What Is The Average Car Insurance Payment

What Is The Average Car Insurance Payment?

The Cost of Car Insurance

When it comes to car insurance, figuring out how much you will need to pay can be tricky. Every driver is unique and has different factors that will influence the cost of their car insurance. It is important to be aware of the average car insurance payment so that you can plan your budget accordingly.

Factors That Determine Car Insurance Cost

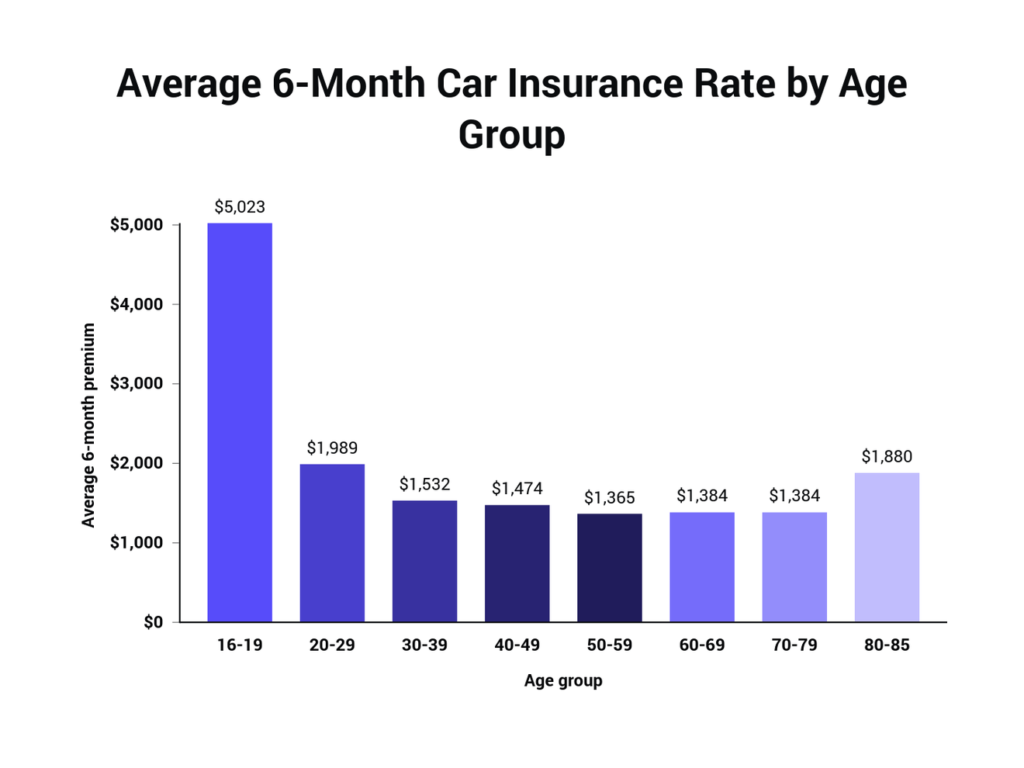

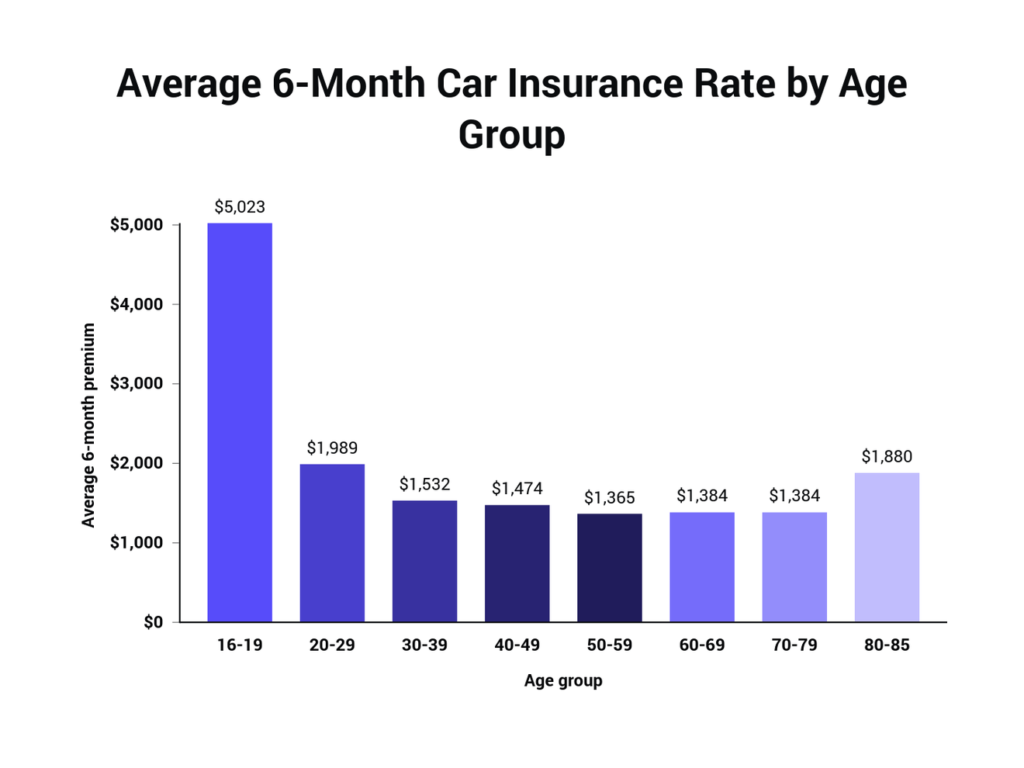

There are a few key factors that will determine the cost of your car insurance. These include the type of car you drive, the age and experience of the driver, the driver’s driving record, and the location of the driver. The type of car you drive will have the biggest impact on the cost of your car insurance because some cars are more expensive to insure than others. Additionally, the age and experience of the driver will also make a difference in the cost of car insurance. Drivers with more years of experience behind the wheel tend to pay less for car insurance because they are viewed as less of a risk. In addition, drivers with a clean driving record will also pay less for car insurance. Lastly, the location of the driver can also be a factor in the cost of car insurance. Drivers living in urban areas will typically pay more for car insurance than drivers living in rural areas.

Average Cost of Car Insurance

The average cost of car insurance in the United States is around $1,500 per year. However, this number can vary significantly depending on the factors mentioned above. Drivers who are younger and less experienced will pay more for car insurance than those who are older and more experienced. Additionally, drivers with a poor driving record will also pay more for car insurance than those with a clean record. Lastly, drivers living in urban areas will typically pay more for car insurance than drivers living in rural areas.

Tips to Lower Your Car Insurance Payment

There are a few simple things you can do to lower your car insurance payment. The first is to compare car insurance quotes from multiple providers. By shopping around, you may be able to find a better rate than the one you are currently paying. Additionally, you may be able to find discounts for things like being a safe driver, having multiple policies with the same provider, or being a member of certain groups or organizations. You can also try to bundle your car insurance with other types of insurance such as homeowners or renters insurance.

Conclusion

The average car insurance payment in the United States is around $1,500 per year. However, the cost of car insurance can vary significantly depending on the type of car you drive, the age and experience of the driver, the driver’s driving record, and the location of the driver. To lower your car insurance payment, you should shop around and compare quotes from multiple providers. Additionally, you should look for discounts and bundle your car insurance with other types of insurance. By following these tips, you can save money on your car insurance payment.

What Is The Average Car Insurance Payment - CarProClub.com

Average Car Insurance Payments For 24 Year Old Males

Average Price Of Car Insurance Per Month - designby4d

Average Car Insurance Payment For 23 Year Old Male - Payment Poin

Average Car Insurance Payment For 23 Year Old Male - Payment Poin