Types Of Car Insurance Coverage

Types Of Car Insurance Coverage Explained

What Is Car Insurance Coverage?

Car insurance coverage is an agreement between you and your insurance company, where you pay a premium in exchange for financial protection against losses related to owning, operating, or driving a car. In the event of an accident, your insurance provider will pay for the cost of repair or replacement of your car, as well as any other claims made against you, such as personal injury. Depending on the type of coverage you choose, car insurance may also cover you for medical expenses and property damage caused by an accident, as well as legal fees associated with any resulting lawsuits.

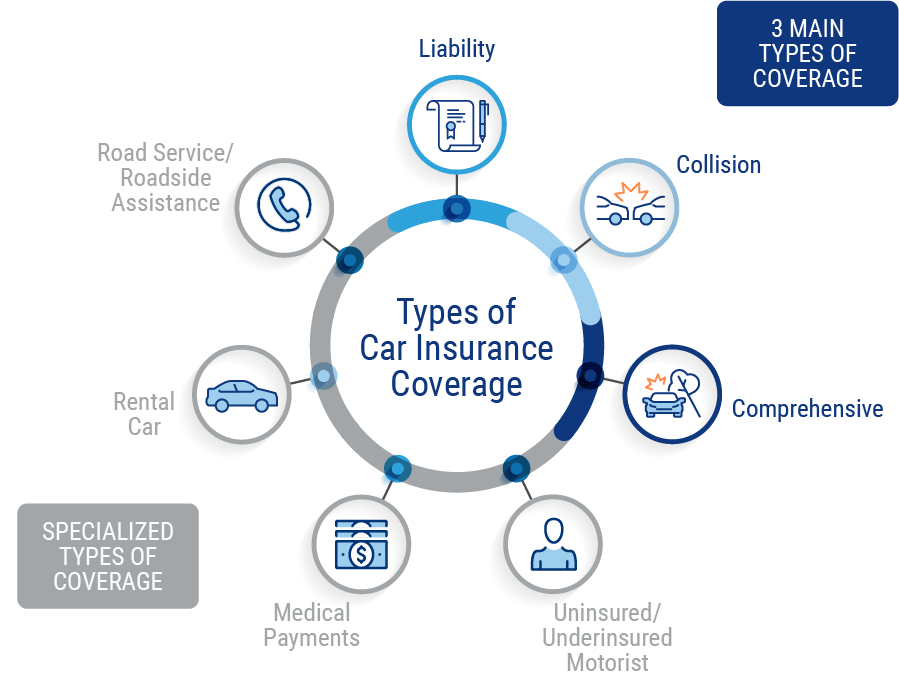

Types Of Car Insurance Coverage

There are several different types of car insurance coverage available, and each type provides different levels of protection. The most common types of coverage are liability, collision, comprehensive, uninsured/underinsured motorist, personal injury protection, and medical payments coverage. Each type of coverage has its own set of benefits, so it’s important to understand the differences before choosing the right coverage for your needs.

Liability Coverage

Liability coverage is the most basic type of car insurance coverage, and it is required in most states. It pays for bodily injury and property damage caused by an accident for which you are at fault. It does not cover any damage to your own car, or any medical expenses you may incur. Liability coverage is typically split into two parts: bodily injury liability and property damage liability. Bodily injury liability covers the cost of medical expenses and lost wages for the other driver, while property damage liability covers the cost of repairing or replacing the other driver’s car.

Collision Coverage

Collision coverage pays for damage to your car caused by an accident, regardless of fault. It covers the cost of repairing or replacing your car, as well as any other items that may have been damaged in the accident. Collision coverage is usually optional, but it’s a good idea to have it if you are financing or leasing your car, as most lenders require it. If you have an older car, it may not be worth the cost of collision coverage.

Comprehensive Coverage

Comprehensive coverage pays for damage to your car caused by something other than an accident, such as theft, fire, hail, or vandalism. It also covers the cost of repairing or replacing any items that may have been stolen from the car. Comprehensive coverage is usually optional, but it’s a good idea to have it if you are financing or leasing your car, as most lenders require it.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage pays for your medical expenses and lost wages if you are injured in an accident caused by an uninsured or underinsured driver. It also covers you if you are hit by a hit-and-run driver, or if you are in an accident with a driver who does not have enough insurance to cover your damages. Uninsured/underinsured motorist coverage is usually required by state law, and it is a good idea to have it even if it is not required.

Personal Injury Protection Coverage

Personal injury protection coverage pays for your medical expenses and lost wages if you are injured in an accident, regardless of fault. It also covers you if you are a pedestrian and are hit by a car. Personal injury protection coverage is usually required by state law, and it is a good idea to have it even if it is not required.

Medical Payments Coverage

Medical payments coverage pays for your medical expenses if you are injured in an accident, regardless of fault. It also covers your passengers if they are injured in the accident. Medical payments coverage is usually optional, but it’s a good idea to have it if you are financing or leasing your car, as most lenders require it. It is also a good idea to have it if you have a high-deductible health insurance plan, as it can help cover the cost of your medical expenses.

7 Types of Car Insurance You Should Consider

List of the Best Car Insurance

The Best Strategy To Use For What Kind Of Auto Insurance Do You Really

Learn the Different Types of Car Insurance Policies

Auto Coverage Types – Thank Goodness For Insurance