Name Non owner Insurance Policy In Va

What Is Non Owner Insurance Policy In VA?

Non Owner Insurance Policy in VA is an insurance policy designed for people who do not own a vehicle, but may need to rent or borrow one now and again. In Virginia, non-owner insurance is a type of liability coverage. It provides protection in the event you are found at fault for an accident while operating a vehicle you don’t own. Non-owner auto insurance is not required by law in Virginia, however, it can provide peace of mind if you’re in the market for a non-owner insurance policy.

Who Needs Non Owner Insurance Policy In VA?

Non Owners Insurance Policy in VA may be a good idea for people who do not own a car, but may occasionally rent or borrow one. It may also be a good idea for people who frequently use ride-sharing services such as Uber or Lyft. Non-owner insurance is sometimes a requirement for those who are required to carry an SR-22 form. SR-22 forms are often required for those with a history of traffic violations, DUIs or at-fault accidents. In addition, non-owner insurance may be a good idea for someone who is planning on getting a vehicle in the near future, but need coverage in the interim.

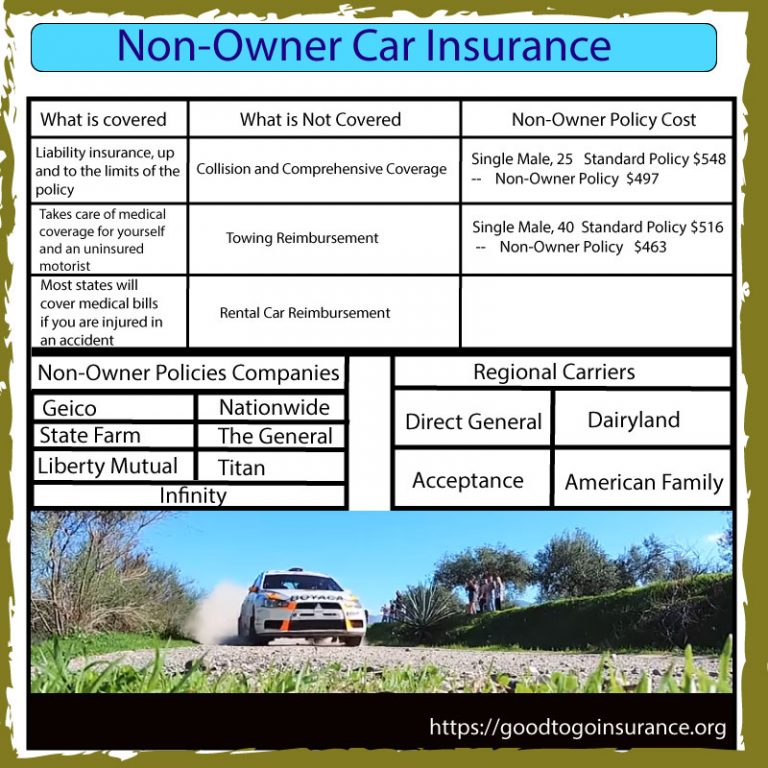

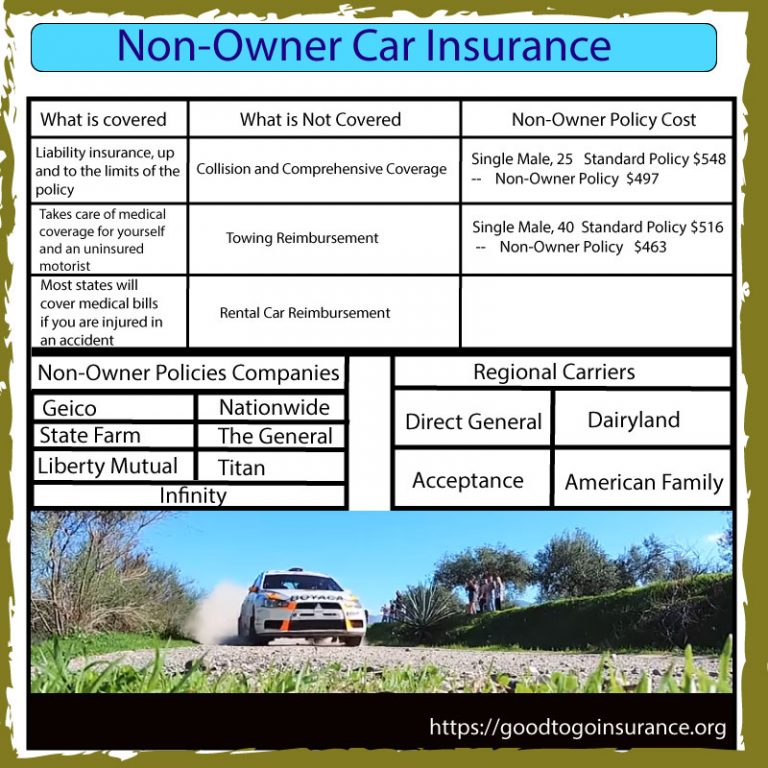

What Does Non Owner Insurance Policy In VA Cover?

Non-owner policies typically include liability coverage only. This means that if you are found to be at fault in an accident, your non-owner policy will cover property damage and medical expenses for other parties involved in the accident. Non-owner policies do not typically provide coverage for any damage done to the vehicle you are operating, as you do not own it. It is important to note, however, that non-owner policies typically do not cover you if you are found at fault for injury to yourself or a passenger in your vehicle.

How Much Does Non Owner Insurance Policy In VA Cost?

The cost of non-owner insurance in VA can vary depending on the coverage you select, your age, and the type of vehicle you will be operating. Generally, non-owner insurance policies are cheaper than a traditional auto insurance policy. However, it is important to shop around for the best coverage and price for your needs.

Where Can I Find Non Owner Insurance Policy In VA?

Non-owner insurance policies can be found through most major auto insurance providers. It is important to compare rates and coverage between different insurers to ensure you are getting the best coverage and price for your needs. You can also compare rates online, or speak with an insurance agent to find the best coverage for your needs.

Conclusion

Non-owner insurance policies in VA can provide peace of mind if you do not own a vehicle, but may need to rent or borrow one now and again. Non-owner policies typically provide liability coverage only, and do not cover damage to the vehicle you are operating. The cost of non-owner insurance can vary, so it is important to shop around and compare rates between different providers to ensure you are getting the best coverage and price for your needs.

Non Owner Auto Insurance | Compare quotes wih Good to Go

Non Owners Car Insurance Policy

Non Owner Sr22 Insurance - Insurancexr Blog Call Us Now And Get Free

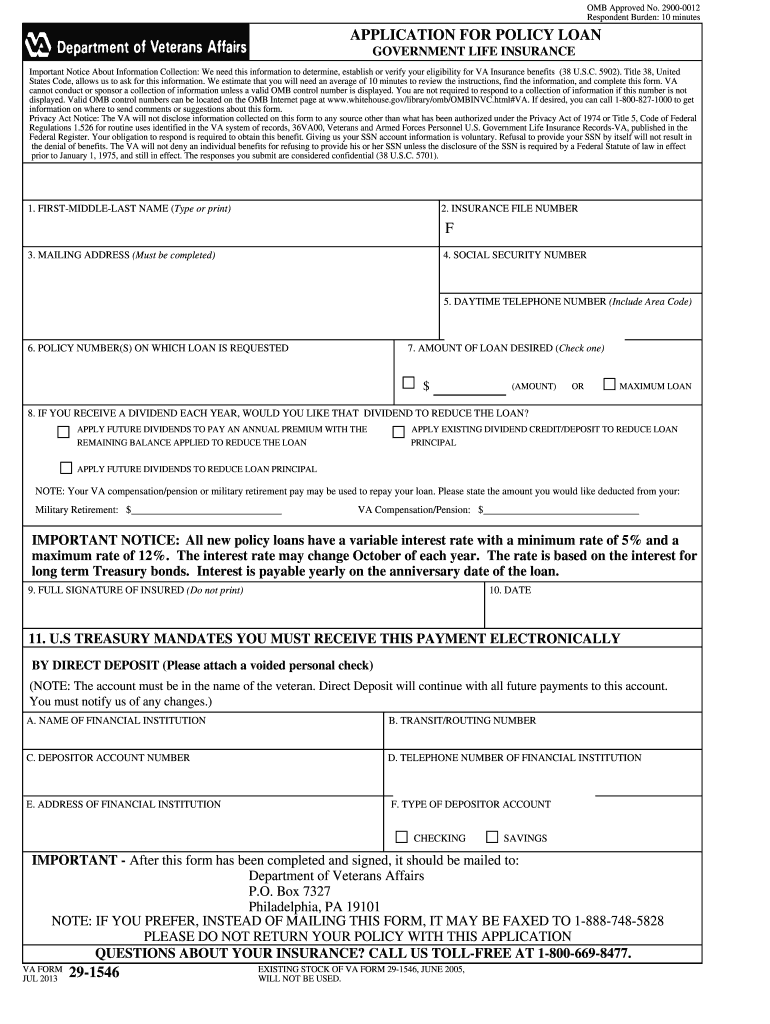

2013-2020 Form VA 29-1546 Fill Online, Printable, Fillable, Blank

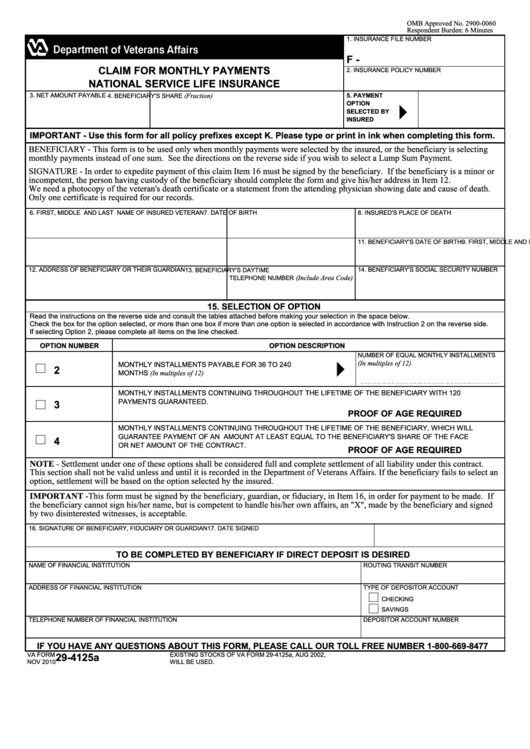

Fillable Va Form 29-4125a - Claim For Monthly Payments National Service