Does Age Affect Car Insurance

Does Age Affect Car Insurance?

What Factors Are Considered For Car Insurance?

Car insurance is a complicated and often expensive process. There are many factors that go into calculating a person’s car insurance premium, such as their driving record, the type of car they drive, where they live, and the amount of coverage they purchase. One factor that can have a significant impact on the cost of car insurance is age.

How Does Age Affect Car Insurance?

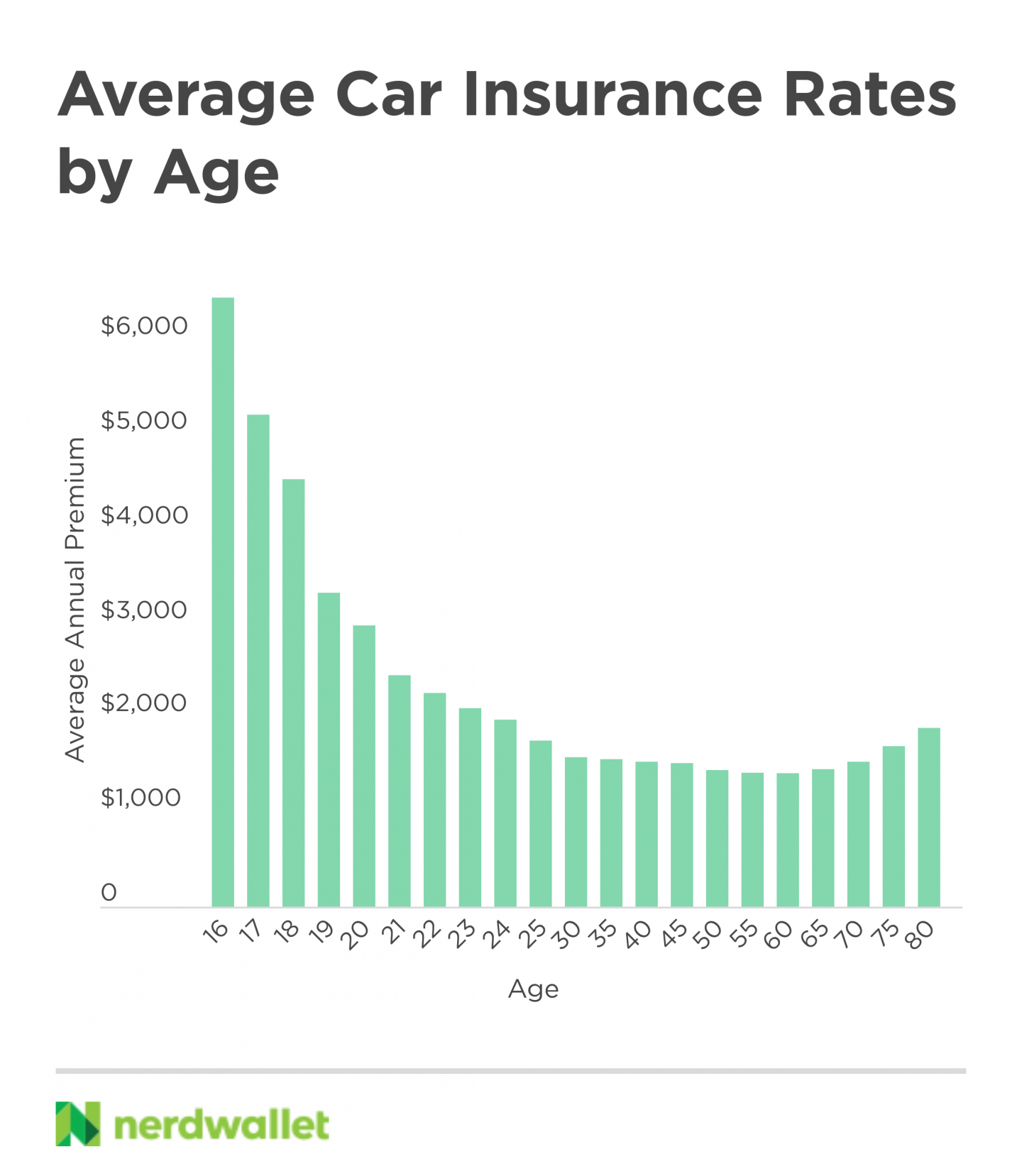

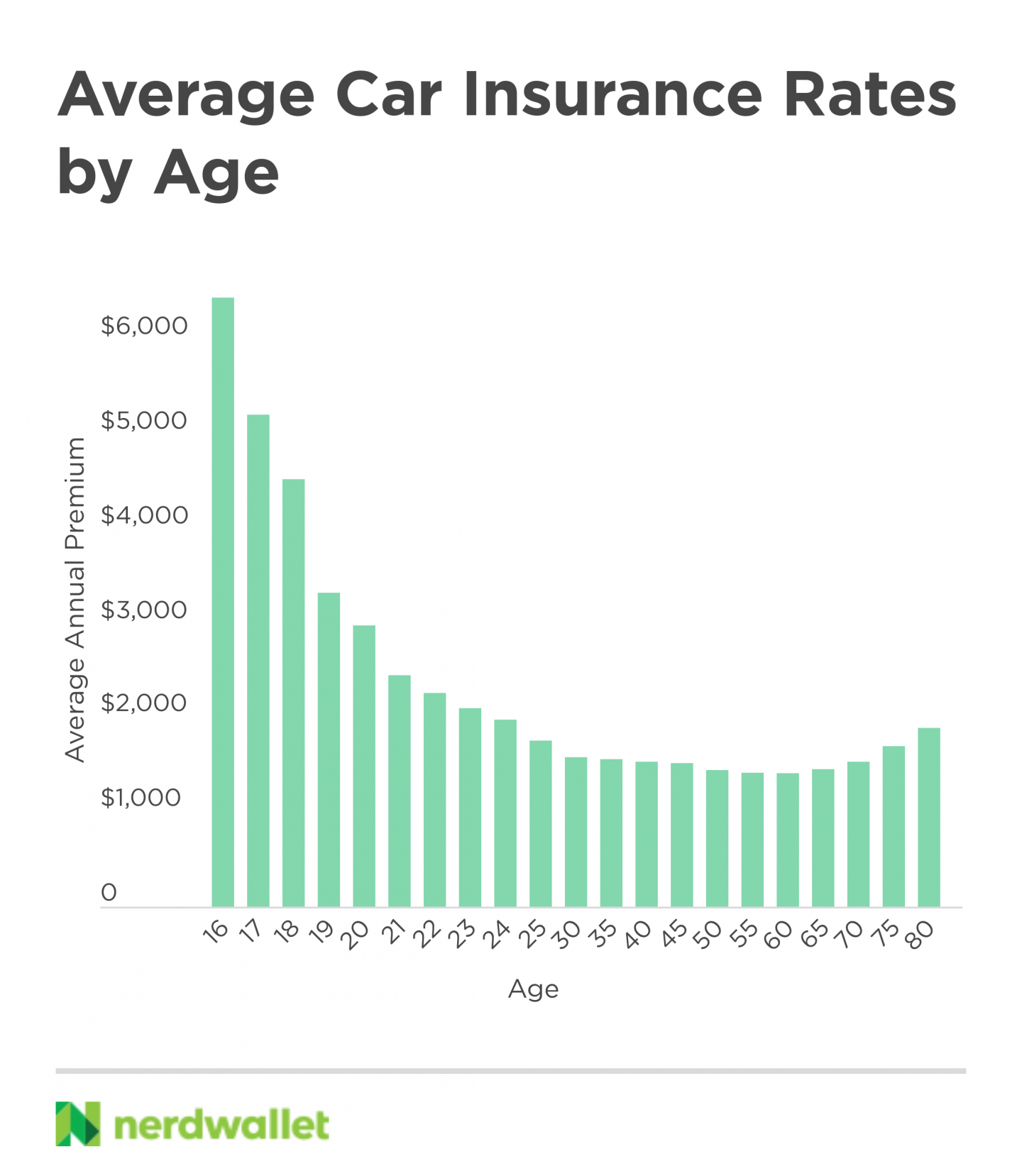

Age is one of the main factors that insurance companies use to determine the cost of car insurance. Generally speaking, drivers under the age of 25 are considered to be inexperienced and are therefore charged higher premiums than older, more experienced drivers. This is because young drivers are more likely to be involved in accidents and to make claims on their insurance policies.

In addition to this, older drivers are also seen as more likely to take extra precautions while driving, such as wearing seat belts, obeying the speed limit, and avoiding distractions. All of these things can help to keep them safe, which can lead to lower insurance premiums.

Can You Save Money On Car Insurance As You Age?

Yes, you can save money on car insurance as you age. As you get older and gain more experience on the road, you become a better and safer driver. This will be reflected in your premiums, as insurance companies consider you a lower risk and therefore will offer you lower rates. Also, if you have a clean driving record and no claims on your insurance policy, you will be eligible for even lower rates.

Another way to save money on car insurance as you age is to take a defensive driving course. These courses are designed to help drivers become better and safer on the road and can lead to discounts on your car insurance.

Conclusion

Age is one of the main factors that insurance companies use to calculate car insurance premiums, and can have a significant impact on the cost. Generally, younger drivers are seen as more of a risk and are charged higher premiums, while older, more experienced drivers are seen as safer and are offered lower premiums.

However, as you get older and gain more experience on the road, you can save money on your car insurance premiums by taking a defensive driving course and maintaining a clean driving record. If you can do these things, you should be able to get a lower rate on your car insurance.

Average Car Insurance Rates by Age and Gender | Urban Wealth Report

Auto Insurance & The Intrinsic Ageism In Us All | Walltypes

What Age Does Car Insurance Go Down And Why? - Cover

How Does Age Affect Car Insurance Rates?

Average Cost of UK Car Insurance 2018 | NimbleFins