Car Insurance Cost For New Drivers

Car Insurance Cost For New Drivers

Introduction

Buying a car is a big deal, and so is insuring it. That's why it's important for new drivers to understand their car insurance costs and the factors that could affect them. Car insurance for new drivers can be expensive, but it doesn't have to be. With the right knowledge and advice, you can find the right coverage for your needs and budget.

Factors Affecting Car Insurance Costs

When you're shopping around for car insurance, there are several factors that will affect your car insurance cost. Your age, gender, driving record, and type of vehicle are all factors that can impact your car insurance cost. Insurance companies look at these factors to determine how much risk is associated with insuring your vehicle.

Age

Your age is one of the biggest factors that insurance companies consider when determining your car insurance cost. Generally speaking, drivers under the age of 25 are considered to be higher risk and therefore have higher car insurance costs. Young drivers are more likely to be involved in accidents, which is why they pay more for their car insurance.

Gender

Your gender is also a factor that insurance companies consider when determining your car insurance cost. Generally speaking, men pay more for their car insurance than women. This is because men are more likely to be involved in accidents and have more traffic violations than women.

Driving Record

Your driving record is also a factor that insurance companies consider when determining your car insurance cost. If you have a good driving record, you may be able to get a lower car insurance cost. However, if you have a poor driving record, you may have to pay more for your car insurance. Insurance companies look at your driving history to determine how much risk is associated with insuring you.

Type of Vehicle

The type of vehicle you drive is also a factor that insurance companies consider when determining your car insurance cost. Luxury vehicles and sports cars are more expensive to insure because they are more expensive to repair and are more likely to be involved in an accident. On the other hand, smaller and less expensive vehicles are usually cheaper to insure.

Tips for Lowering Car Insurance Costs

If you're a new driver and you're looking for ways to lower your car insurance cost, here are a few tips that may help. First, shop around and compare car insurance rates from different companies. Different companies offer different rates, so it pays to do your research. Second, consider raising your deductible. A higher deductible can lower your car insurance cost, but make sure you can afford to pay it if you are ever in an accident. Finally, take a defensive driving course. Taking a defensive driving course can help you learn how to be a safer driver, which can result in lower car insurance costs.

Conclusion

Car insurance for new drivers can be expensive, but it doesn't have to be. With the right knowledge and advice, you can find the right coverage for your needs and budget. There are several factors that affect your car insurance cost, such as your age, gender, driving record, and type of vehicle. There are also several tips that can help you lower your car insurance cost, such as shopping around, raising your deductible, and taking a defensive driving course. By understanding these factors and taking steps to lower your car insurance cost, you can get the coverage you need at a price you can afford.

Average Cost of Car Insurance for Young Drivers 2020 | NimbleFins

The average cost of car insurance in the US, from coast to coast

New Driver Insurance Cost Varies Widely Depending on Your Situation

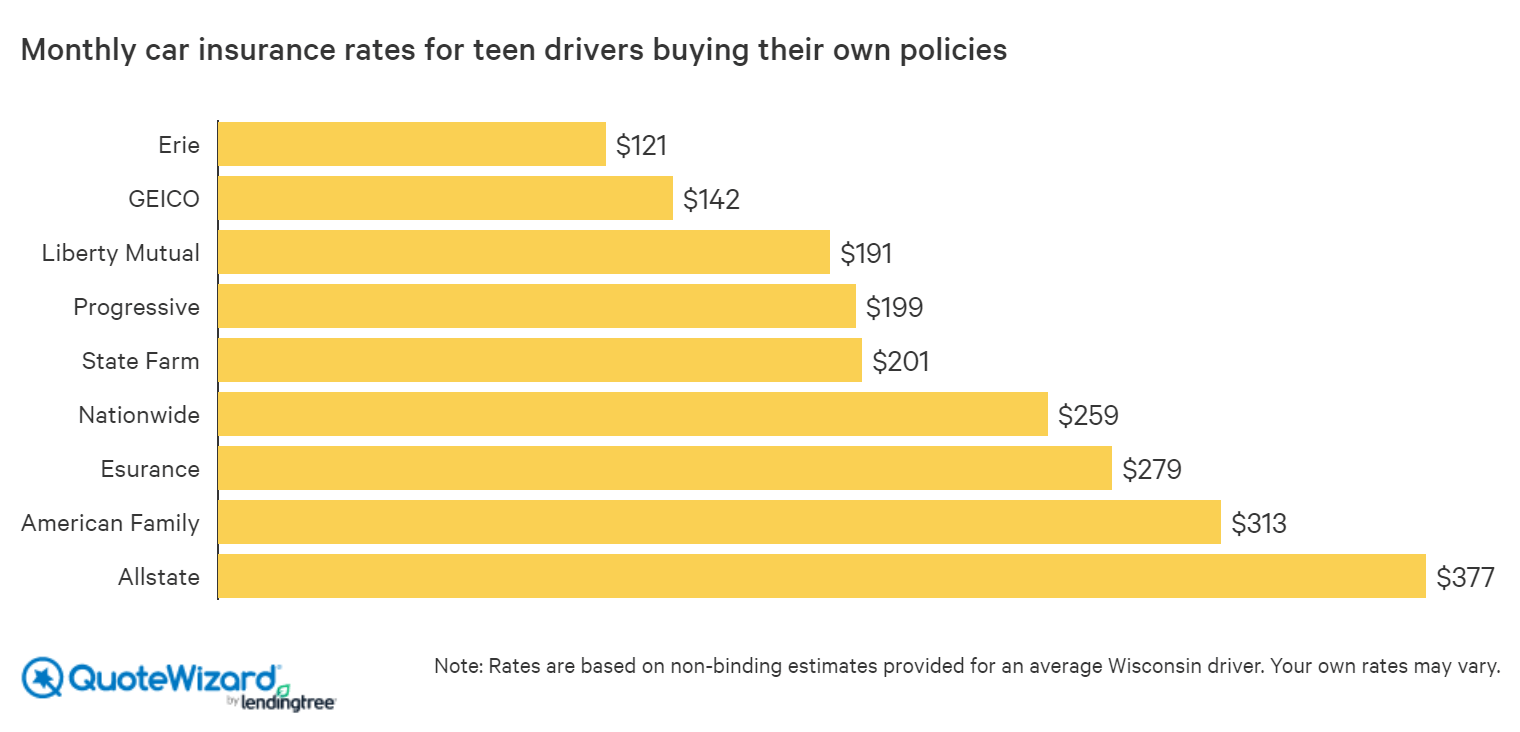

Best Car Insurance for Teens | QuoteWizard

Average Cost Of Car Insurance For 19 Year Old Female - Car Retro