Auto Insurance For Someone With No Car

Understanding Auto Insurance For Someone With No Car

In the modern day, auto insurance is a necessity for anyone who owns a car. But what if you don’t own a car, or you don’t plan to get one anytime soon? Is there still a way to get auto insurance? The answer is yes, you can still get auto insurance even if you don’t own a car.

What Is Non-Owner Auto Insurance?

Non-owner auto insurance is a special type of coverage for people who don’t own a car, but still occasionally rent or borrow one. It provides protection for any accidents that might occur while you’re driving a borrowed or rented car. It’s important to note that non-owner auto insurance will not cover any damages that occur to the car you’re driving, only those that occur to other vehicles or property.

Who Needs Non-Owner Auto Insurance?

Non-owner auto insurance is valuable for anyone who doesn’t own a car, but occasionally needs to drive one. This could include people who rent cars frequently, or those who borrow cars from family or friends. It’s also a great option for people who use car-sharing services like ZipCar. Non-owner auto insurance is especially important for people with bad driving records, since it can provide an easy way to get back on the road.

What Does Non-Owner Auto Insurance Cover?

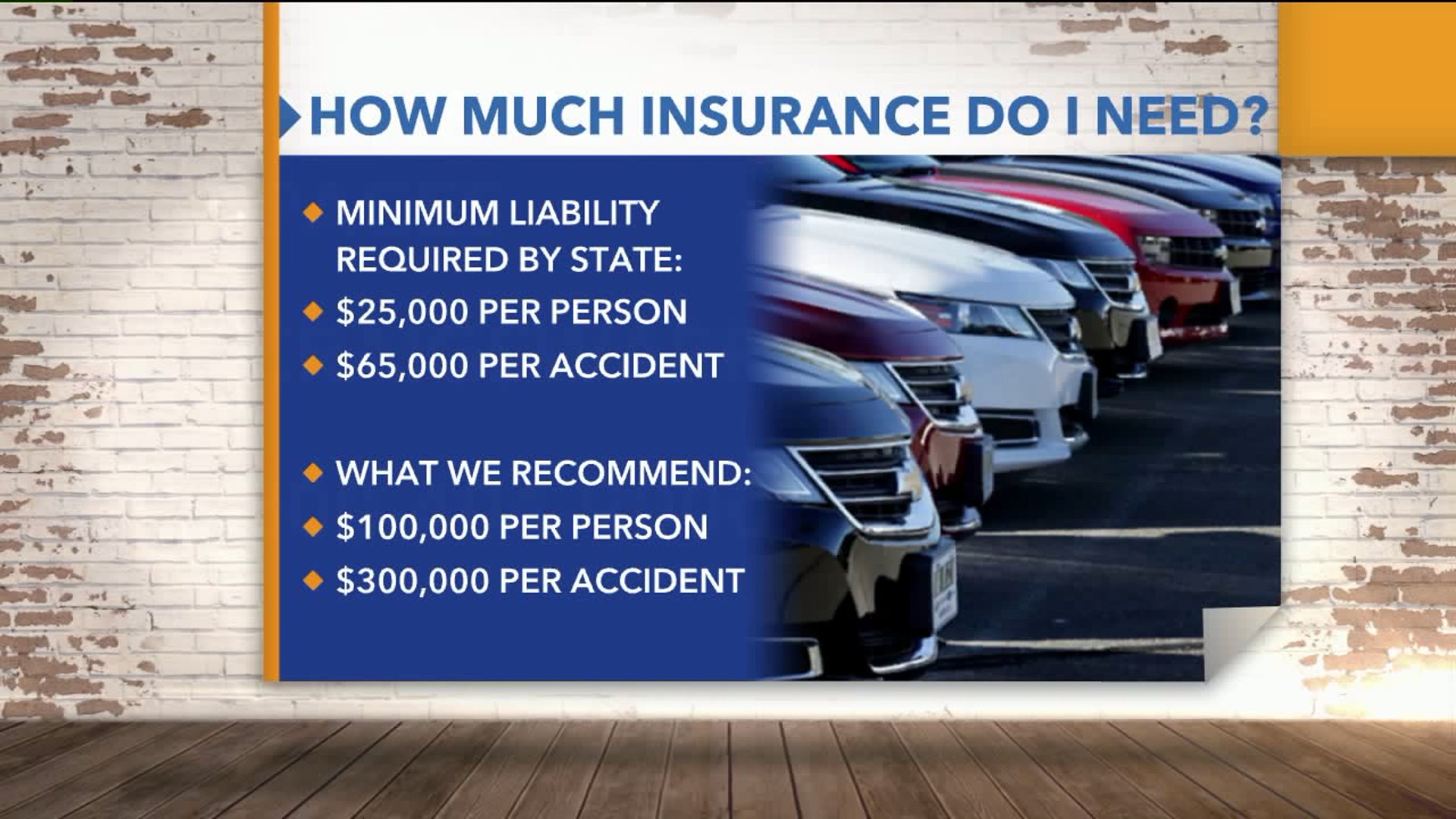

Non-owner auto insurance covers many of the same things that regular auto insurance does, including liability coverage and uninsured/underinsured motorist protection. It can also provide coverage for medical payments and personal injury protection. Liability coverage is especially important, since it will cover any damages you cause to other vehicles or property.

How Much Does Non-Owner Auto Insurance Cost?

Non-owner auto insurance is typically much cheaper than regular auto insurance. This is because you’re not insuring a car, so the risk to the insurance company is much lower. The exact cost of your policy will depend on your age, driving record, and other factors, but it’s usually quite affordable.

How Do I Get Non-Owner Auto Insurance?

Getting non-owner auto insurance is easy. All you have to do is contact your insurance company and ask about their non-owner auto insurance policies. They’ll be able to provide you with a quote and help you set up your policy. It’s important to make sure you understand the terms of your policy before you sign up, so make sure to read through the policy carefully.

Conclusion

Non-owner auto insurance is a great option for people who don’t own a car but still need to drive one occasionally. It’s much cheaper than regular auto insurance, and it provides the same level of coverage. You can easily get a non-owner auto insurance policy by contacting your insurance company. Just make sure to read through the policy before you sign up, so you understand what’s covered and what’s not.

Hit by Someone with no Car Insurance? - Wise Insurance Group

How To Make A Claim Against Someone Else’s Car Insurance – Forbes Advisor

Car Free Insurance : PPT - Buy Car Insurance Online PowerPoint

Can A Minor Get Car Insurance On Their Own - Quotes nordicquote.com

Understanding auto insurance