Renters Insurance Average Cost Per Month

What Is Renters Insurance and How Much Does It Cost?

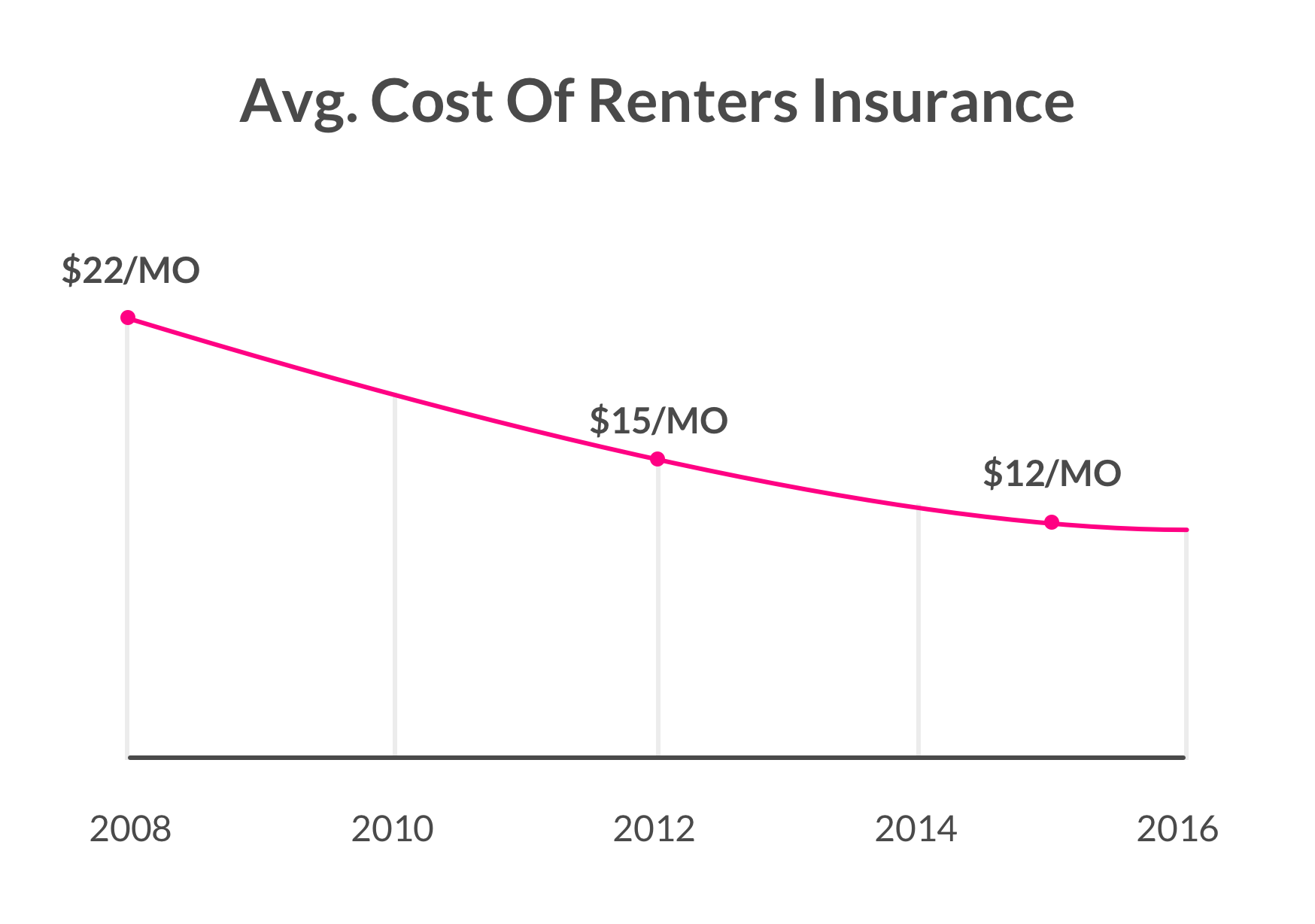

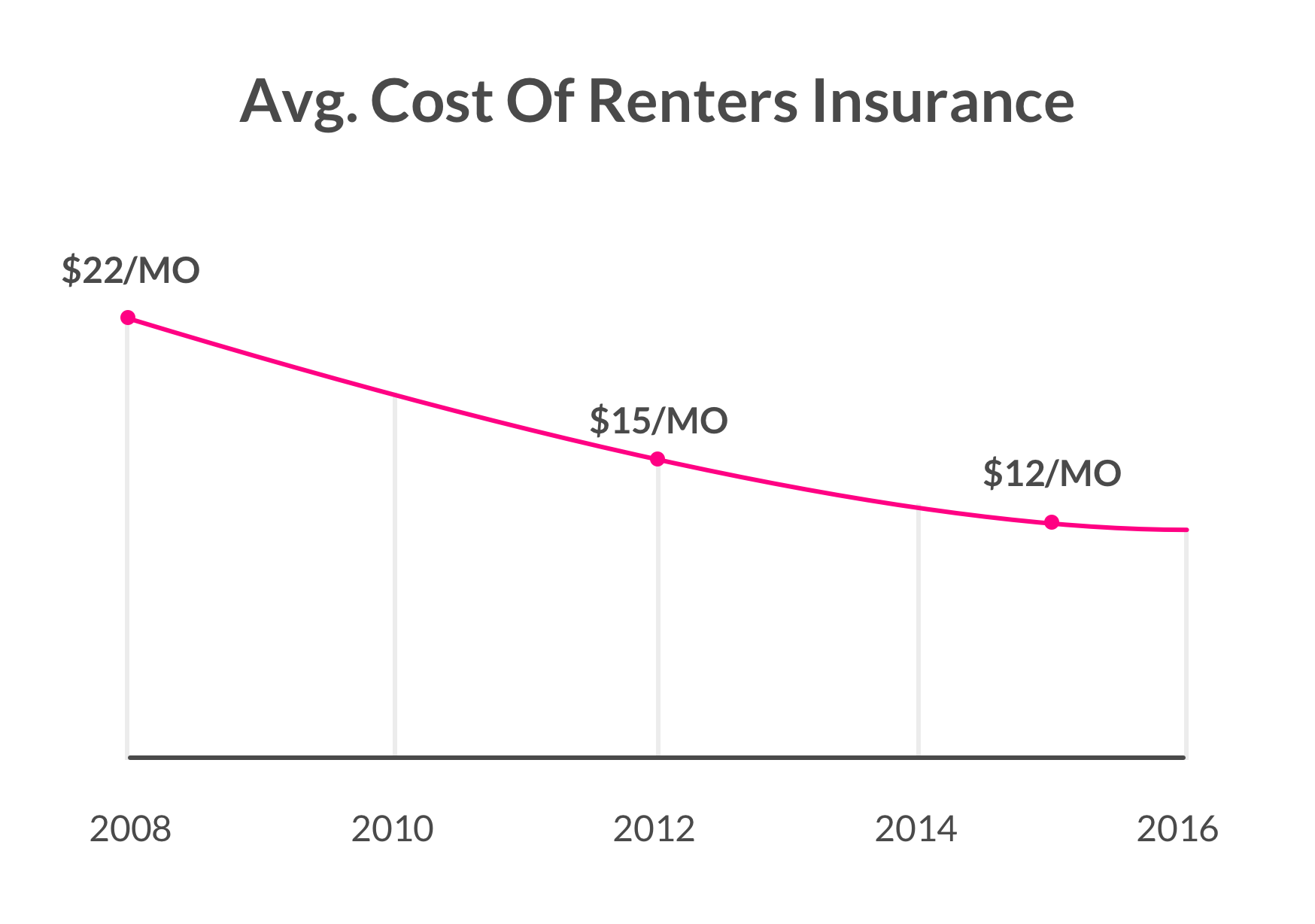

Renters insurance is an often-overlooked type of insurance that can provide coverage for a person’s possessions and liability in case of certain events, such as theft and fire. When it comes to insurance, the cost of coverage varies greatly depending on the individual's circumstances, including the size of the home or apartment they rent, the value of their belongings, and their location. In general, however, renters insurance averages around $15 to $30 per month.

What Does Renters Insurance Cover?

Renters insurance typically covers a variety of potential losses, including theft, fire, water damage, and liability. The exact coverage depends on the policy, so it is important for renters to read the policy carefully to understand what is and is not covered. Renters insurance can also provide coverage for additional living expenses if the rental is uninhabitable due to the covered event.

Factors Affecting Renters Insurance Cost

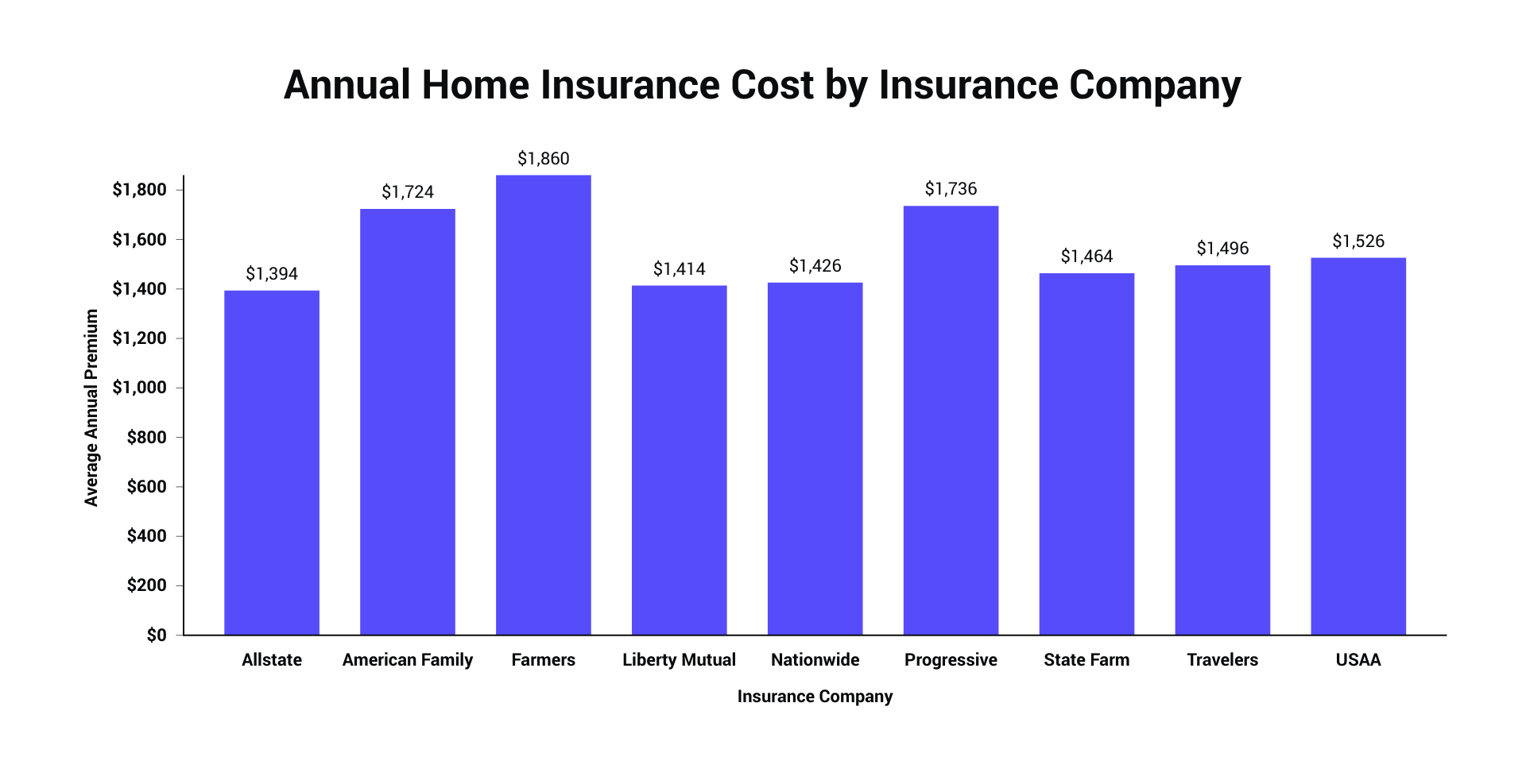

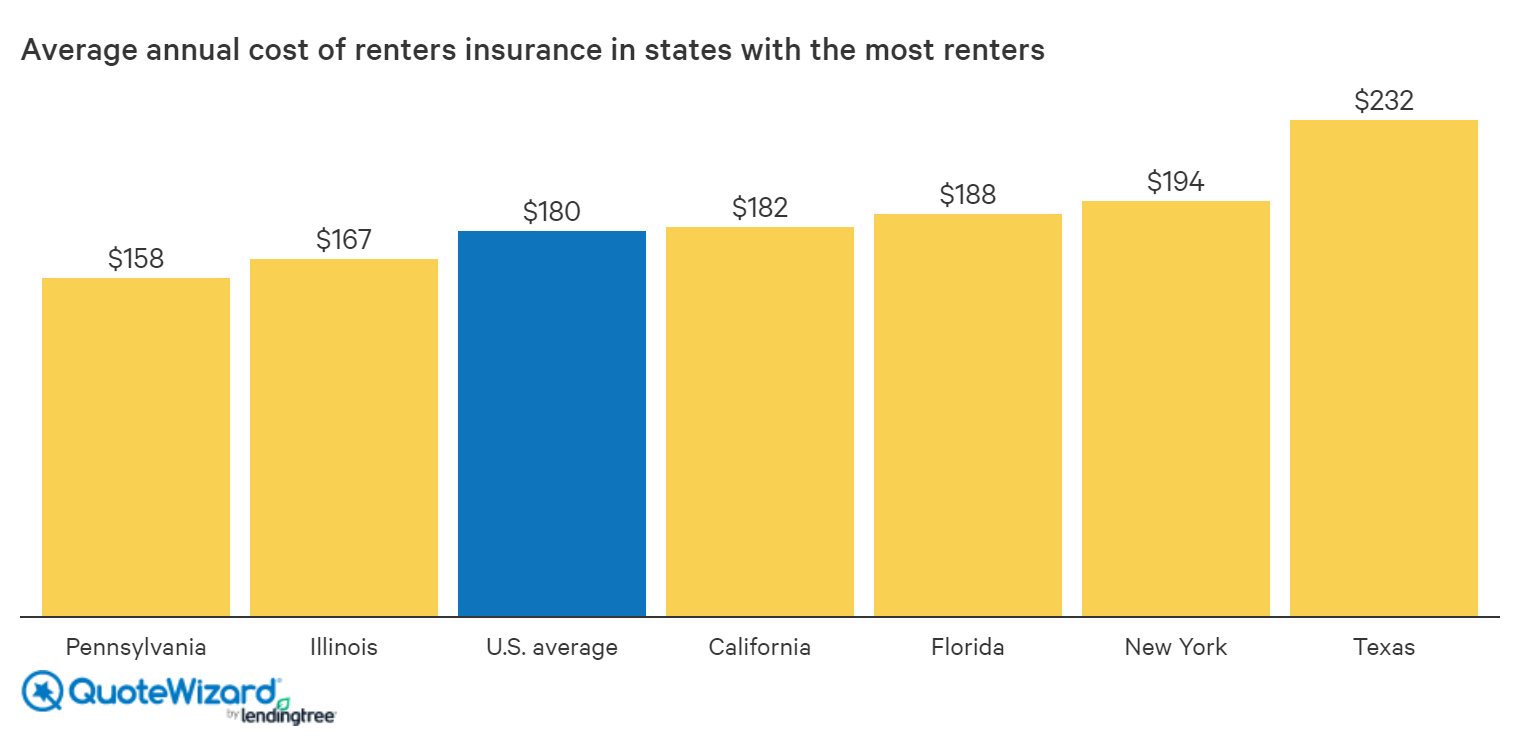

As with any type of insurance, the cost of renters insurance depends on a variety of factors. These can include the size of the rental unit, the value of the possessions being insured, and the location. The type of coverage selected and the deductible can also affect the cost. It is important to note that the cost of renters insurance may also vary depending on the insurer, so it is a good idea to shop around and compare quotes.

What Is Considered When Calculating the Value of a Rental?

When calculating the cost of renters insurance, the insurer will consider the value of the rental unit. This includes the size and age of the rental, as well as the type of construction, features, and any improvements that have been made. The insurer will also consider the value of the possessions in the rental, including furniture, clothing, electronics, and any other items that are considered part of the rental unit. The cost of renters insurance is based on the value of the rental and the possessions.

What Is the Average Cost of Renters Insurance?

The cost of renters insurance varies greatly depending on the individual’s circumstances and the type of coverage they select. In general, however, renters insurance averages around $15 to $30 per month, or $180 to $360 per year. The cost of renters insurance can also be discounted if the renter bundles it with other types of insurance, such as auto insurance.

Is Renters Insurance Worth the Cost?

Renters insurance is an important type of insurance that can provide coverage for a person’s belongings and liability in case of certain events, such as theft and fire. While the cost of renters insurance varies depending on the individual’s circumstances, it is typically affordable and can be a wise investment for renters. Before selecting a renters insurance policy, it is important to research the different types of coverage and compare quotes from multiple insurers to ensure the best coverage and rate.

When’s The Best Time To Get Renters Insurance? | Lemonade Blog

How Much Does Renters Insurance Cost? | QuoteWizard

The Best Cheap Renters Insurance in Virginia - ValuePenguin

How Much is Renters Insurance?

How Much Is Homeowners Insurance Per Month On Average : Mortgage