Car Insurance For New Jersey

What You Need to Know About Car Insurance in New Jersey

New Jersey is one of the few states in the United States that requires drivers to carry car insurance. It is a necessary precaution to protect both the driver and others on the road. With car insurance, you are financially protected in the event of an accident. Having car insurance also helps to keep the roads safe by reducing the chances of uninsured drivers.

The Different Types of Car Insurance in New Jersey

In New Jersey, there are three main types of car insurance coverage: Liability, Collision, and Comprehensive. Liability coverage is the most basic type and is required by the state. It covers damages to the other driver if you are found at fault in an accident. Collision coverage is optional but does cover damages to your car if you are in an accident. Comprehensive coverage is also optional and covers damages to your car that are caused by non-accidental events, such as theft or weather-related events.

What are the Minimum Requirements for Car Insurance in New Jersey?

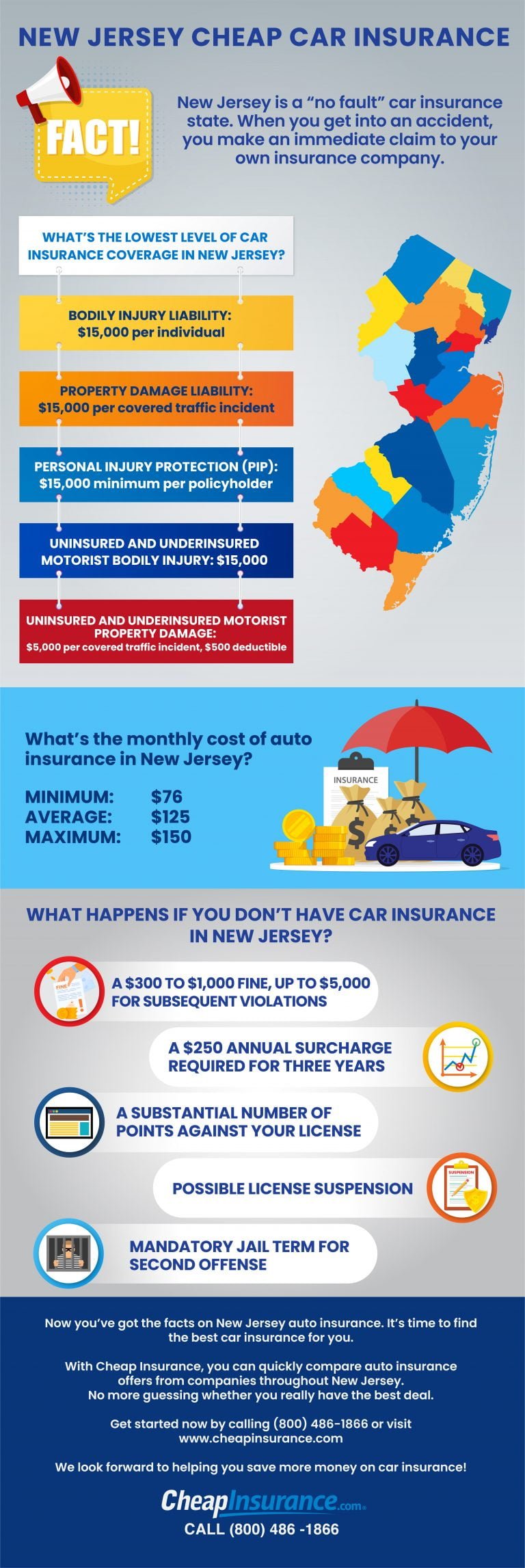

In New Jersey, all drivers must have a minimum amount of car insurance coverage in order to legally drive on the road. The minimum requirements are $15,000 per person for bodily injury, $30,000 per accident for bodily injury, and $5,000 per accident for property damage. This means that if you are found at fault in an accident, the insurance company will cover up to $15,000 per person in bodily injury, up to $30,000 per accident in bodily injury, and up to $5,000 in property damage.

What are the Penalties for Not Having Car Insurance in New Jersey?

In New Jersey, drivers who are caught without car insurance will face serious penalties. The first time a driver is caught without insurance, they may face a fine of up to $500 and their license and registration can be suspended for one year. If the driver is caught a second time, they will face a fine of up to $1,000 and their license and registration can be suspended for two years. In addition, a driver’s car may be impounded and they may have to pay a fee to get it back.

Where Can I Get Car Insurance in New Jersey?

There are many companies that offer car insurance in New Jersey. You can get car insurance from an insurance agent or broker, or you can purchase car insurance online. It is important to shop around and compare rates and coverage from different companies to make sure you are getting the best deal. You can also check with the state insurance department to make sure the company you are considering is licensed to do business in New Jersey.

Conclusion

Car insurance is an important part of driving in New Jersey. All drivers must have a minimum amount of car insurance coverage in order to legally drive on the road. Drivers who are caught without insurance will face serious penalties. It is important to shop around and compare rates and coverage from different companies to make sure you are getting the best deal.

New Jersey Car Insurance Comparison Chart and Guide

Who Has the Cheapest Car Insurance in New Jersey? - ValuePenguin

New Jersey Cheap Car Insurance Provider | Car Insurance Coverage

11 Best & Cheapest Car Insurance Companies in New Jersey (2019)

The Best Car Insurance in New Jersey