What Is General Liability Insurance Coverage

What Is General Liability Insurance Coverage?

What Is General Liability Insurance?

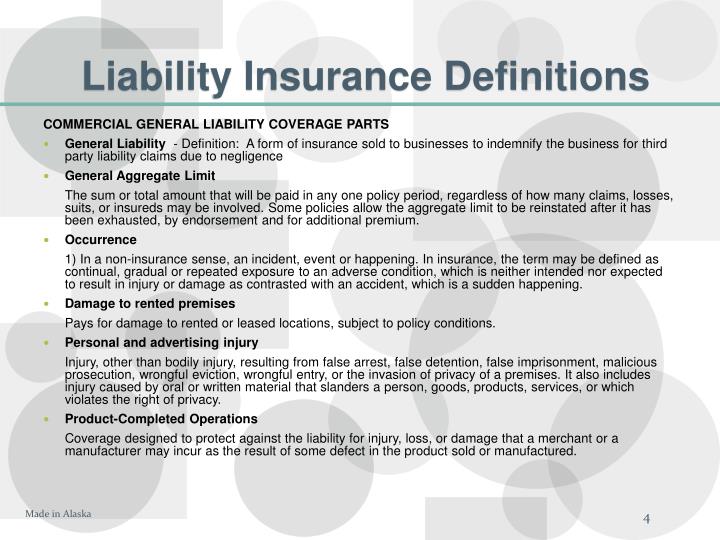

General liability insurance is a type of insurance policy purchased by business owners to protect them from any lawsuits or claims that may arise from their operations or business activities. It is a key part of any comprehensive business insurance package. It covers both actual and alleged damages, including bodily injury, personal injury, property damage, and reputational harm. It also provides protection from any legal costs associated with defending such claims. In some cases, it may even cover certain types of punitive damages. General liability insurance is essential for any business, regardless of its size or type.

What Does General Liability Insurance Cover?

General liability insurance provides protection from claims or lawsuits that arise from the business’s operations. It typically covers bodily injury, property damage, and personal injury. This includes any claims related to accidents that occur on the business premises, as well as any claims related to the business’s products or services. In addition, some policies may also provide coverage for medical payments, legal defense costs, and punitive damages. Depending on the policy, it may also provide protection from libel, slander, and copyright infringement.

What Types of Businesses Need General Liability Insurance?

Any business, regardless of its size or type, should consider purchasing general liability insurance to protect itself from any potential lawsuits or claims. This is especially true if the business is involved in any activities that could potentially lead to claims, such as providing services, manufacturing products, or dealing with customers. Additionally, some businesses may be required to purchase general liability insurance before they can begin operations. For example, many states require contractors to purchase general liability insurance before they can begin working on any projects.

How Much Does General Liability Insurance Cost?

The cost of general liability insurance varies depending on the type of business and its specific needs. Generally speaking, the cost of the policy is based on the business’s size, the type of activities it conducts, the number of employees it has, and the amount of coverage it needs. In some cases, the cost of the policy may also be affected by the business’s location and the industry it is in. In general, the cost of general liability insurance is relatively low compared to the potential costs associated with defending a lawsuit.

What Is the Difference Between General Liability Insurance and Professional Liability Insurance?

General liability insurance and professional liability insurance are two different types of insurance coverage. General liability insurance covers claims related to bodily injury, property damage, and personal injury. Professional liability insurance, on the other hand, covers claims related to errors or omissions made in the course of providing professional services. It is sometimes referred to as “errors and omissions” insurance. Professional liability insurance is typically purchased by businesses that provide professional services, such as doctors, lawyers, and accountants.

What Are the Benefits of Having General Liability Insurance?

Having general liability insurance provides a number of benefits for businesses. First, it helps protect the business from any potential lawsuits or claims that may arise from its operations. Second, it can help cover the costs associated with defending a lawsuit, which can be very expensive. Third, it can provide peace of mind for business owners, knowing that they are protected from any potential legal issues that may arise. Finally, it can help to protect the business’s reputation, as it shows that the business is taking the necessary steps to protect itself.

General Liability Insurance Quote - Protect Your Business | EINSURANCE

commercial general liability insurance definition – Kcaweb

How to Protect Your Business From Unpredictable Events With General

General Liability Insurance Facts Businesses Need to Know | LPM Risk

General vs Professional Liability Insurance