Tesco Bank Box Insurance Portal

Sunday, November 5, 2023

Edit

Tesco Bank Box Insurance Portal: The Best Way to Insure Your Car

What is Tesco Bank Box Insurance?

Tesco Bank Box Insurance is a revolutionary way of insuring your car that has been developed by the leading UK supermarket, Tesco. It is a telematics policy that provides drivers with a unique way to save money on their car insurance. With this type of policy, drivers can choose to pay based on the actual miles they drive, rather than the estimated miles they may drive in a year. This can result in significant savings on your premium.

The policy is based on a black box, which is installed in your car. This black box is used to monitor the miles you drive and the driving behaviour of the driver. This data is then used to calculate the premium you pay. The policy also includes a number of other features, such as the option to get a discount if you have a clean driving record.

How Does Tesco Bank Box Insurance Work?

Once you have applied for the policy, you will be sent a black box to install in your car. This box will then monitor your mileage and driving behaviour. This data is then used to calculate the premium you pay. The more carefully you drive, the lower your premium will be.

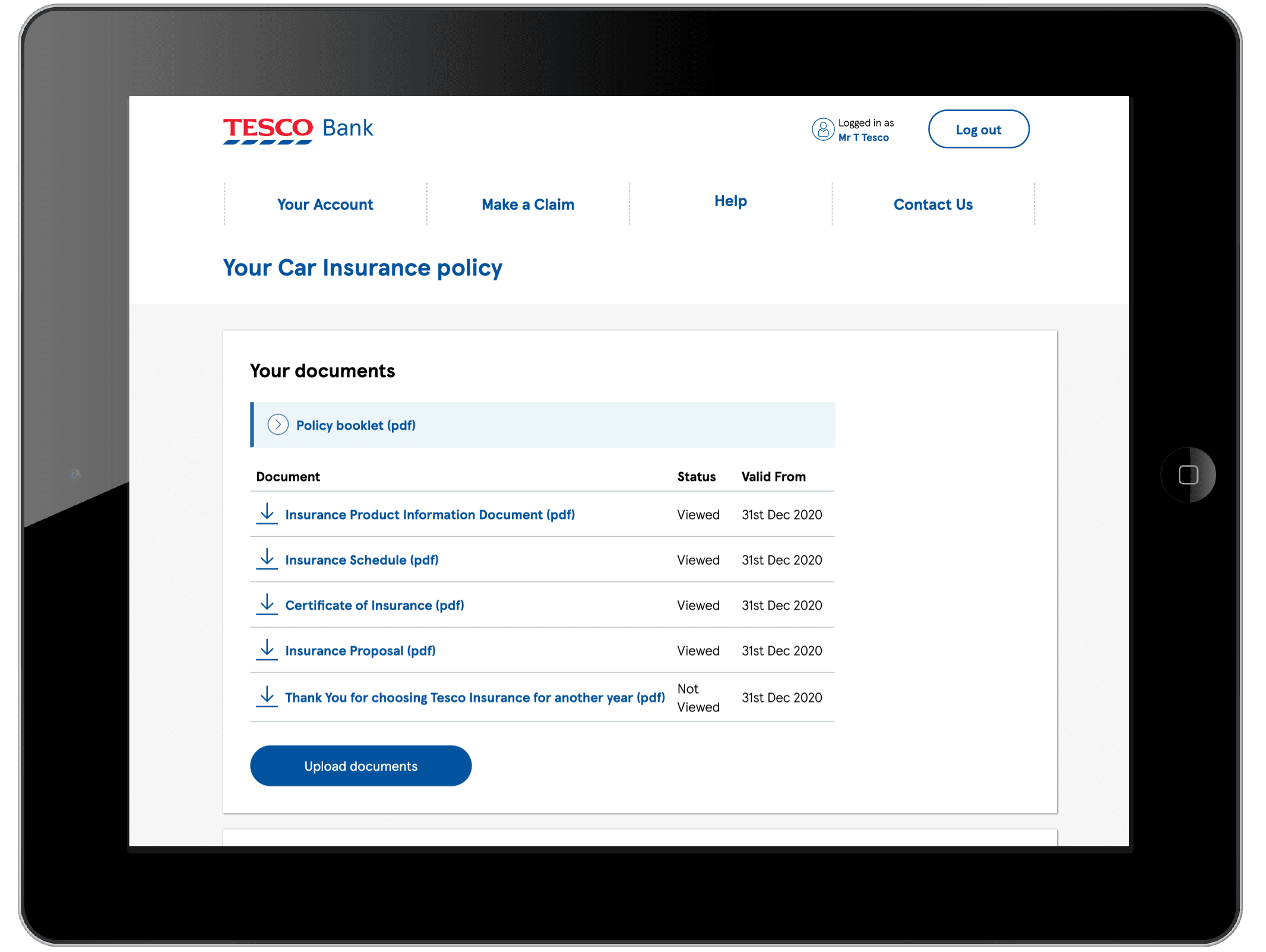

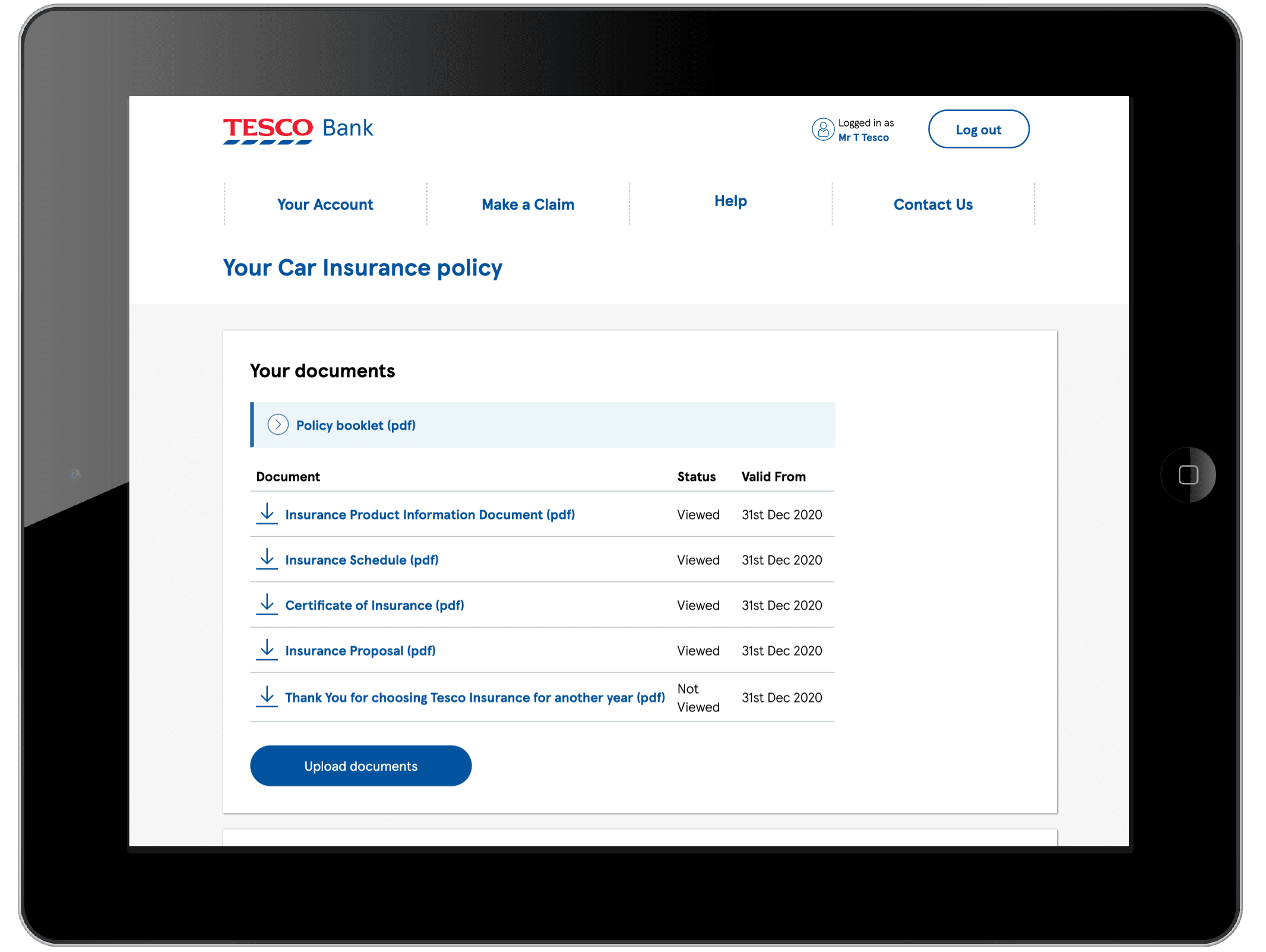

The policy also includes a number of other features, such as the option to get a discount if you have a clean driving record. You can also choose to pay for your policy on a monthly basis, rather than an annual basis. This can help you to spread the cost of your policy over the course of the year.

What are the Benefits of Tesco Bank Box Insurance?

The main benefit of Tesco Bank Box Insurance is the fact that it can save drivers money on their premiums. As the policy is based on the actual miles you drive, rather than an estimated mileage, drivers can save a significant amount of money. This is particularly beneficial for drivers who don't drive a lot, as their premiums will be lower than those of drivers who drive more miles.

The policy also includes a range of other features, such as the option to get a discount if you have a clean driving record. The policy also includes a number of additional benefits, such as breakdown cover and the ability to make a claim quickly and easily.

What Are the Drawbacks of Tesco Bank Box Insurance?

Despite the numerous benefits of Tesco Bank Box Insurance, there are also some drawbacks. For example, the policy is not available to drivers who are considered to be high-risk, such as those who have had numerous accidents or convictions. Additionally, the policy is only available in certain areas, so not all drivers will be able to benefit from the policy.

The policy also requires drivers to install a black box in their car, which some drivers may find intrusive. Additionally, the black box will monitor the driver's behaviour, which may be off-putting for some drivers.

Should You Consider Tesco Bank Box Insurance?

Tesco Bank Box Insurance is a great way to save money on your car insurance premium, particularly if you don't drive a lot. The policy also includes a number of additional benefits, such as the option to get a discount if you have a clean driving record and breakdown cover.

However, the policy is not available in all areas and is not suitable for high-risk drivers. Additionally, the black box may be intrusive for some drivers. Therefore, before taking out a policy, it is important to consider all the pros and cons and decide if it is the right policy for you.

Tesco Box Car Insurance Number : Tesco Joins The Digital Receipt

Tesco Bank home insurance | Bankrate

Tesco Bank hires ex-Treasury exec Sir John Kingman to join board

Tesco Bank home insurance | Bankrate UK

Tesco Bank home insurance | Bankrate