Name Non Owner Insurance Policy

What is a Non-Owner Insurance Policy?

When you don’t own a car, but regularly drive borrowed vehicles, you may want to consider a non-owner insurance policy. Non-owner insurance is a type of car insurance policy that provides liability coverage when you’re driving a car you don’t own. This type of insurance policy is great for individuals who are borrowing or renting a car on a regular basis, or who commute by car-sharing. It’s also beneficial for individuals who are required to maintain a certain level of insurance coverage in order to keep their driver’s license.

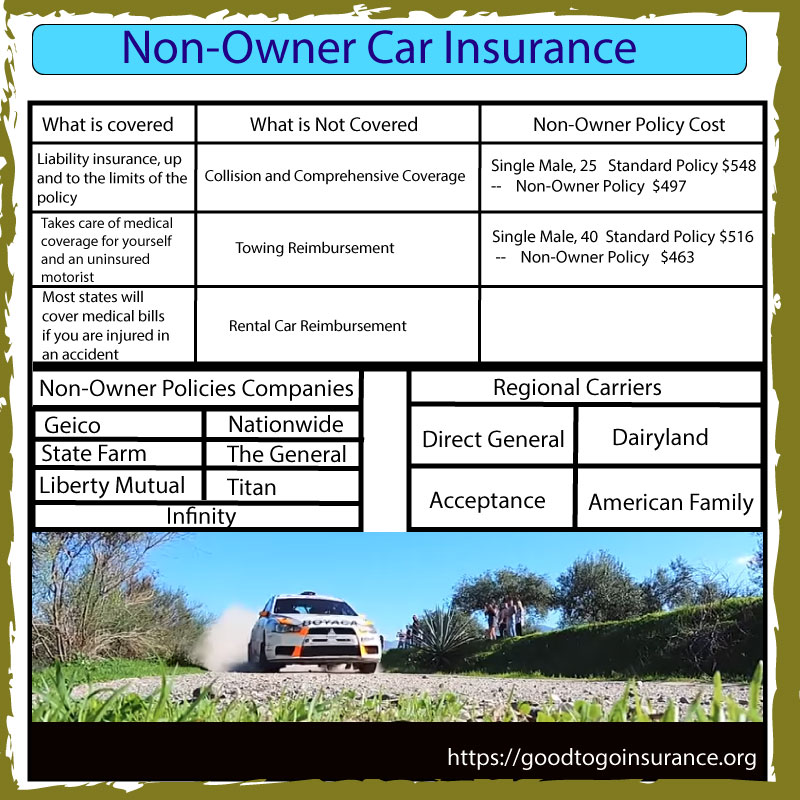

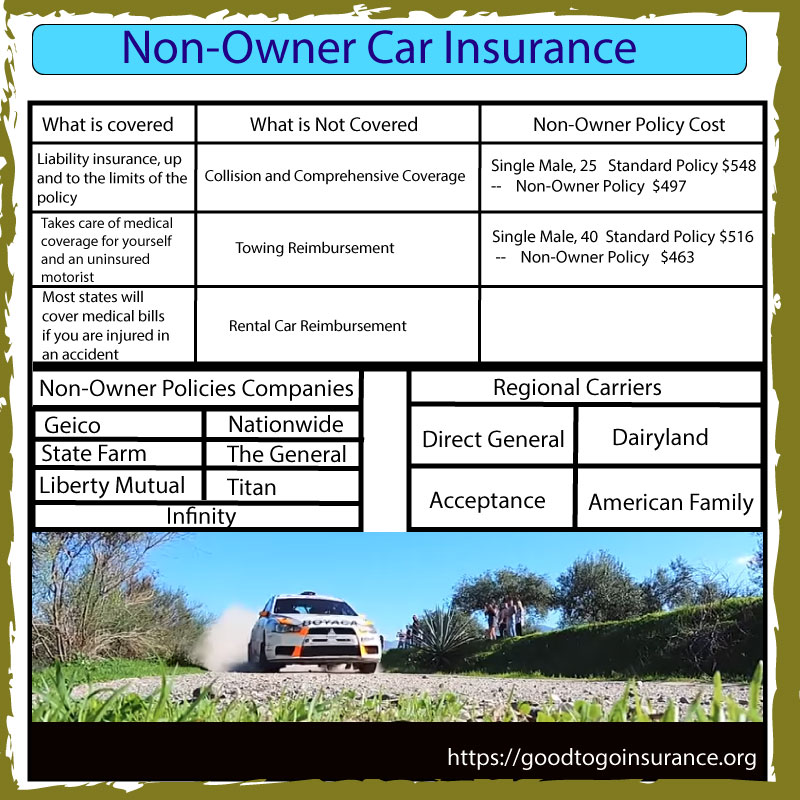

A non-owner insurance policy can provide the same coverage as a standard car insurance policy, but with a few key differences. For example, a non-owner policy usually only provides liability coverage, meaning it won’t pay for damage to the vehicle you’re driving, or for medical expenses if you’re injured in an accident. It also won’t cover any passengers in the car. It’s important to keep in mind that non-owner policies are not the same as short-term or temporary car insurance, so make sure you understand the differences between the two.

Benefits of a Non-Owner Insurance Policy

The main benefit of a non-owner insurance policy is that it provides the necessary coverage for individuals who are regularly driving cars they don’t own. It also provides protection for individuals who are required to maintain a certain level of insurance in order to keep their driver’s license. A non-owner policy is also much more affordable than a standard car insurance policy since it’s only providing liability coverage.

Non-owner insurance policies can also help individuals save money on car rentals. Since the policy provides the necessary coverage for rental cars, you won’t have to purchase the car rental company’s expensive insurance coverage. This can save you quite a bit of money and make renting a car much more affordable.

Drawbacks of a Non-Owner Insurance Policy

The main drawback of a non-owner insurance policy is that it only provides liability coverage, so it won’t pay for damage to the car you’re driving or any medical expenses if you’re injured in an accident. It also won’t cover any passengers in the car. Additionally, non-owner policies are typically more expensive than standard car insurance policies, since they only offer liability coverage.

Who Should Consider a Non-Owner Insurance Policy?

A non-owner insurance policy is a great option for individuals who are regularly driving borrowed vehicles, such as car-sharing services or rental cars. It’s also beneficial for individuals who are required to maintain a certain level of insurance coverage in order to keep their driver’s license. Non-owner policies are also much more affordable than standard car insurance policies, so they’re a great option for individuals who don’t own a car but need to maintain the necessary coverage.

If you’re an individual who regularly drives borrowed vehicles, a non-owner insurance policy may be a great option. This type of policy can provide the necessary coverage while also saving you money on car rentals and other vehicle-related expenses. Be sure to carefully compare different policies and ask plenty of questions before making a decision.

Non Owner Auto Insurance | Compare quotes wih Good to Go

Non Owners Car Insurance Policy

Non-Owner Car Insurance Explained

Get Non Owner Car Insurance Online

What Is Non-Owner Car Insurance and Do You Need It? | RamseySolutions.com