Named Non owner Personal Auto Policy Would Be Ideal For Whom

What Is Named Non Owner Personal Auto Policy?

A named non owner personal auto policy is a type of insurance coverage that is designed to protect an individual who does not own a vehicle but who often drives one. It is available to individuals who have been found to have a high risk of being involved in an accident due to their driving habits or lack of experience. This type of policy is especially beneficial for those who do not possess their own car but who often use hired vehicles, rental cars, or vehicles that belong to others.

This type of policy is typically offered by insurance companies and provides coverage for liability, collision, and other expenses that may occur from an accident. It is important to note that this policy does not provide coverage for the car itself or any property that may be damaged in an accident. It is also important to understand that this type of policy does not provide coverage for any medical bills that may be incurred as a result of an accident.

Who Would Benefit from a Named Non Owner Personal Auto Policy?

This type of policy is most beneficial to those who often drive vehicles that they do not own, such as a rental car or a vehicle that belongs to someone else. It is also beneficial to those who are considered to be a higher risk driver, such as those who are under the age of 25 or those who have had numerous traffic violations. In addition, this type of policy is also beneficial to those who may need to provide proof of insurance to their employer or to a leasing agency when renting a vehicle.

This type of policy is also beneficial to those who are not able to obtain traditional auto insurance due to financial constraints or due to their poor driving record. It can provide them with the coverage they need in order to legally drive, without the need to purchase a full coverage policy. Additionally, this type of policy may also be beneficial for those who do not own a vehicle and who may only need coverage for a short period of time.

How Does a Named Non Owner Personal Auto Policy Work?

This type of policy works by providing the same coverage that a standard auto policy would provide. This includes liability, collision, and other expenses that may arise from an accident. However, the premiums for this type of policy are typically much lower than those for traditional auto policies since the individual is not actually the owner of the vehicle. In addition, this type of policy can also be more affordable for those who are considered to be higher risk drivers, since it may be less expensive than traditional auto policies.

In addition, this type of policy can provide coverage for those who need to provide proof of insurance to their employer or to a leasing agency when renting a vehicle. It can also provide coverage for those who may not be able to afford the premiums for a traditional auto policy. Finally, this type of policy can also provide coverage for those who may need coverage for a short period of time, such as when traveling for business or pleasure.

Conclusion

Named non owner personal auto policies can provide individuals with the coverage they need in order to legally drive, without the need to purchase a full coverage policy. This type of policy is most beneficial to those who often drive vehicles that they do not own, such as a rental car or a vehicle that belongs to someone else. It is also beneficial to those who are considered to be a higher risk driver, such as those who are under the age of 25 or those who have had numerous traffic violations. In addition, this type of policy is also beneficial to those who may need to provide proof of insurance to their employer or to a leasing agency when renting a vehicle.

Non Owners Car Insurance Policy

BEST CAR INSURANCE: About Non-Owners Car Insurance | BEST CAR INSURANCE

Non Owner Auto Insurance | Compare quotes wih Good to Go

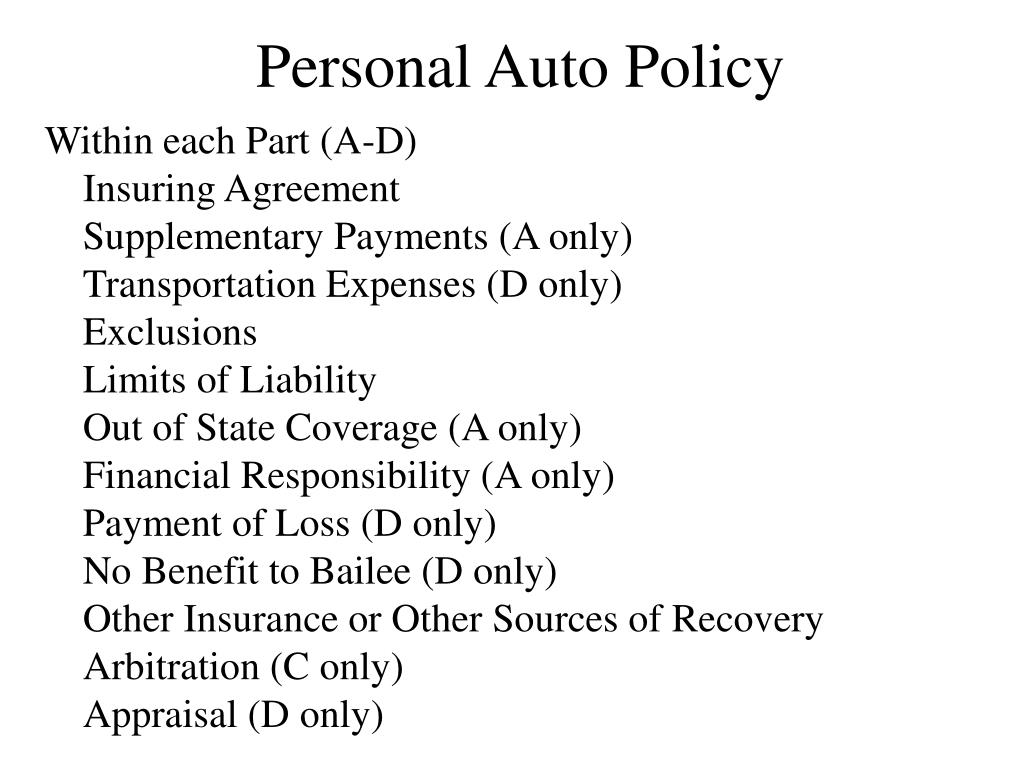

PPT - Personal Lines Policies PowerPoint Presentation - ID:5442823

PPT - Personal Lines Policies PowerPoint Presentation, free download