Best And Cheapest Car Insurance In Michigan

Wednesday, September 6, 2023

Edit

Best and Cheapest Car Insurance in Michigan

Discovering the Best Car Insurance Rates in Michigan

One of the most important decisions you will make as a Michigan driver is choosing the best car insurance for your budget and lifestyle. With so many options, it can be difficult to decide which insurance company to choose. The good news is that there are a variety of ways to save money and ensure that you get the best coverage for your needs.

In Michigan, the state requires drivers to have a minimum amount of liability coverage. This coverage pays for any damages or injuries that you may cause to other drivers in the event of an accident that is your fault. You can also choose to add additional coverage such as collision, comprehensive, uninsured motorist, and medical payments coverage.

When shopping for car insurance, it is important to compare rates from multiple companies in order to get the best deal. The internet is a great resource for finding the lowest rates. You can also use an independent insurance agent to help you find the best policy and coverage.

Tips to Get the Cheapest Car Insurance Rates in Michigan

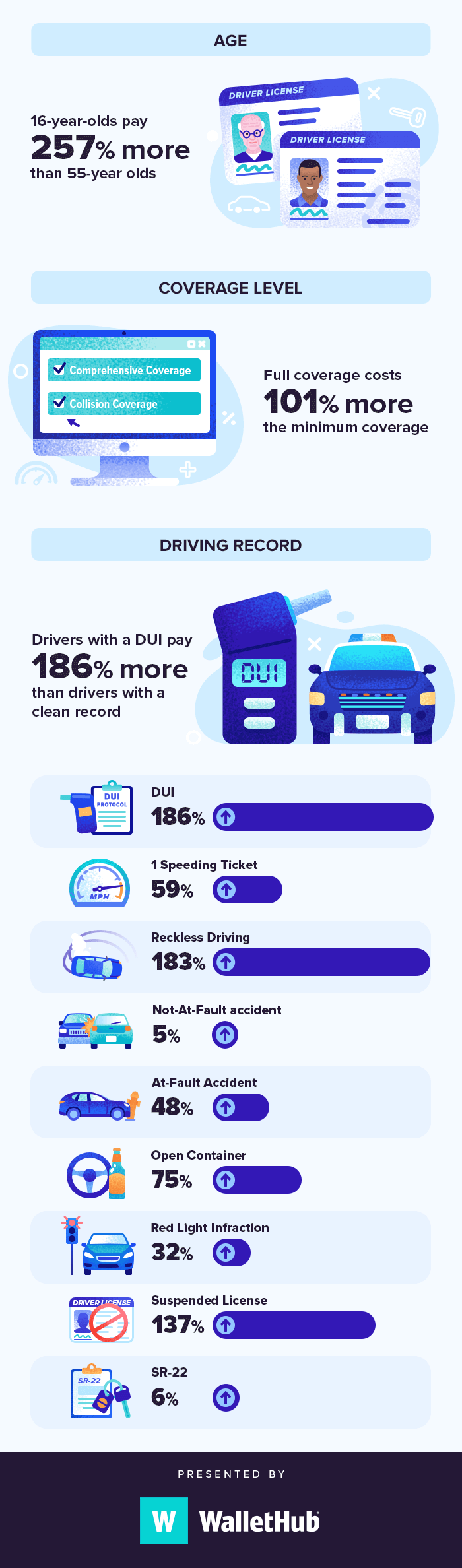

To get the best car insurance rates in Michigan, there are several things you can do to save money. The first is to make sure you have a clean driving record. If you have a history of speeding tickets or accidents, your rates will be higher. You can also save money by taking a defensive driving course or agreeing to a safe driver discount.

You can also get discounts for being a good student or having multiple cars on the same policy. Many insurance companies also offer discounts for having an anti-theft device installed in your vehicle. It is also important to shop around to compare rates from multiple companies.

The Best Auto Insurance Companies in Michigan

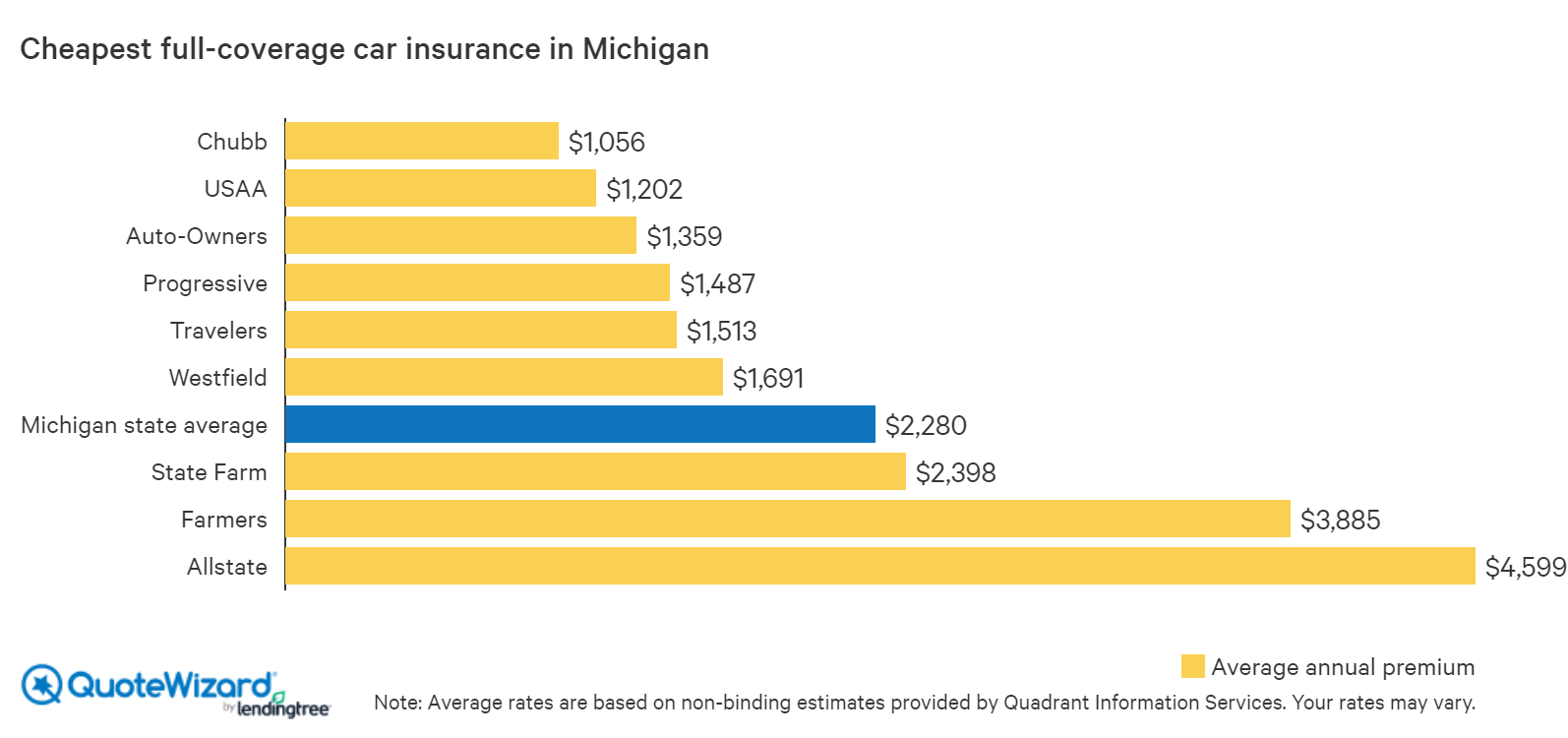

When shopping for car insurance in Michigan, there are several companies that are known for offering the best rates. These include State Farm, Allstate, Progressive, and Nationwide. Each of these companies offers a variety of coverage options, so it is important to compare policies and find the best one for your budget and needs.

In addition to these larger companies, there are also a number of smaller, local auto insurance companies in Michigan. These companies may offer more personalized service and better rates. It is important to compare several companies before making a decision.

Why You Should Compare Car Insurance Quotes

Comparing car insurance quotes is the best way to find the best rate and coverage for your needs. Every insurance company has different rates and coverage levels, so it is important to compare several quotes before making a decision.

By comparing quotes, you can ensure that you are getting the best rate and coverage for your money. You can also find discounts and other incentives that may not be available with other companies. Comparing quotes is also a great way to make sure you are getting the most comprehensive coverage for your needs.

Conclusion

Finding the best and cheapest car insurance in Michigan is an important decision for any driver. It is important to compare rates and coverage from multiple companies and find the best policy for your budget and needs. You can also save money by taking advantage of discounts and incentives. By shopping around and comparing quotes, you can ensure that you are getting the best coverage for your money.

Find cheap car insurance in 8 easy steps • InsureMeta in 2020 | Cheap

Top 10 Cheapest Car Insurance Companies - YouTube

Cheapest Car Insurance in Michigan | QuoteWizard

Download Car Insurance Midland Mi Background

7 Best Cheap Car Insurance Companies in 2019 | Compare & Save