

The insurance company will pay for damages caused by the individual’s negligence up to the limits of the SR22 insurance policy. If the individual fails to maintain the required financial responsibility, their driver’s license may be suspended or revoked. Non vehicle owner SR22 insurance is usually required for a period of three years, but may be required for a longer period of time depending on the state and the individual’s driving record.

How Much Does Non Vehicle Owner SR22 Insurance Cost?

The cost of non vehicle owner SR22 insurance is determined by a variety of factors such as the individual’s driving record, the state they live in, and the type of coverage they choose. Generally, non vehicle owner SR22 insurance costs more than regular auto insurance because it is providing financial responsibility coverage rather than actual vehicle coverage.

The cost of non vehicle owner SR22 insurance can range from a few hundred dollars to several thousand dollars depending on the individual’s driving record, the state they live in, and the type of coverage they choose. It is important to compare prices from multiple companies in order to get the best deal on non vehicle owner SR22 insurance.

Where Can I Get Non Vehicle Owner SR22 Insurance?

Non vehicle owner SR22 insurance can be purchased from most major auto insurance companies. It is important to compare prices from multiple companies in order to get the best deal on non vehicle owner SR22 insurance.

In addition, there are companies that specialize in providing non vehicle owner SR22 insurance. These companies often offer lower rates than traditional auto insurance companies and can provide the necessary coverage quickly and easily.

Conclusion

Non vehicle owner SR22 insurance is a type of financial responsibility insurance that is required by a state for individuals who don’t own a vehicle but are required to maintain a certain amount of financial responsibility in order to legally drive. The cost of non vehicle owner SR22 insurance can range from a few hundred dollars to several thousand dollars depending on the individual’s driving record, the state they live in, and the type of coverage they choose. Non vehicle owner SR22 insurance can be purchased from most major auto insurance companies or from companies that specialize in providing non vehicle owner SR22 insurance.

Non Owner SR22 Insurance, from $7/month. Click HERE Now

Non Owner Car Insurance Sr22 | Life Insurance Blog

The Buzz on Non-owner South Carolina Sr22 Insurance – The sr22 auto

Sr22 California - What Is It? When Do I Need It? | insurancesr22ryay885

The Pros and Cons of Non Owner SR22 Insurance