Can I Get A Cover Note For Car Insurance

Can I Get A Cover Note For Car Insurance?

What is a Cover Note?

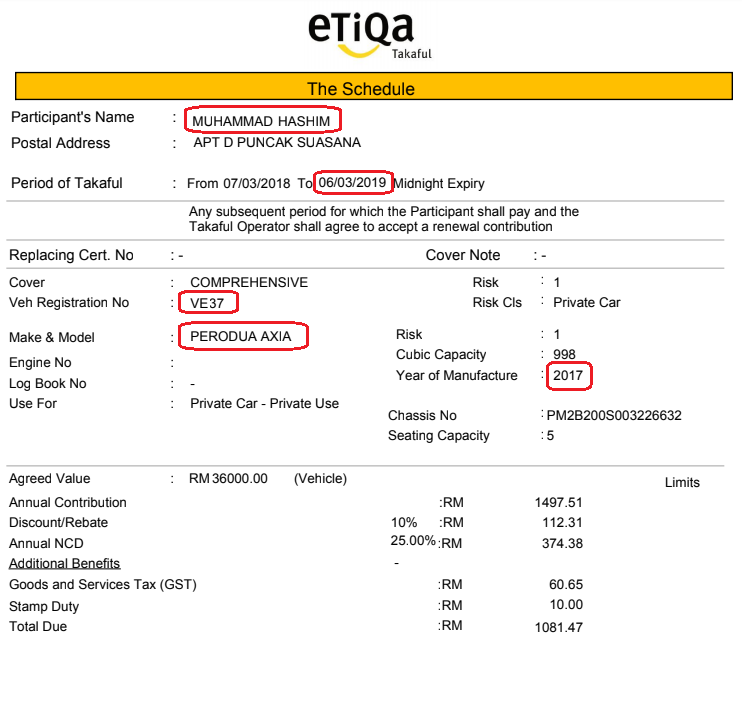

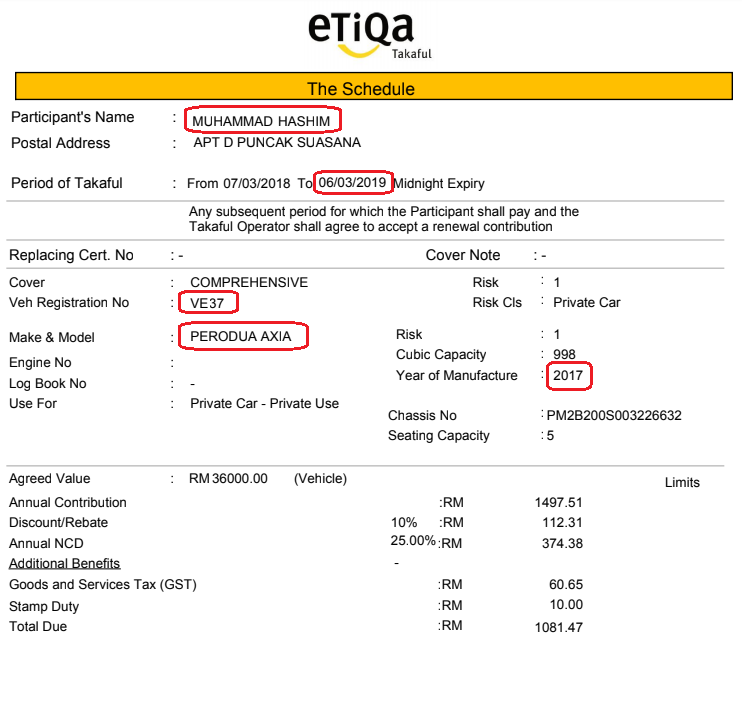

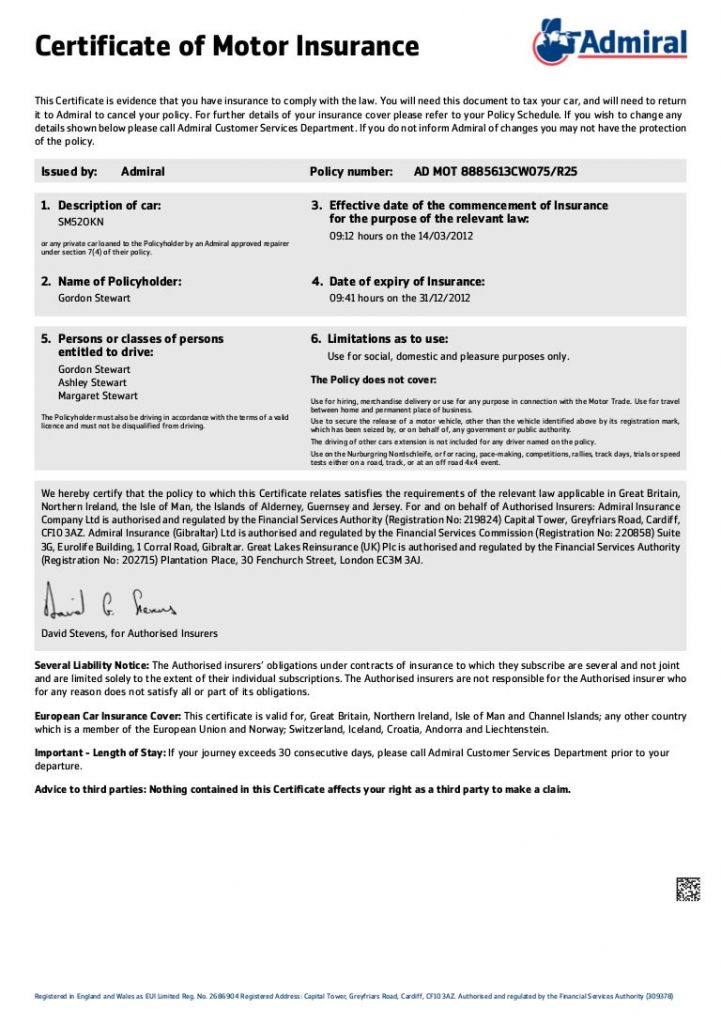

A cover note for car insurance is a document that serves as a proof of insurance for your vehicle. It is provided to you by your car insurance provider as a temporary document that is valid for a short period of time until you receive your official insurance policy. The cover note is a legally binding document that provides the same coverage for your vehicle as the permanent insurance policy.

What Does a Cover Note Cover?

A cover note is designed to provide the same coverage that is provided by the car insurance policy. This includes coverage for liability, property damage, and medical expenses. The cover note also provides coverage for any other persons who were involved in the accident and any property damage that was caused. In addition to providing coverage for the accident, the cover note may also provide coverage for other incidents, such as vandalism and theft.

What is the Difference Between a Cover Note and a Car Insurance Policy?

The main difference between a cover note for car insurance and a car insurance policy is the duration of coverage. A cover note is typically valid for a short period of time, usually ranging from one to three months. The insurance policy, on the other hand, is valid for a longer period of time, usually up to one year or more.

When Do I Need a Cover Note?

You may need a cover note if you are unable to obtain a car insurance policy in a timely manner. For example, if you are a new driver and are still in the process of obtaining a car insurance policy, you may need to use a cover note in the meantime. You may also need a cover note if you are purchasing a new vehicle and need immediate coverage. Additionally, if you are making a change to your existing car insurance policy, you may need to use a cover note until you receive the new policy.

How Do I Obtain a Cover Note?

You can obtain a cover note for car insurance from your car insurance provider. Typically, you will need to provide some basic information about yourself and your vehicle in order to obtain a cover note. Once the information is submitted, your car insurance provider will generate the cover note and provide you with a copy. It is important to note that the cover note is only valid for a limited period of time.

Conclusion

A cover note for car insurance is a temporary document that provides the same coverage as a permanent car insurance policy. It is typically valid for a short period of time, usually one to three months. A cover note is a good option if you are unable to obtain a car insurance policy in a timely manner or if you need immediate coverage for a new vehicle. You can obtain a cover note from your car insurance provider by providing some basic information about yourself and your vehicle.

Can I Change My Address On My Car Registration Online - Classic Car Walls

Insurance Cover Note Malaysia - lounsfe

What is a Cover Note? Driving Theory Test Question and Answer

Does Car Insurance Cover Hail Damage Repair | Colorado Springs

Contoh Cover Note Insurance Kereta - Galeri Sampul