Car Loan Interest Rate Policybazaar

Sunday, November 5, 2023

Edit

Car Loan Interest Rate Policybazaar – A Comprehensive Guide

What is a Car Loan Interest Rate?

A car loan interest rate is the percentage of interest that you will be charged for borrowing funds to purchase a car. It is the cost of borrowing money to buy a vehicle and is usually a percentage of the total loan amount. This interest rate can vary widely depending on the type of loan and the lender. It is important to understand the terms of the loan and the impact of the interest rate on your overall monthly payments.

What is Policybazaar?

Policybazaar is an online financial comparison website that provides information and analysis on car loan interest rates in India. It offers a wide range of financial products and services, including car loan interest rates, personal loans, credit cards, and insurance policies. The website also provides expert advice and analysis on the car loan market. It is one of the most comprehensive sources of car loan information in India.

How to Compare Car Loan Interest Rates on Policybazaar?

Policybazaar makes it easy to compare car loan interest rates from a variety of lenders. The website has an easy-to-use user interface and provides detailed information about different car loan products. To compare car loan interest rates, you can search for loans based on your loan amount, repayment tenure, and interest rate. You can also filter your search to include only those loans from lenders that meet your specific criteria.

What Factors Affect Car Loan Interest Rates?

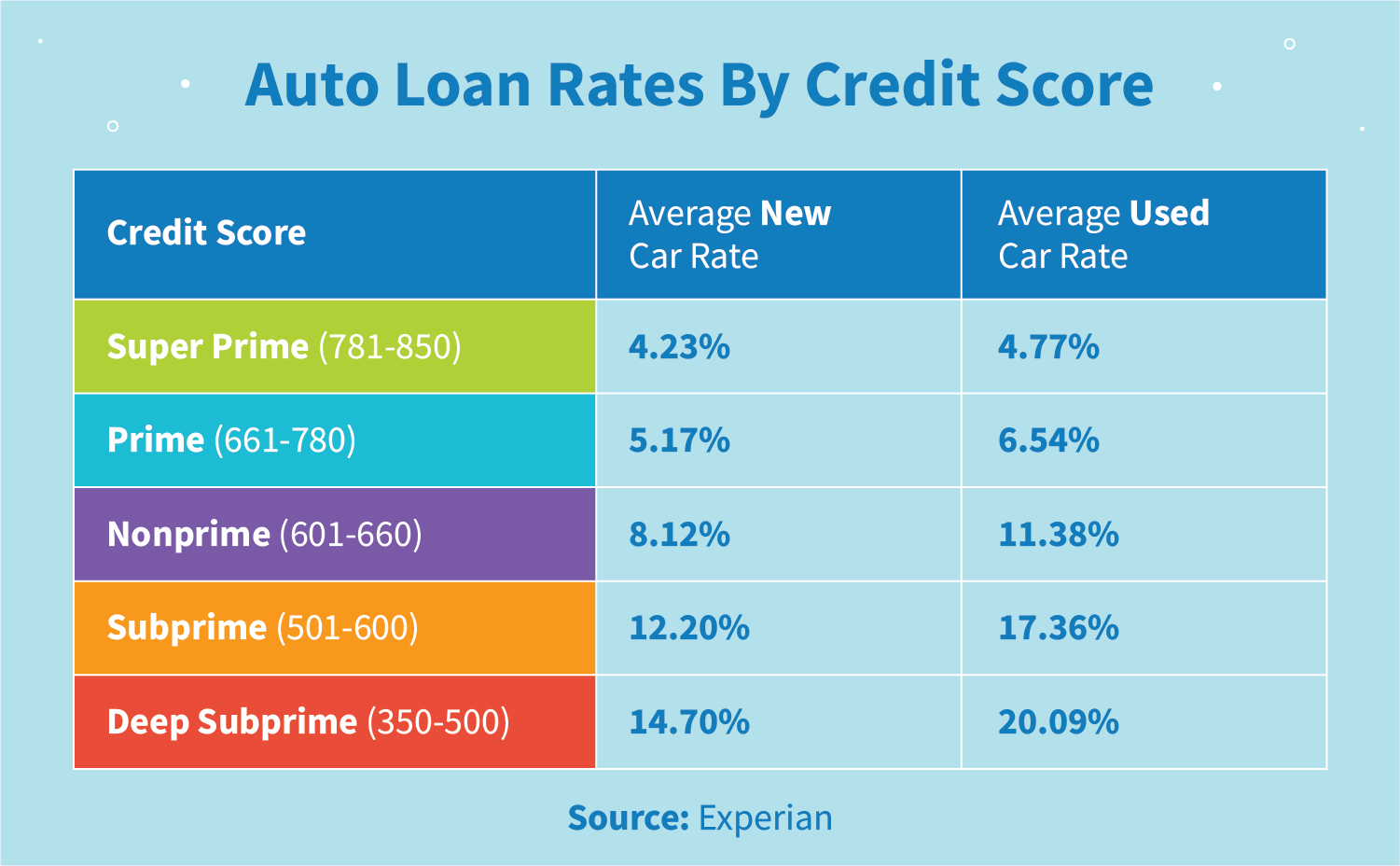

Car loan interest rates depend on several factors, including the type of loan, the lender, the loan amount, and the borrower’s credit score. The type of loan and the lender are the two biggest factors in determining the interest rate. For example, secured loans usually have lower interest rates than unsecured loans. The amount of the loan also plays a role in the interest rate, as larger loans typically come with lower interest rates. Finally, the borrower’s credit score is also a major factor in determining the interest rate. Borrowers with higher credit scores are likely to get better interest rates.

What are the Benefits of Using Policybazaar?

Policybazaar offers a number of advantages for car loan borrowers. The website provides detailed information about a variety of car loan products, making it easy to compare interest rates and loan terms. The website also offers expert advice and analysis on the car loan market, helping borrowers make informed decisions. Finally, Policybazaar is a secure website and all transactions are protected by SSL encryption.

Conclusion

Policybazaar is one of the best resources for car loan borrowers in India. The website offers a wide range of financial products and services, including car loan interest rates, personal loans, credit cards, and insurance policies. The website also provides detailed information and analysis on the car loan market, helping borrowers make informed decisions. With Policybazaar, borrowers can compare car loan interest rates from a variety of lenders and find the best loan for their needs.

New Car Loan Rates - Compare & Apply Loans & Credit Cards in India

Average Used Car Interest Rate Canada / Average Auto Loan Interest

Average Auto Loan Rates | Credit Repair

Interest rate for honda car loan in malaysia

Car Loan Interest Rate Malaysia 2020 / Auto Loans: Getting Pre-Approved