Average Renters Insurance Cost Per Month

Tuesday, March 11, 2025

Edit

Average Renters Insurance Cost Per Month

What is Renters Insurance?

Renters insurance is an insurance policy that provides financial compensation if your personal property is damaged or stolen. It also provides liability coverage in the event someone is injured in your home. It is important to note that renters insurance does not cover damage to the actual structure of the property itself. That is the responsibility of the landlord. Renters insurance is designed to protect your belongings and provide financial protection in the event of an accident.

What Does Renters Insurance Typically Cover?

Renters insurance typically covers the cost of replacing your personal belongings if they are damaged or stolen, as well as providing liability coverage if someone is injured in your home. It also provides coverage for items that you may keep in a storage unit or at a second home. In addition, renters insurance may provide additional coverage for items such as jewelry, computers, and other expensive items.

How Much Does Renters Insurance Cost?

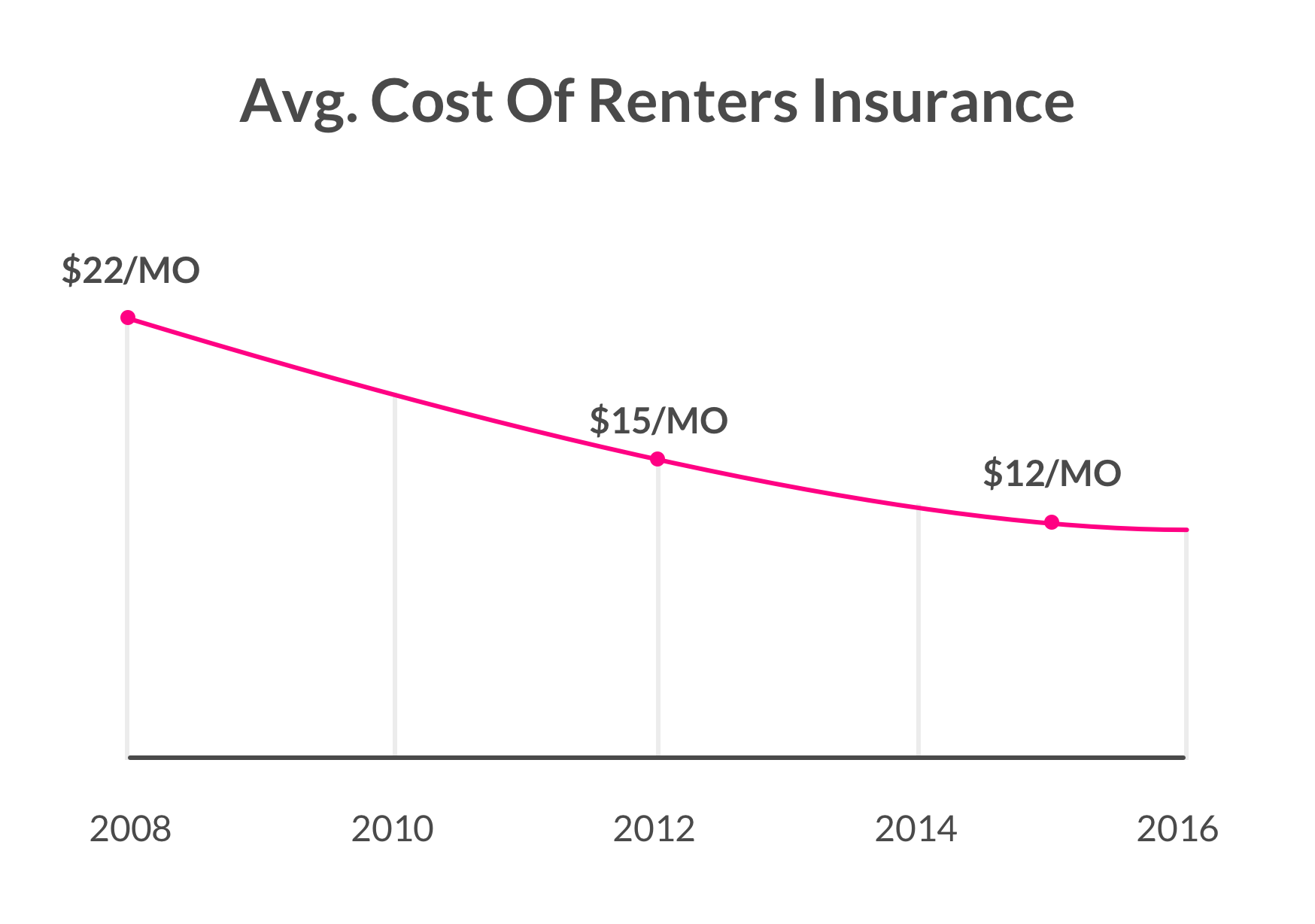

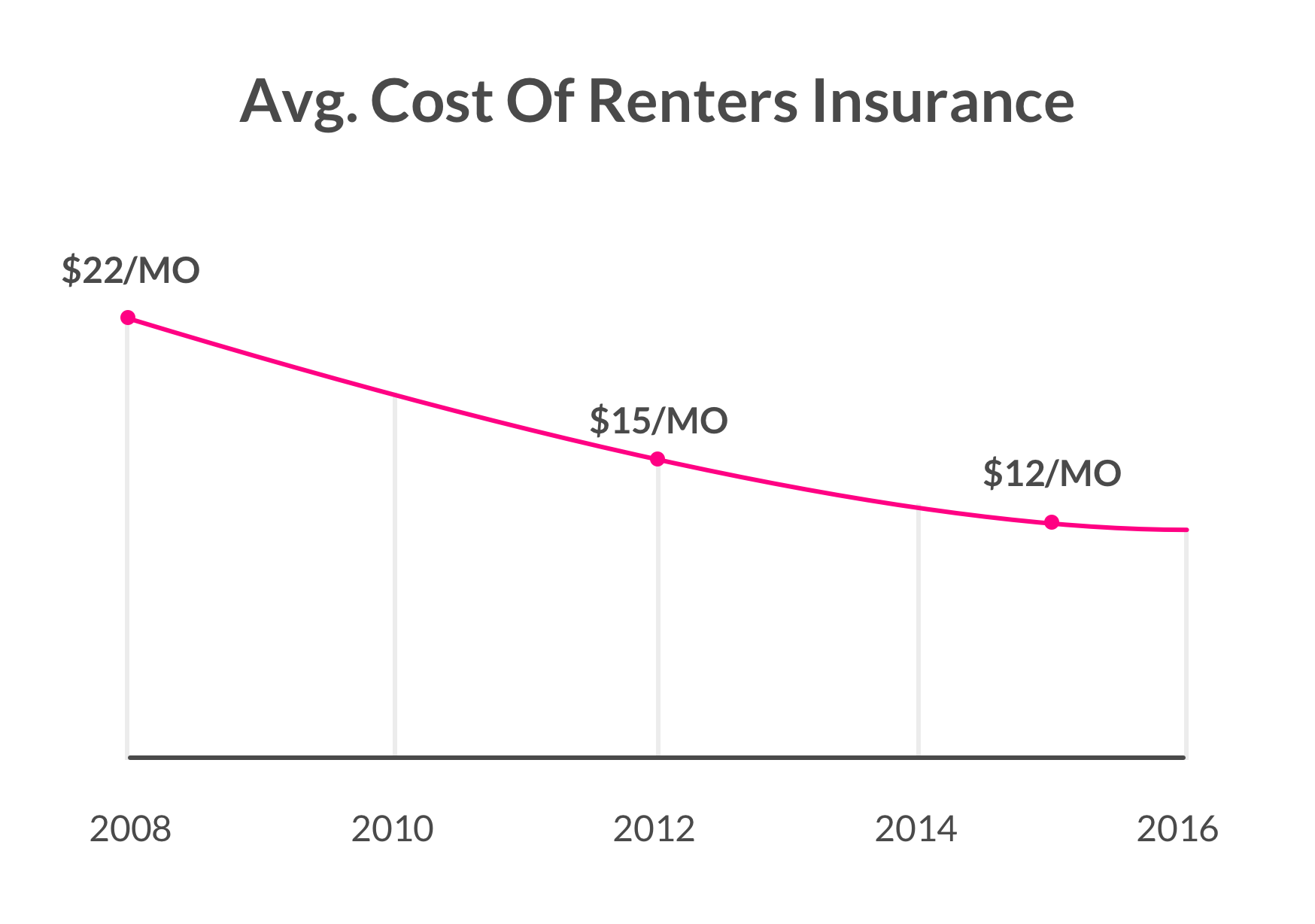

The cost of renters insurance varies by provider and coverage amount. Generally, the average cost of renters insurance is between $15 and $30 per month. However, the exact cost of your policy will depend on the type and amount of coverage you choose, as well as your location and the value of your belongings.

Do I Really Need Renters Insurance?

Renters insurance is not legally required, but it is highly recommended. It provides financial protection in the event of an accident or theft, and can help to protect your belongings in the event of a fire or other disaster. Plus, it is relatively inexpensive and can provide peace of mind.

What Factors Affect the Cost of Renters Insurance?

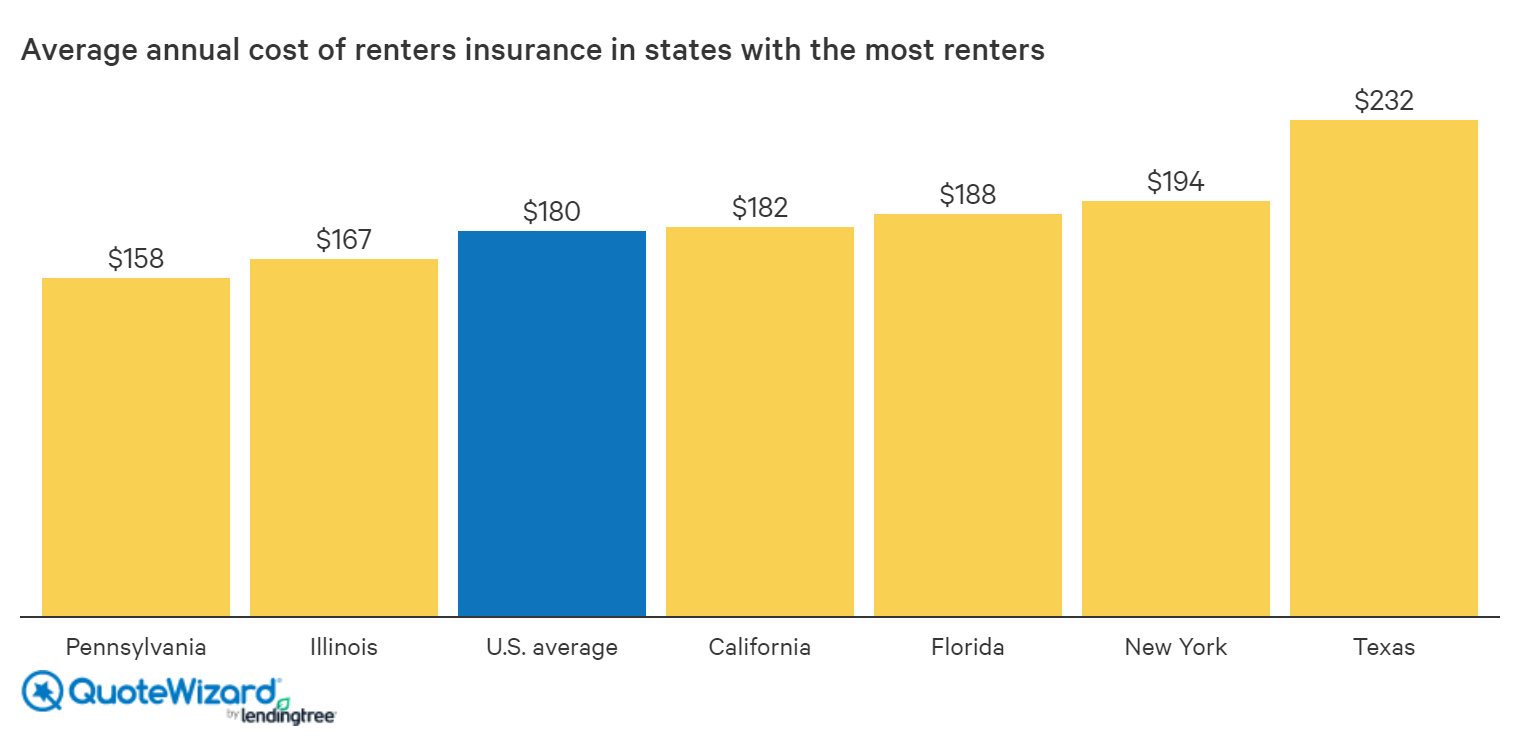

The cost of renters insurance is affected by several factors, including the amount of coverage you choose, the value of your belongings, and the location of your rental property. Your credit score may also be taken into consideration by some insurance providers. Additionally, the type of coverage you choose, such as liability or personal property coverage, can affect your premium.

How Can I Get the Best Deal on Renters Insurance?

The best way to get the best deal on renters insurance is to shop around and compare quotes from different insurance providers. Make sure to read the fine print and understand what is covered and excluded from your policy. You should also consider the value of your belongings and the amount of coverage you need. Additionally, look for discounts, such as multi-policy discounts or discounts for paying your premium in full.

When’s The Best Time To Get Renters Insurance? | Lemonade Blog

The Best Cheap Renters Insurance in Alabama - ValuePenguin

How Much Does Renters Insurance Cost? | QuoteWizard

Looking at Average Renters Insurance Rates Across All 50 States