Cancel American General Life Insurance Policy

Cancelling American General Life Insurance Policy

Why Do People Cancel Their Insurance Policy?

People often cancel their life insurance policies for a variety of reasons. Some are looking to make changes in their life insurance coverage due to a change in family circumstances, such as the birth of a new baby or the death of a loved one. Others may be seeking a lower rate or looking to switch to a different insurance provider. In some cases, people may find that their existing policy does not meet their needs or provide the necessary protection for their family. Whatever the reason for wanting to cancel an American General Life Insurance Policy, it is important to understand the process and the consequences.

How to Cancel an American General Life Insurance Policy

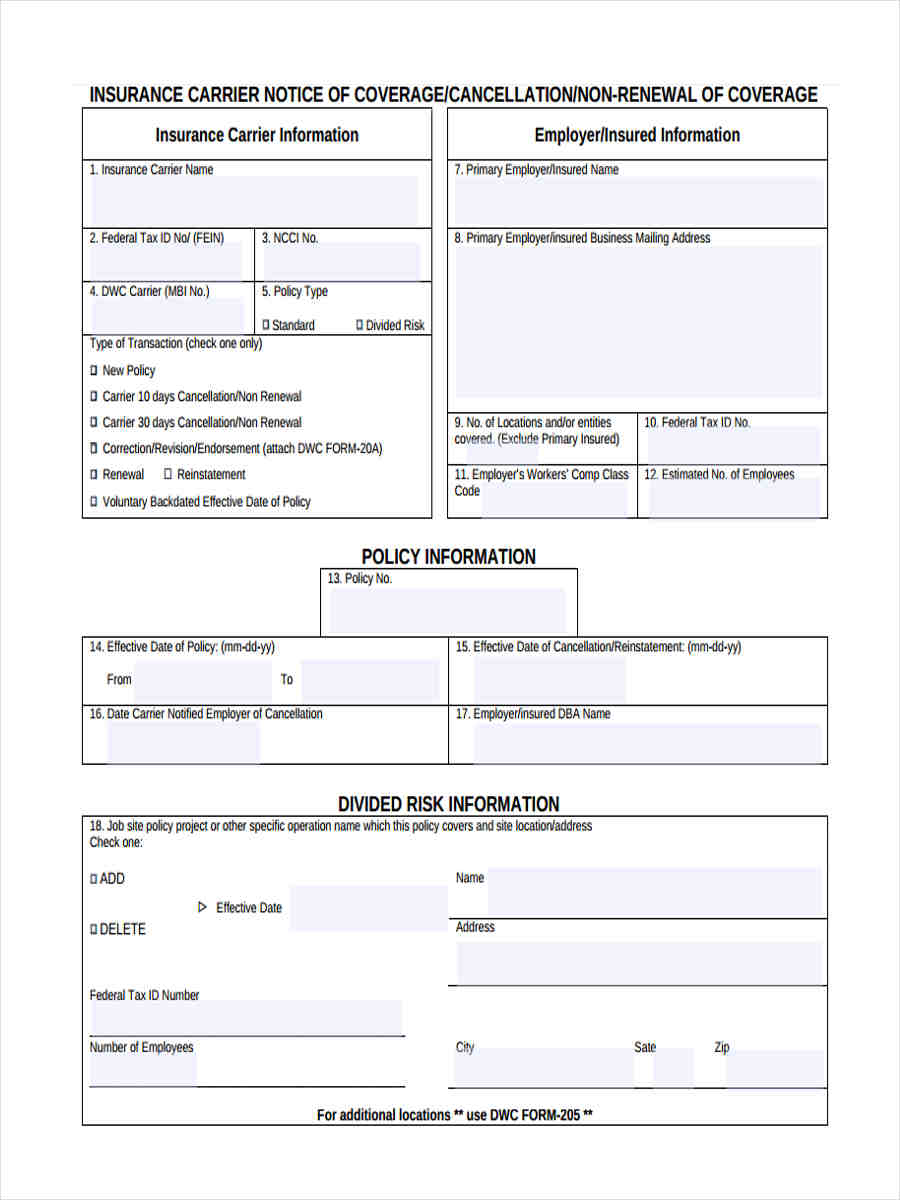

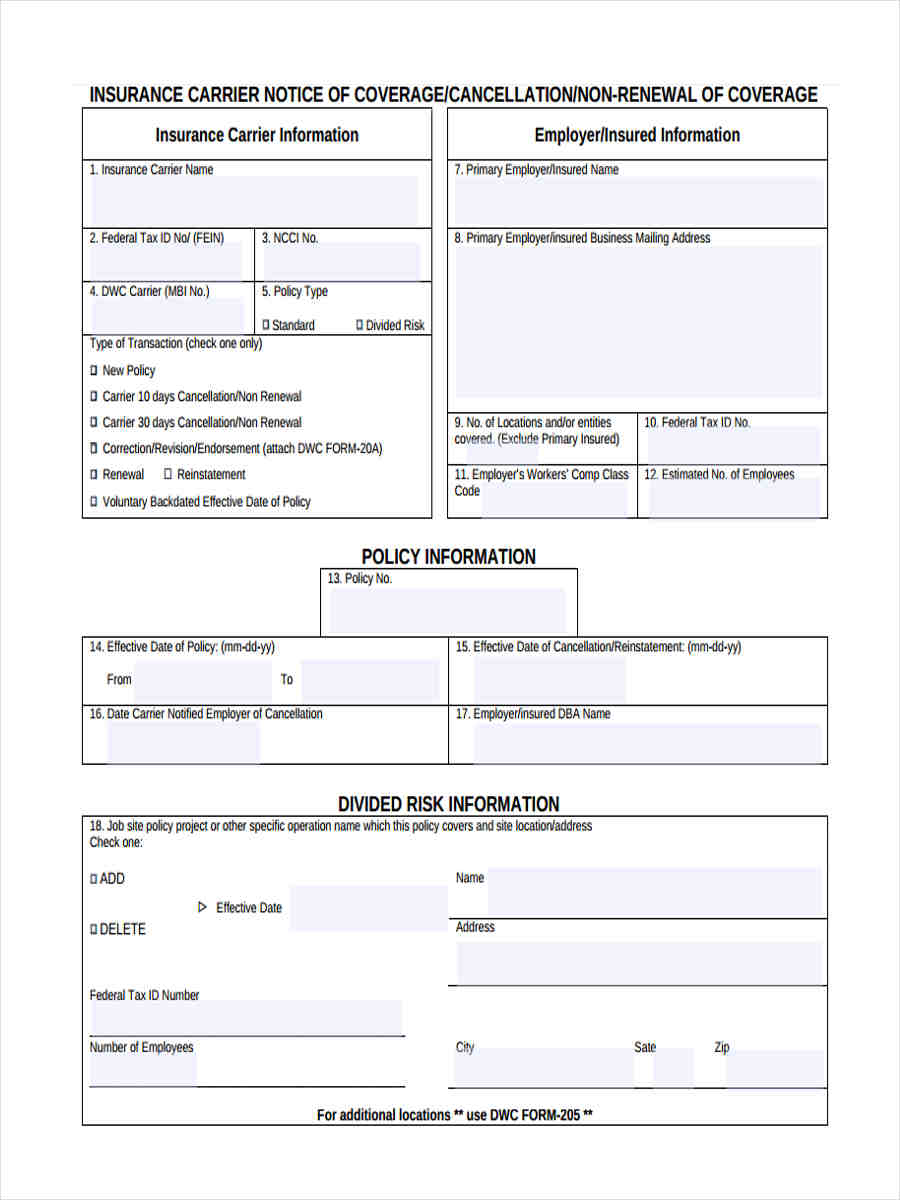

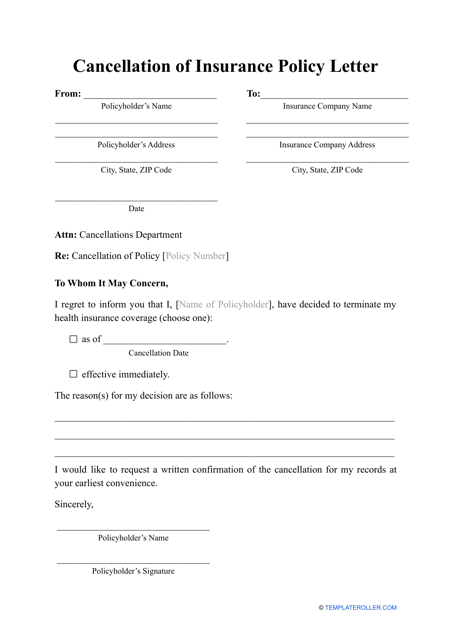

The process for canceling an American General Life Insurance Policy can vary depending on the type of policy. Generally, if you have a whole life insurance policy, you will need to contact American General Life Insurance and notify them of your intention to cancel the policy. They will then provide you with the necessary forms and information to complete the process. The forms will typically require you to provide a written statement outlining the reasons why you are canceling the policy and the amount of coverage you wish to cancel. Once the forms are completed, they must be sent to American General Life Insurance for review.

What Happens After Canceling an American General Life Insurance Policy?

Once your American General Life Insurance Policy is canceled, you will receive a notice from American General confirming the cancellation. This notice will typically provide information regarding any remaining coverage or payments that are due. If you have any remaining premiums due, you will need to pay the amount prior to the cancellation date. Depending on the type of policy, you may also be entitled to a refund of any premiums paid in advance. If you have any questions regarding your policy or the cancellation process, it is important to contact American General Life Insurance as soon as possible.

What Are the Consequences of Canceling an American General Life Insurance Policy?

Once your American General Life Insurance Policy is canceled, you will no longer have any coverage under the policy. This means that if you have dependents or other family members who rely on the policy for protection, they will no longer be covered. Additionally, you may face a financial penalty for canceling the policy, depending on the terms and conditions of the policy. If you cancel the policy within the first two years, you may be required to pay a surrender charge, which is a fee for canceling the policy before it reaches maturity. It is important to understand the terms and conditions of your policy before canceling it.

Conclusion

Cancelling an American General Life Insurance Policy is a serious decision that should not be taken lightly. Before canceling your policy, it is important to review the terms and conditions of your policy, as well as any potential financial penalties associated with canceling the policy. Additionally, it is important to understand the implications of canceling the policy, as it will no longer provide coverage for any dependents or family members who rely on it. If you have any questions about the cancellation process or the consequences of canceling the policy, it is important to contact American General Life Insurance for more information.

FREE 8+ Sample Notice of Cancellation Forms in MS Word | PDF

Cancel Life Insurance Policy Letter - How To Write A Letter To Cancel

Life Insurance Cancellation Letter Sample Reasons Why Life Insurance

American General Life Insurance Review

Can A Beneficiary Designation Be Contested at Design