Typical Car Insurance Cost Monthly

Thursday, April 27, 2023

Edit

The Typical Car Insurance Cost Monthly

Introduction to Car Insurance

Car insurance is a critical purchase for anyone who owns a car. Not only is it required by law in most states, but it also helps to protect you from financial ruin should you be involved in an accident. That said, the typical car insurance cost monthly can vary significantly depending on your individual circumstances. In this article, we'll take a closer look at the typical car insurance cost monthly.

Factors Affecting the Typical Car Insurance Cost Monthly

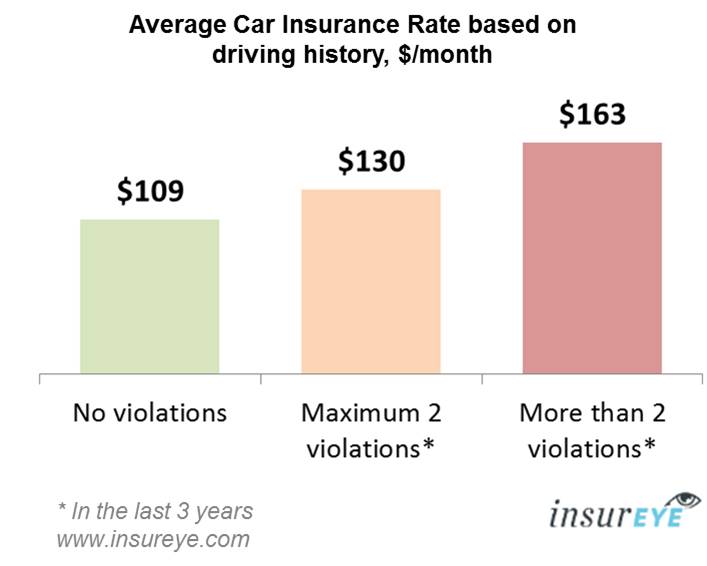

There are a number of factors that can affect the typical car insurance cost monthly. These include the type of car you drive, your driving record, the location you live in, and the type of coverage you choose.

For example, if you drive a luxury car, you will likely have higher premiums than if you drive an economy car. The same is true for your driving record. If you have a history of traffic violations or accidents, you may be seen as a higher risk and your premiums will be higher.

The location you live in can also affect your premiums. If you live in an area with higher crime rates, your premiums may be higher than they would be if you lived in a low crime area. Finally, the type of coverage you choose will also affect your premiums. Generally speaking, the more coverage you choose, the higher your premiums will be.

Typical Car Insurance Cost Monthly

So, what is the typical car insurance cost monthly? According to the Insurance Information Institute, the average cost of car insurance in the United States is $1,548 per year, or $129 per month. However, this is just an average, and your actual cost may be significantly higher or lower, depending on the factors discussed above.

How to Lower Your Car Insurance Cost

If you're looking to lower your car insurance cost, there are a few things you can do. First, shop around. Different insurance companies will offer different rates, so it pays to compare quotes from multiple companies.

Second, consider raising your deductible. Your deductible is the amount you will have to pay out of pocket before your insurance kicks in. The higher your deductible, the lower your premiums will be. Just make sure you have the financial means to pay the higher deductible if you need to.

Third, consider reducing your coverage. If you have comprehensive or collision coverage, you may be able to reduce these coverages and lower your premiums. However, bear in mind that this will also reduce your protection in the event of an accident.

Conclusion

In conclusion, the typical car insurance cost monthly can vary significantly depending on a number of factors. However, the average cost of car insurance in the United States is $129 per month. If you're looking to lower your car insurance cost, there are a few things you can do, such as shopping around, raising your deductible, and reducing your coverage.

The average cost of car insurance in the US, from coast to coast

House Insurance Prices Per Month

What's the Average Auto Insurance Cost Per Month? | The Lazy Site

Average Cost of Car Insurance (2019) | Average Cost of Insurance

Car Insurance Alberta | Average Rate is $114 per month