Average Insurance Cost Per Month For New Driver

Tuesday, May 30, 2023

Edit

Average Insurance Cost Per Month For New Driver

What Is The Average Cost of Car Insurance For A New Driver?

As a new driver, the cost of car insurance can be overwhelming. The cost of insurance can vary greatly depending on a variety of factors, such as age, gender, type of vehicle, and driving record. According to the Insurance Information Institute, the average cost of car insurance for a new driver is approximately $1,400 per year, or $117 per month. This figure is based on a variety of factors, including the type of car being insured, the driver’s age and driving record, and the type of coverage being purchased.

Factors That Impact The Cost Of Car Insurance For New Drivers

The cost of car insurance for new drivers can vary greatly depending on a variety of factors. Some of these factors include the type of car being insured, the driver’s age and driving record, and the type of coverage being purchased. Additionally, the cost of insurance can be impacted by the area in which the driver lives. For example, living in an area with a high rate of car theft or other criminal activity can drive up the cost of insurance.

Type Of Car And Model

The type of car that is being insured can have a significant impact on the cost of car insurance for new drivers. Generally speaking, newer cars with more safety features are more expensive to insure than older, less safe vehicles. Additionally, certain types of cars, such as sports cars or luxury vehicles, can be more expensive to insure than more common vehicles.

Driver's Age And Driving Record

The age and driving record of the driver can also greatly affect the cost of car insurance for new drivers. Generally speaking, younger drivers are considered to be more risky and are charged higher rates than more experienced drivers. Additionally, drivers with a history of traffic violations or accidents may be charged higher rates than drivers with a clean driving record.

Type Of Coverage

The type of coverage being purchased can also have an impact on the cost of car insurance for new drivers. Generally speaking, higher levels of coverage, such as comprehensive and collision coverage, will cost more than basic liability coverage. Additionally, certain types of coverage, such as gap insurance or roadside assistance, may be available for an additional cost.

Tips For Reducing The Cost Of Car Insurance For New Drivers

The cost of car insurance for new drivers can be expensive, but there are several things that can be done to reduce the cost. One of the best ways to save money is to shop around and compare rates from multiple insurance companies. Additionally, some insurance companies offer discounts for safe drivers or for drivers who have taken a defensive driving course. Additionally, raising the deductible and reducing the coverage limits can help to reduce the cost of car insurance for new drivers.

What's the Average Auto Insurance Cost Per Month? | The Lazy Site

New Driver Insurance Cost Varies Widely Depending on Your Situation

The Average Auto Insurance Cost Per Month | The Lazy Site

Average Car Insurance Cost In Missouri Per Month

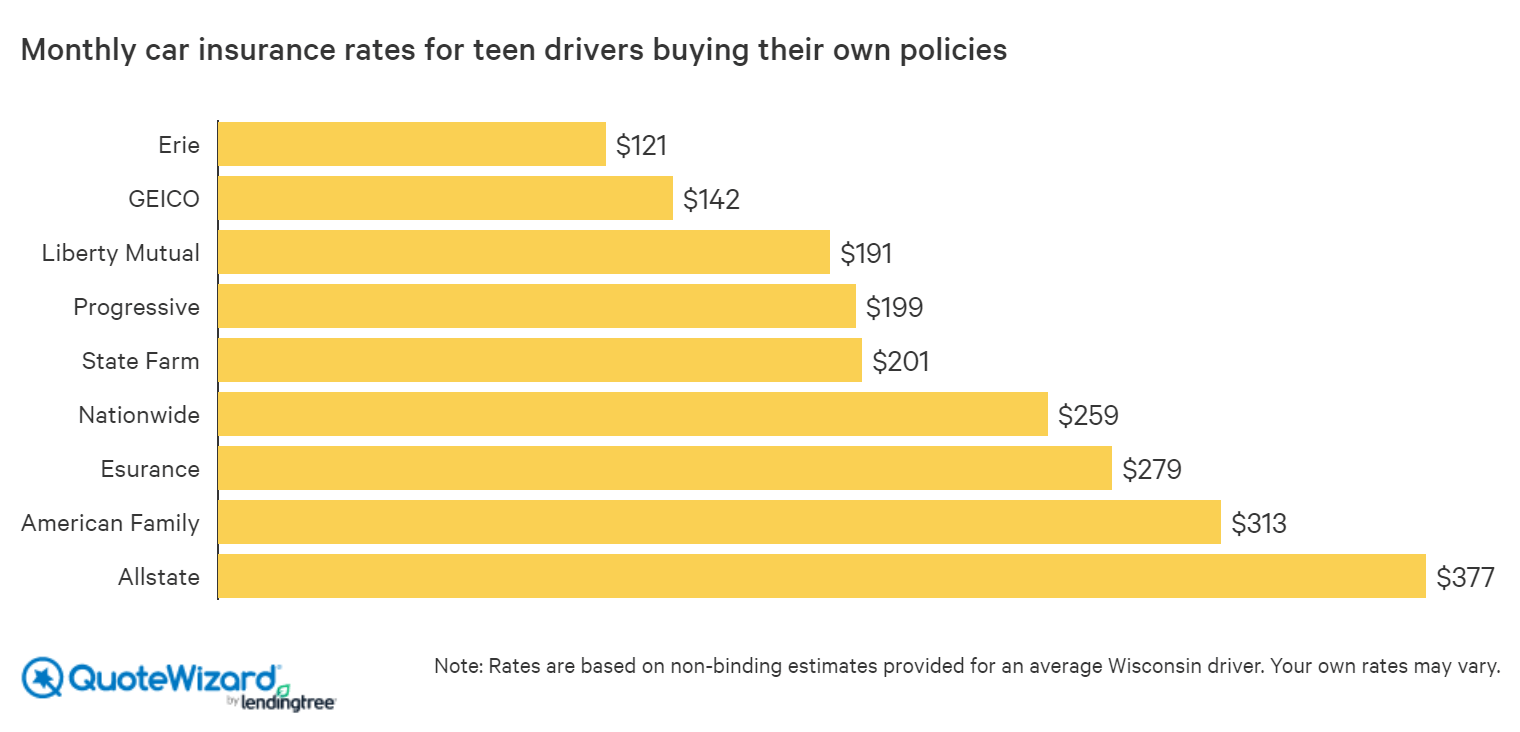

Best Car Insurance for Teens | QuoteWizard