Average Cost Of Sr22 Insurance In California

Average Cost Of Sr22 Insurance In California

What is SR22 Insurance?

SR22 Insurance is a form of auto insurance that is required by the California Department of Motor Vehicles (DMV) for certain drivers who have been convicted of a DUI or other serious driving offense. It is also referred to as an “SR22 filing” and is a document that must be filed with the DMV in order for the driver to maintain his or her driving privileges. SR22 Insurance is typically more expensive than traditional auto insurance, and the cost can vary depending on the policy and the driver’s driving record.

What Does SR22 Insurance Cover?

SR22 Insurance is a form of liability insurance and is required for any driver who has been convicted of a DUI or other serious driving offense. It is designed to protect the driver, their passengers, and other motorists from potential financial losses due to an accident caused by the driver. SR22 Insurance can cover the cost of medical bills, property damage, and legal fees associated with an accident.

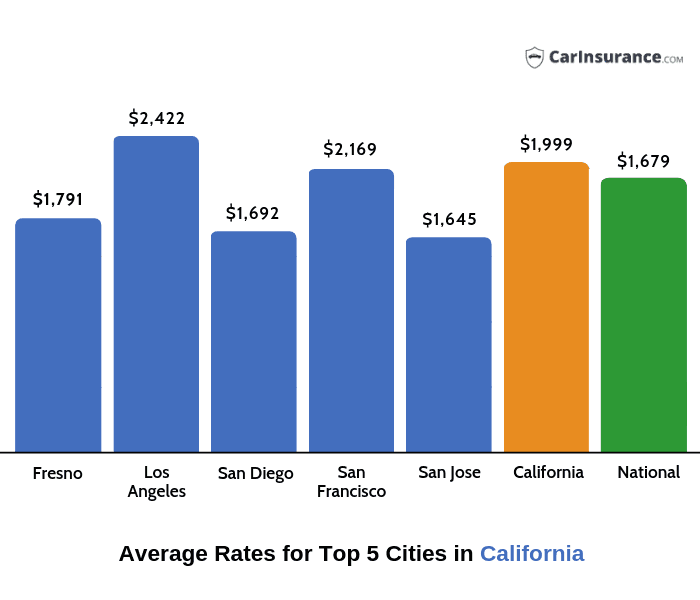

What is the Average Cost of SR22 Insurance in California?

The average cost of SR22 Insurance in California is approximately $1,500 per year. This cost can vary depending on the policy, the driver’s driving record, and the amount of coverage purchased. Generally, the higher the risk the driver poses to insurance companies, the higher the cost of their SR22 Insurance. Additionally, the cost of SR22 Insurance may increase if the driver has had multiple DUI convictions or other serious driving offenses.

Who Needs SR22 Insurance?

SR22 Insurance is generally required for drivers who have been convicted of a DUI or other serious driving offense in California. This can include drivers who have had their license suspended or revoked due to a DUI conviction, as well as drivers who have been convicted of reckless driving, hit and run, or other serious driving offenses. Additionally, drivers may need to file an SR22 Insurance form if they have been found to be at fault in an accident and do not have enough liability insurance.

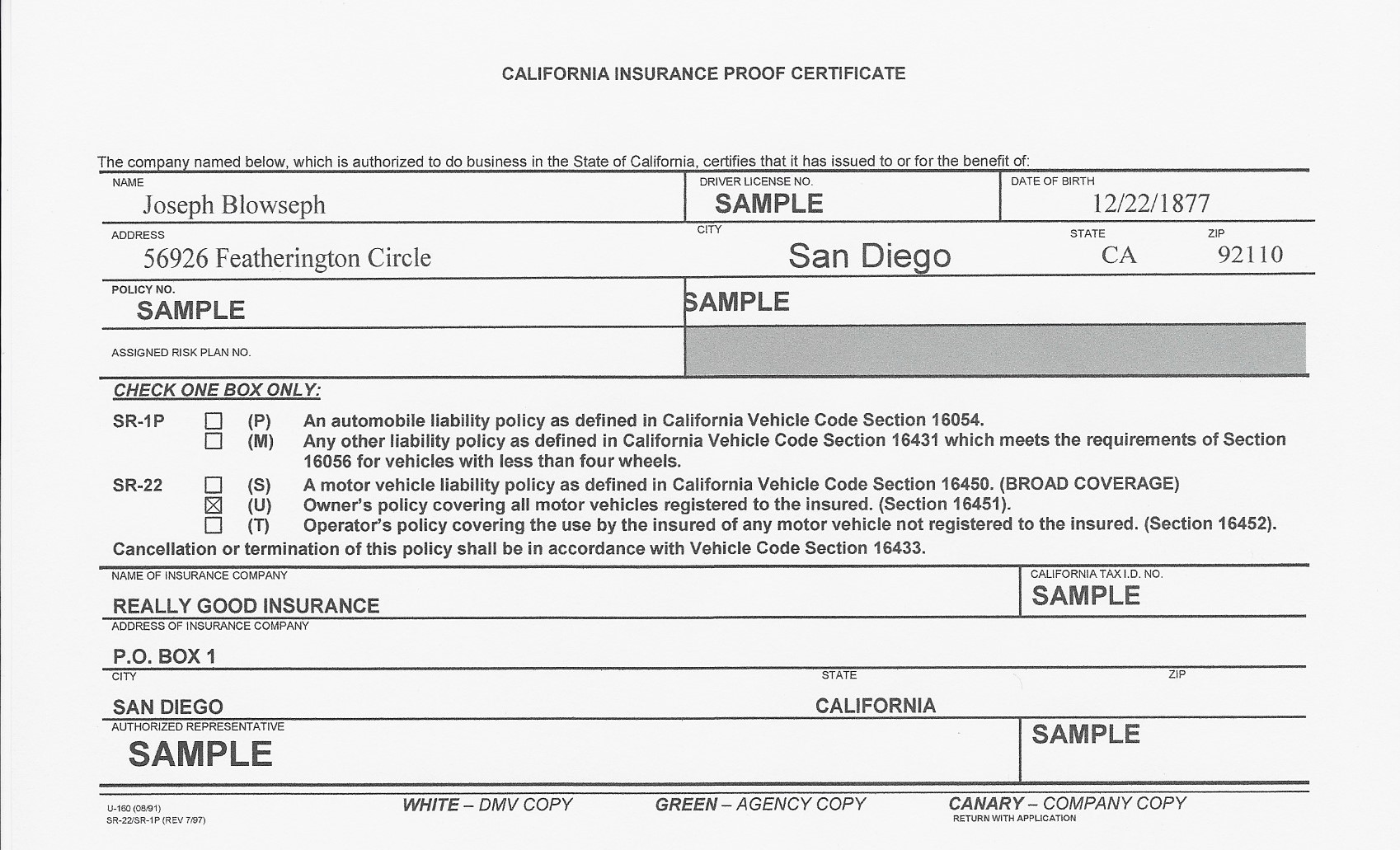

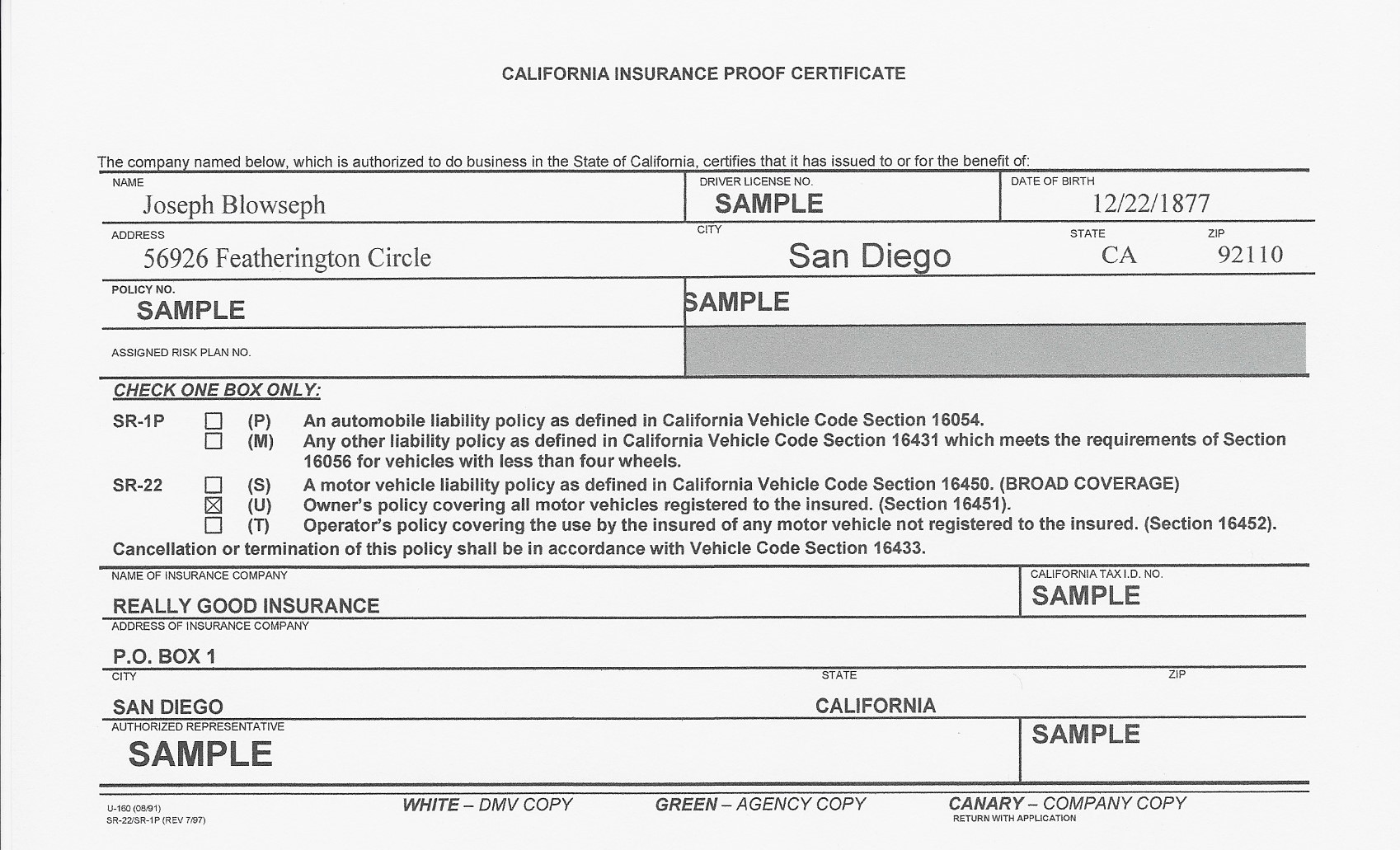

What is the Process for Filing an SR22 Insurance Form?

In order to file an SR22 Insurance form, drivers must first contact their auto insurance provider. The insurance provider will then provide the driver with the necessary forms and instructions for filing the SR22 Insurance form. After the form has been completed, it must be submitted to the DMV in order for the driver to maintain his or her driving privileges. Once the form has been received and approved by the DMV, the driver will be able to continue driving with their current license.

Conclusion

The average cost of SR22 Insurance in California is approximately $1,500 per year. Drivers who have been convicted of a DUI or other serious driving offense may be required to purchase SR22 Insurance in order to maintain their driving privileges. The cost of SR22 Insurance can vary depending on the policy and the driver’s driving record. To file an SR22 Insurance form, drivers must first contact their insurance provider and then submit the form to the DMV.

San Diego, California SR22 Financial Responsibility Filing | McCormick

Sr22 insurance - insurance

Anatomy of an SR22 Insurance Filing – mckennainsurance.com

How Much is Car Insurance in California & How to Lower it?