State Farm Car Insurance Monthly Cost

Friday, June 23, 2023

Edit

Understanding State Farm Car Insurance Monthly Cost

What is State Farm Car Insurance?

State Farm car insurance is one of the largest insurance companies in the US. It has been in business since 1922 and offers a wide range of insurance products, including car insurance. State Farm offers a variety of options when it comes to car insurance, including liability coverage, collision coverage, comprehensive coverage, and more. Additionally, State Farm offers discounts and other benefits that can help you save money on your monthly car insurance premiums.

What Factors Affect State Farm Car Insurance Monthly Cost?

The cost of your State Farm car insurance policy is based on several factors, including your driving record, the type of vehicle you drive, and the amount of coverage you choose. Your driving record is especially important, as a history of traffic violations or accidents can result in higher premiums. Additionally, the type of vehicle you drive can affect your premium. For example, if you drive an older car with a higher likelihood of being stolen or damaged, you may pay more for your policy. Furthermore, the amount of coverage you choose can have a major effect on your monthly cost. If you choose higher levels of coverage, you may pay more for your policy.

What Are Some Ways to Lower State Farm Car Insurance Monthly Cost?

There are several ways to lower your State Farm car insurance monthly cost. First, consider increasing your deductible. A deductible is the amount of money you’ll need to pay out of pocket before your insurance kicks in. The higher your deductible, the lower your monthly premium. Additionally, you may be able to qualify for discounts if you have a clean driving record, if you’ve taken defensive driving classes, or if you’ve installed certain safety features in your car. Finally, you may be able to save money if you bundle your car insurance with other State Farm policies, such as homeowners or life insurance.

What Are the Benefits of State Farm Car Insurance?

There are several benefits to having State Farm car insurance. First, the company offers a variety of coverage options to suit your needs. Additionally, State Farm provides 24/7 customer service, so you can get help whenever you need it. Furthermore, State Farm offers a variety of discounts and other benefits to help you save money on your premiums. Finally, the company offers an online portal where you can manage your policy and make payments.

What Are the Drawbacks of State Farm Car Insurance?

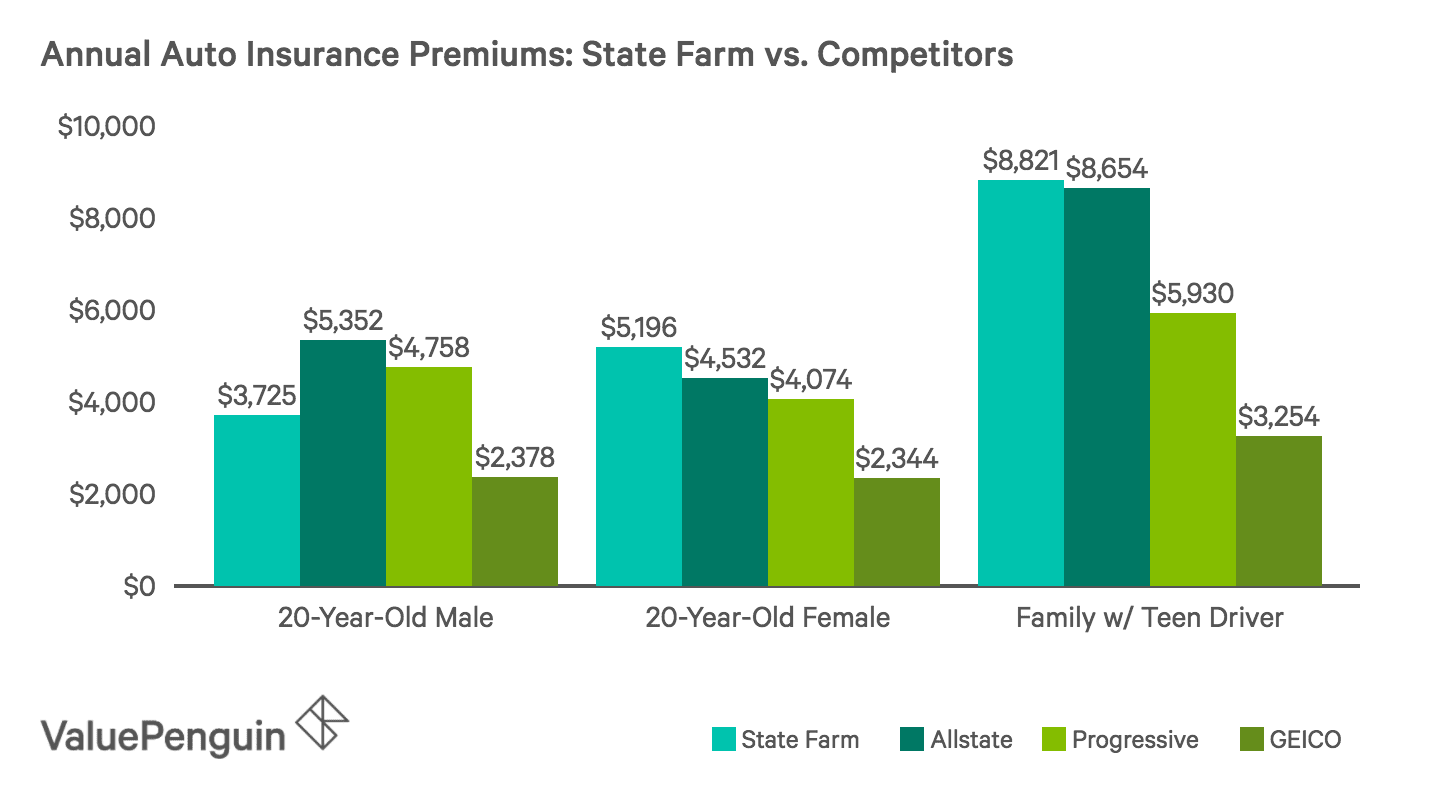

While State Farm car insurance offers many benefits, there are also some drawbacks. For example, the company’s rates may be higher than some of its competitors. Additionally, State Farm may require you to pay more if you have a poor driving record. Finally, the company’s customer service may not always be as helpful as you’d like.

Conclusion

State Farm car insurance is a reliable option for those looking for coverage. The company offers a variety of coverage options, discounts, and other benefits to help you save money. However, the company’s rates may be higher than some of its competitors and its customer service may not always be as helpful as you’d like. If you’re looking for an affordable car insurance policy, be sure to compare different insurers and shop around to find the best rates.

State Farm Insurance: Rates, Consumer Ratings & Discounts

Review Of Car Insurance Quote For State Farm 2022 - Auto Insurance Claims

State Farm Auto & Home Insurance Review: Quality Service and Lots of

State Farm Insurance Rates By Vehicle