Old Car Insurance Price List

Old Car Insurance Price List

Exploring the Cost of Old Car Insurance

If you’re looking for coverage for an older car, you’ll need to take a look at the cost of old car insurance. Insurance companies typically charge higher premiums for older cars because they are more likely to be involved in an accident or stolen. Older cars also tend to be more expensive to repair or replace if they are damaged in an accident.

As with any other type of insurance, the cost of old car insurance can vary widely depending on the type of coverage you’re looking for and the company you choose. Insurance companies consider a variety of factors when determining premiums, including the age of the car, its make and model, the location you live in, and your driving history. As such, it’s important to shop around and compare prices from several different insurance companies to ensure you’re getting the best coverage for the best price.

What is the Average Cost of Old Car Insurance?

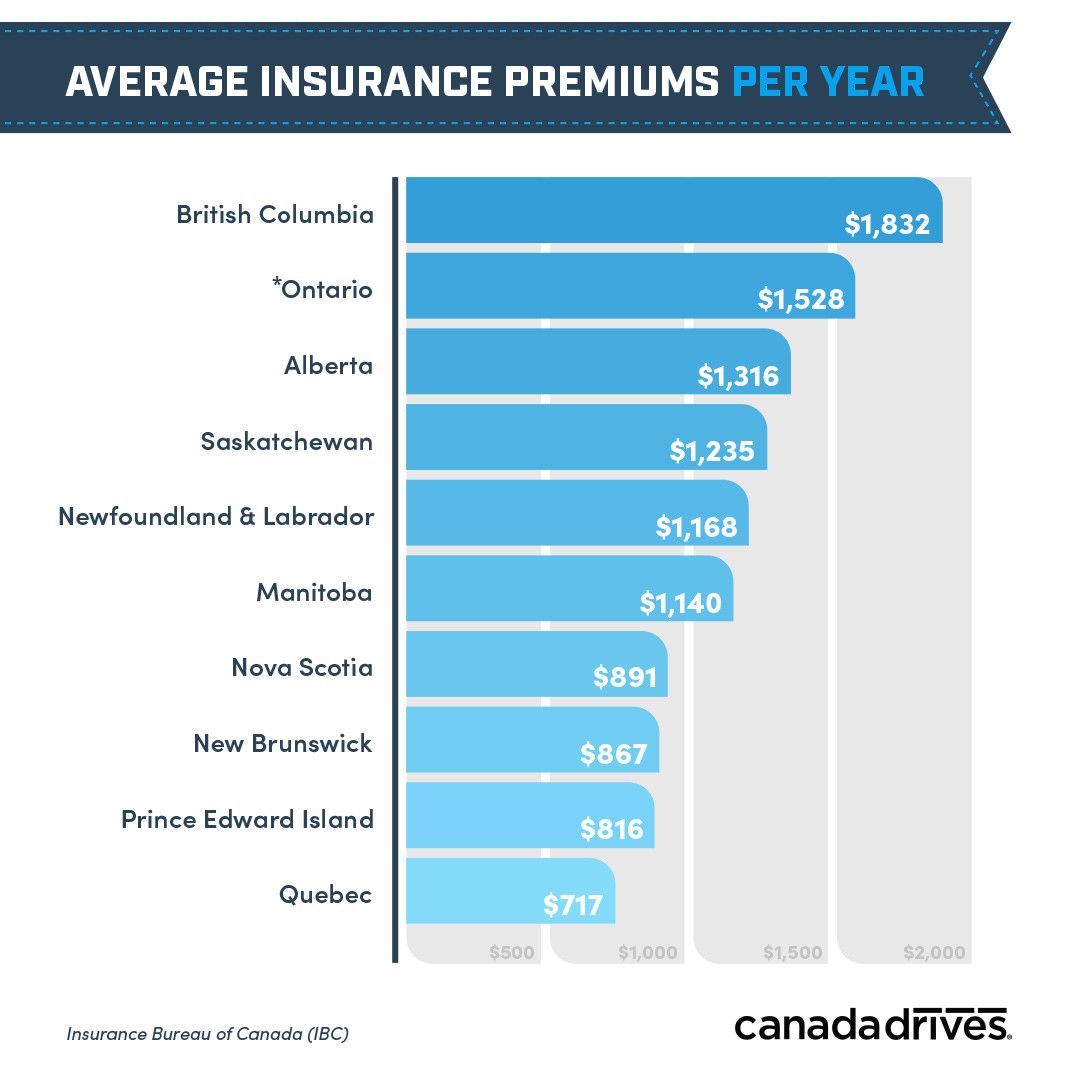

The average cost of old car insurance will vary depending on a variety of factors, including the make and model of the car, the age of the driver, and the location of the car. Generally speaking, older cars tend to cost more to insure than newer models, and drivers with a poor driving record may pay higher premiums than those with a clean record.

In addition to the age of the car, the make and model can also affect the cost of insurance. Luxury cars, sports cars, and other high-end models tend to cost more to insure than more basic models. It’s also important to keep in mind that the cost of old car insurance can vary depending on the coverage you choose. For example, a policy with comprehensive coverage may cost more than one with just liability coverage.

How to Find the Best Price for Old Car Insurance?

The best way to find the best price for old car insurance is to shop around and compare quotes from several different companies. It’s important to make sure you’re getting the coverage you need at the best possible price. In addition to comparing prices, it’s also wise to read customer reviews and check the financial ratings of the companies you’re considering.

You may also be able to find discounts on old car insurance by bundling it with other types of insurance, such as home or life insurance. Finally, it’s important to make sure you’re taking advantage of discounts that may be available, such as good driver discounts or discounts for installing safety devices in your car.

Conclusion

The cost of old car insurance can vary significantly depending on a variety of factors. It’s important to shop around and compare quotes from several different companies to ensure you’re getting the best coverage at the best price. Additionally, you may be able to find discounts on old car insurance by bundling it with other types of insurance or taking advantage of discounts that may be available.

What's the average cost of car insurance in the US? - Business Insider

Is Insurance On Older Cars Cheaper - Best Classic Cars

Skoda dealers charging RTO tax & insurance on old (higher) price, not

Find Best Car Insurance Rates Auto

Average Cost Of Car Insurance For 19 Year Old Female - Car Retro