Average Cost For Health Insurance Per Month

Tuesday, November 7, 2023

Edit

Average Cost for Health Insurance Per Month

What is the Average Cost of Health Insurance?

The average cost of health insurance is rising. While the cost of health insurance varies from person to person, the average cost for a family of four is around $1,200 a month for a mid-level plan. The cost of health insurance has risen rapidly in recent years, with premiums increasing by an average of 20 percent or more in some years.

The cost of health insurance depends on a variety of factors, including the type of plan chosen, the age and health of the insured, the location of the insured, and the number of people covered. It is important to compare plans before making a decision to ensure that the plan chosen is the best fit for the individual or family.

Factors That Affect the Cost of Health Insurance

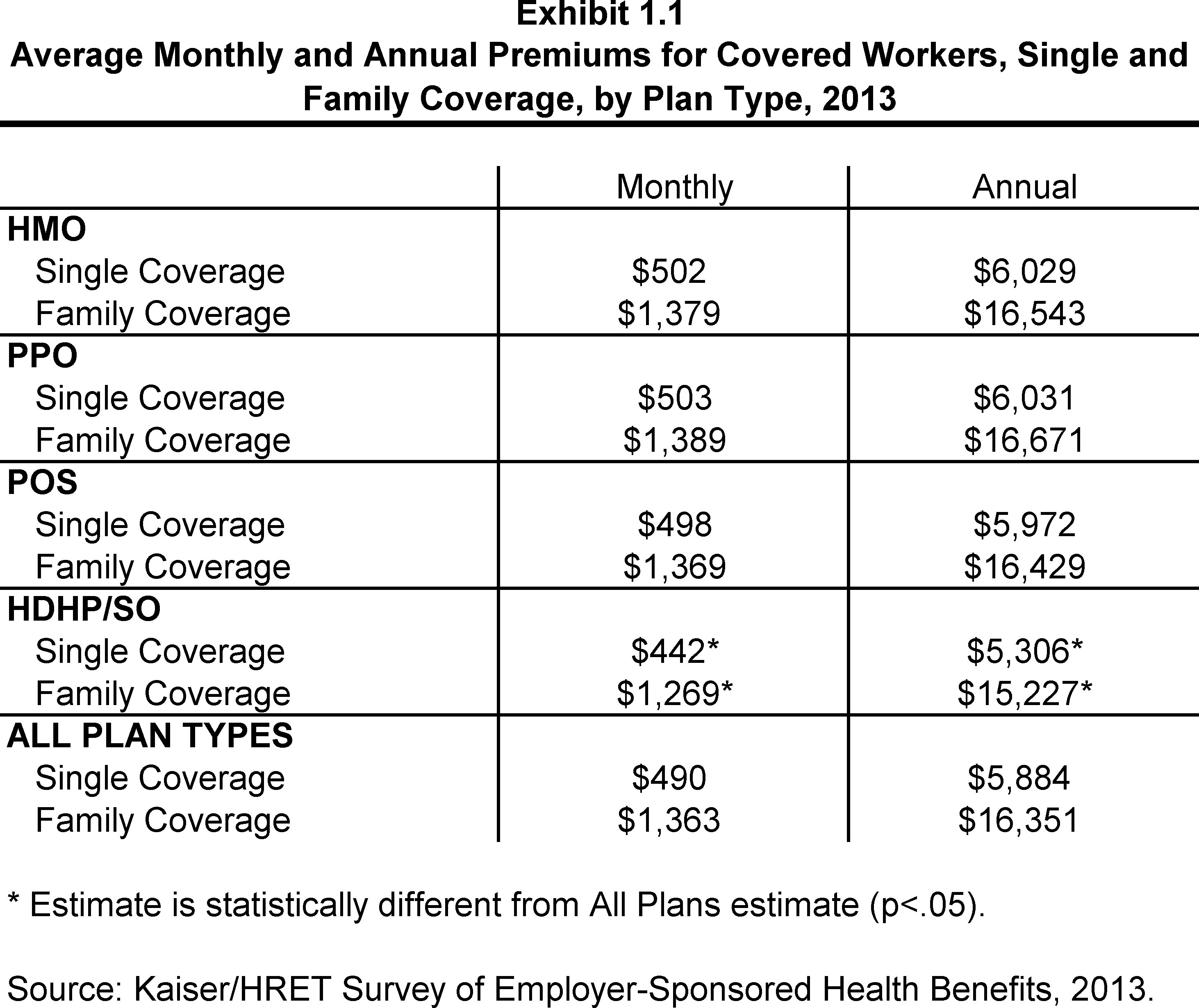

The type of plan chosen is one of the primary factors that affects the cost of health insurance. Generally, the more comprehensive the plan, the higher the premium will be. There are three main types of health insurance plans: Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), and Point-of-Service (POS) plans.

HMO plans typically have the lowest premiums, but they also have the most restrictions. PPOs are more expensive but offer more flexibility. POS plans are a combination of the two, offering some flexibility but also requiring the insured to use designated providers.

The age and health of the insured also affect the cost of health insurance. Generally, younger individuals pay lower premiums than older individuals, as they are perceived to be less likely to need medical care. The health of the insured also plays a role in determining rates, as those with pre-existing medical conditions or chronic illnesses may have higher premiums than those who are healthy.

The location of the insured can also have an effect on the cost of health insurance. In some states, health insurance premiums are higher due to a variety of factors, including the cost of living, the prevalence of certain medical conditions, and the availability of providers.

Finally, the number of people covered by a health insurance plan also affects its cost. Generally, the more people covered by a plan, the higher the premium will be.

How to Reduce the Cost of Health Insurance

There are several ways to reduce the cost of health insurance. First, comparison shop for plans to ensure that the plan chosen is the best fit for the individual or family. It is also important to be aware of any subsidies or tax credits for which the individual or family may be eligible.

In addition, individuals and families can look for plans with lower premiums and higher deductibles. This means that the insured will pay more out-of-pocket for medical care, but the premium will be lower. It is also important to check to see if the employer offers any type of health insurance plan, as this can often result in lower premiums.

Finally, individuals and families can look into health savings accounts, which are tax-advantaged savings accounts that can be used to pay for medical expenses. This can result in lower premiums and also offers a way to save for unexpected medical expenses.

Conclusion

The cost of health insurance is rising, but individuals and families can take steps to reduce the amount they pay for coverage. It is important to compare plans before making a decision to ensure that the plan chosen is the best fit for the individual or family. In addition, individuals and families can look for plans with lower premiums and higher deductibles and look into health savings accounts to save money on their health insurance premiums.

A bargain no longer: Lancaster County health insurance costs approach

How Much Does Health Insurance Cost Per Month ~ news word

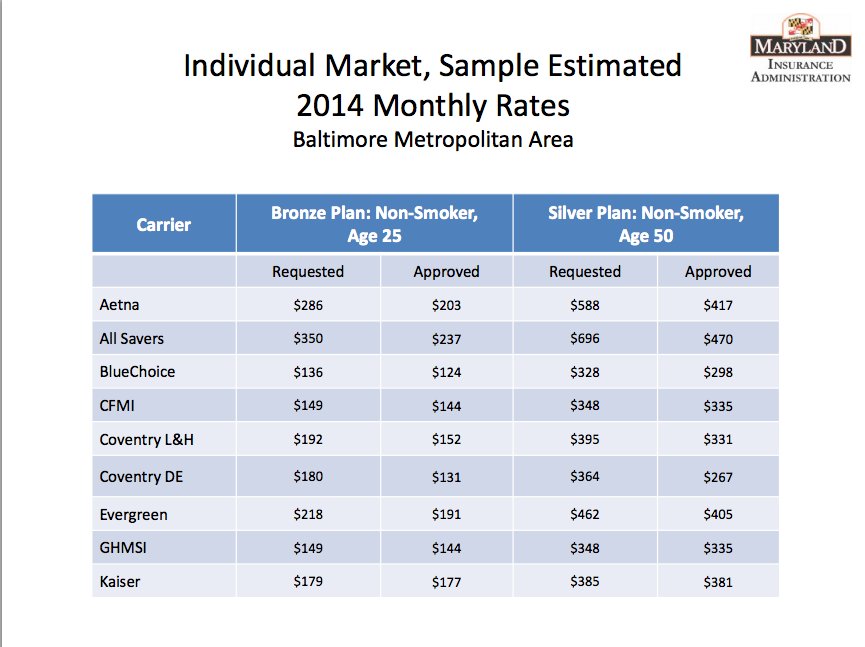

Maryland Touts Low Obamacare Health Insurance Premiums

Ehbs 2013 Section 1 The Henry J Kaiser Family Foundation

How Much Is Health Insurance A Month? | Period Furniture Hardware