General Liability Insurance Policy For Djs

Why Do DJs Need General Liability Insurance?

If you’re a DJ, you’ll want to ensure that your business is protected from potential risks and liabilities. A General Liability Insurance policy is a great way to do just that. It’s a type of insurance that covers you in the event of any liability claims made against you. This type of insurance will help to protect you financially, should any third party suffer an injury or property damage as a result of your services. It’s important to have a good understanding of what a General Liability Insurance policy can provide and why it’s essential for DJs to have one.

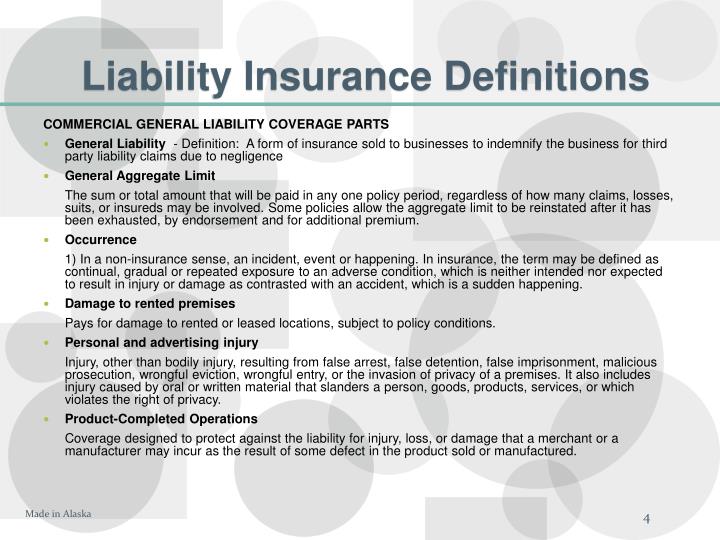

What Does General Liability Insurance Cover?

General Liability Insurance covers a wide range of risks and liabilities. It can protect you from claims made by third parties for bodily injury, property damage, personal injury, advertising injury, and medical expenses. It also covers any legal costs and settlements that may arise from such claims. In addition, it will cover you for any costs associated with defending yourself against a claim that is not covered by the policy. The policy will also cover you for any damages that may be imposed by a court.

What Are the Benefits of Having a General Liability Insurance Policy?

Having a General Liability Insurance policy can provide a range of benefits for DJs. It provides a financial safety net in the event of any liability claims made against you. It can also act as a deterrent, as potential customers will be reassured that you are covered against any potential risks or liabilities. This can be particularly important if you are providing services at venues or events. Furthermore, it can help to protect your reputation, as you can demonstrate that you are taking all necessary steps to ensure that your business is protected.

What Is the Cost of General Liability Insurance for DJs?

The cost of a General Liability Insurance policy for DJs will vary depending on the type of coverage you require and the size of your business. Generally speaking, policies start at around $25 per month, but the cost can increase depending on the level of coverage. It’s important to shop around and compare different policies to ensure you get the best deal. You may also be able to get a discounted rate if you are part of a professional association.

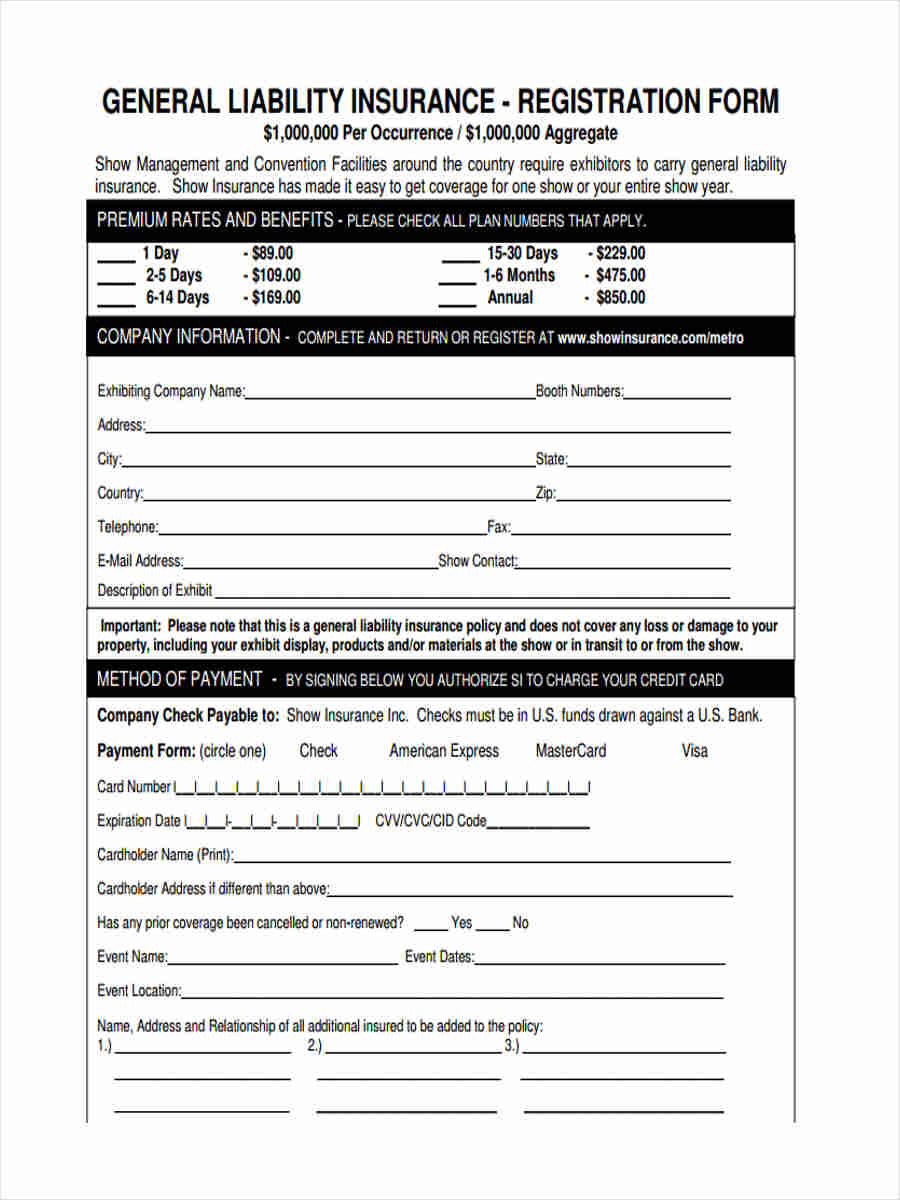

How Do I Get General Liability Insurance?

It’s easy to get General Liability Insurance for DJs. You can purchase a policy online through a reputable insurer or broker. You can also speak to insurance brokers or agents to get a better understanding of the different policies available and the cost. Once you have chosen a policy, you will need to provide the necessary information and make payment. Once the policy is in place, you can enjoy the peace of mind that comes from knowing that your business is protected.

In Conclusion

General Liability Insurance is an essential form of cover for DJs. It can provide financial protection against a range of liabilities and risks, as well as peace of mind. The cost of a policy will vary depending on the type of coverage you require, but it’s important to shop around and compare different policies to get the best deal. Once you have purchased a policy, you can enjoy the security of knowing that your business is protected.

Liability Insurance - Pro Sound & Light Show

Gl Policy Insurance - General Liability Insurance: What's Covered and

commercial general liability insurance definition – Kcaweb

FREE 7+ Liability Insurance Forms in MS Word | PDF

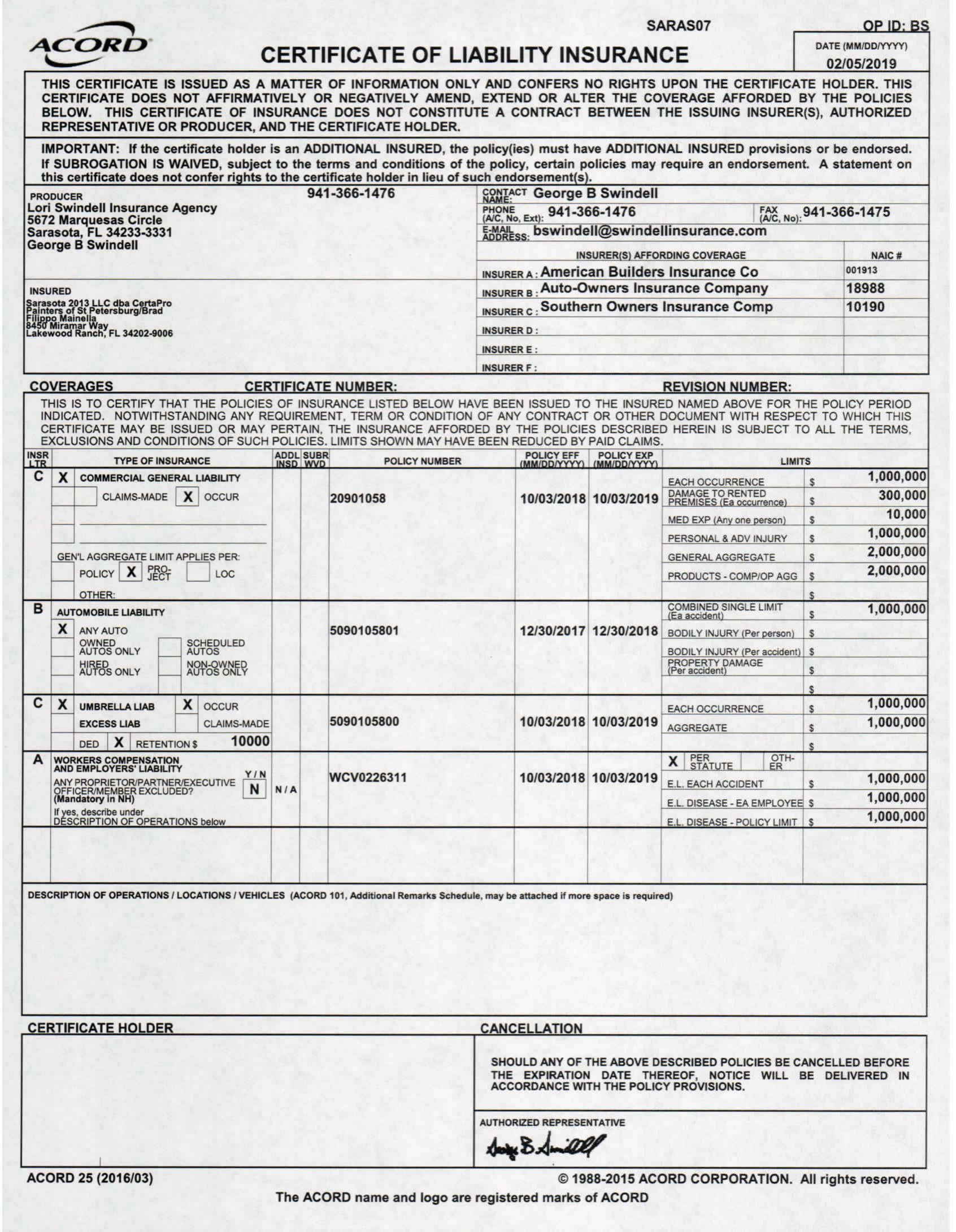

General Liability Insurance - CertaPro Painters of St Petersburg