Cheap General Liability Insurance For Contractors

Cheap General Liability Insurance For Contractors

What is General Liability Insurance?

General Liability Insurance is a type of insurance coverage for businesses that provides protection against claims of property damage, bodily injury, and personal and advertising injury. It is an important part of any business insurance portfolio. Contractors often need General Liability Insurance to protect their business from expensive liability claims. It is important for contractors to understand what is covered by this type of insurance and how to get a policy that fits their needs.

Why Do Contractors Need General Liability Insurance?

Contractors need General Liability Insurance to protect their business from expensive liability claims. This type of insurance can provide coverage for a variety of situations including property damage, bodily injury, and personal and advertising injury. Without General Liability Insurance, contractors could be vulnerable to large financial losses due to a lawsuit or settlement. It is important for contractors to understand the need for this type of insurance and how to get a policy that meets their needs.

How to Get Cheap General Liability Insurance for Contractors?

There are several ways for contractors to get cheap General Liability Insurance. The first step is to shop around. Comparing different insurance companies and their policies is the best way to find the most affordable coverage. It is also important to research the different types of coverage available and make sure the policy is comprehensive and covers all potential risks. Additionally, contractors should look for discounts and other ways to save money on their policy.

What to Look for in a Policy?

When looking for a policy, it is important to make sure the coverage is comprehensive and covers all potential risks. Additionally, contractors should look for discounts and other ways to save money on their policy. The policy should also include coverage for property damage, bodily injury, and personal and advertising injury. Finally, contractors should make sure they understand the policy and all of its details before purchasing.

Tips for Finding Cheap General Liability Insurance for Contractors

Finding the right policy for your business can be a complicated process, but there are several tips that can help make it easier. First, shop around and compare different insurance companies and their policies. Secondly, research the different types of coverage available and make sure the policy is comprehensive and covers all potential risks. Additionally, look for discounts and other ways to save money on a policy. Finally, make sure you understand the policy and all of its details before purchasing.

Conclusion

General Liability Insurance is an important part of any business insurance portfolio for contractors. It provides protection against claims of property damage, bodily injury, and personal and advertising injury. Shopping around and comparing different insurance companies and their policies is the best way to find the most affordable coverage. Additionally, contractors should research the different types of coverage available and look for discounts and other ways to save money on their policy.

Cheap general liability insurance for contractors - insurance

Cheap General Liabilty, Commercial Auto Insurance Metroplus Insurance

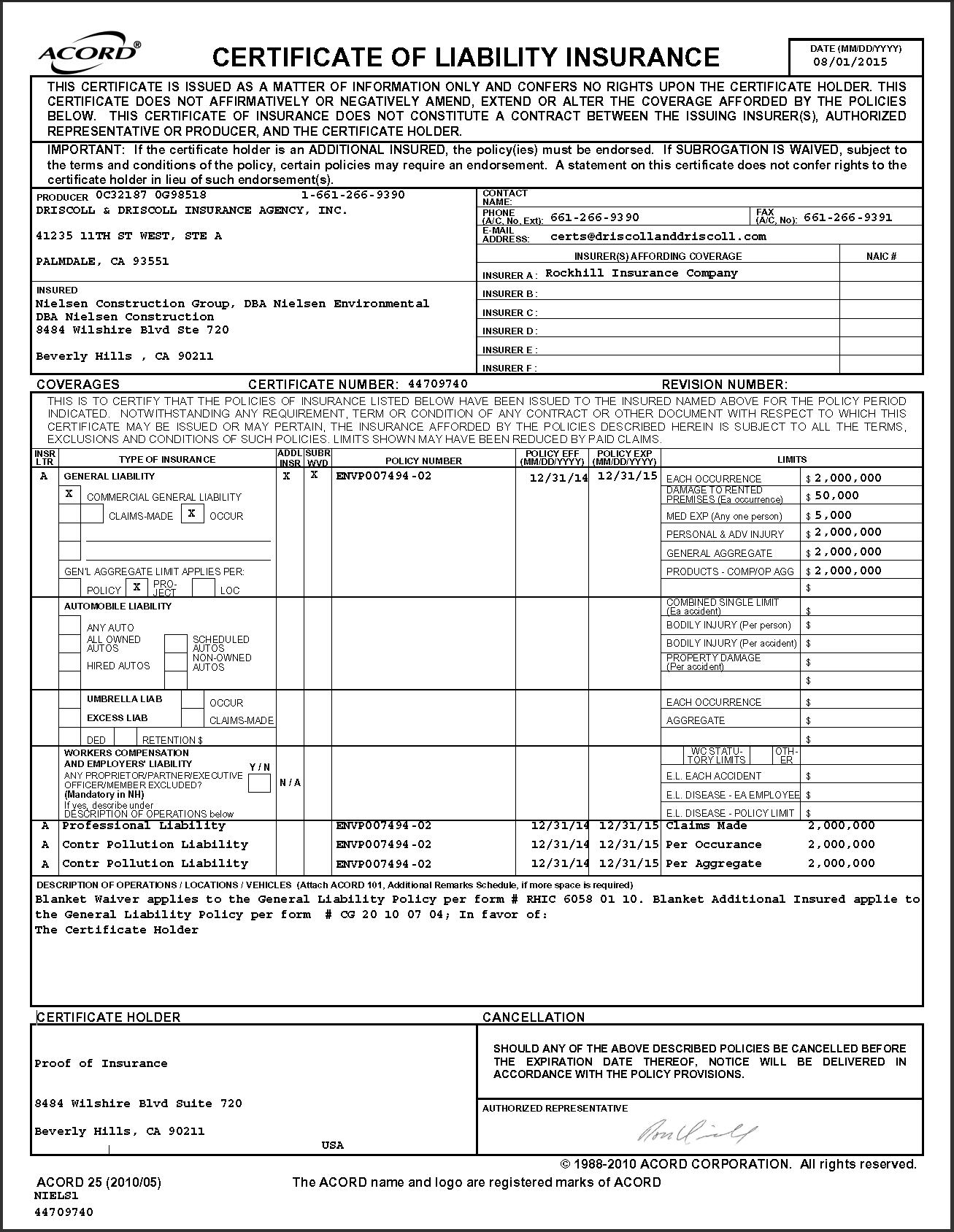

Contractor Insurance | Nielsen Environmental

General Liability Insurance - CertaPro Painters of San Mateo

Commercial General Liability Insurance — White Paper | Lorman Education