Hdfc Ergo Motor Insurance Claim Form

Get to Know about HDFC ERGO Motor Insurance Claim Form

What is HDFC ERGO Motor Insurance?

HDFC ERGO Motor Insurance is a form of coverage that helps protect you financially from damages caused by accidents or other events related to your vehicle. It provides coverage for any losses or damages that may occur due to an accident, theft, fire, vandalism, or any other unexpected event. With HDFC ERGO Motor Insurance, you can be sure that you are protected from any financial losses that may occur due to an unexpected event.

What is the HDFC ERGO Motor Insurance Claim Form?

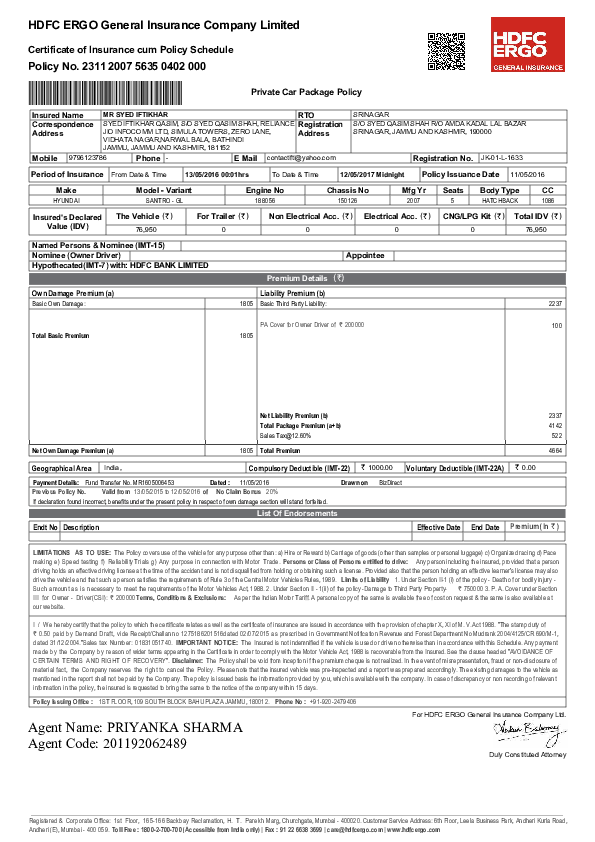

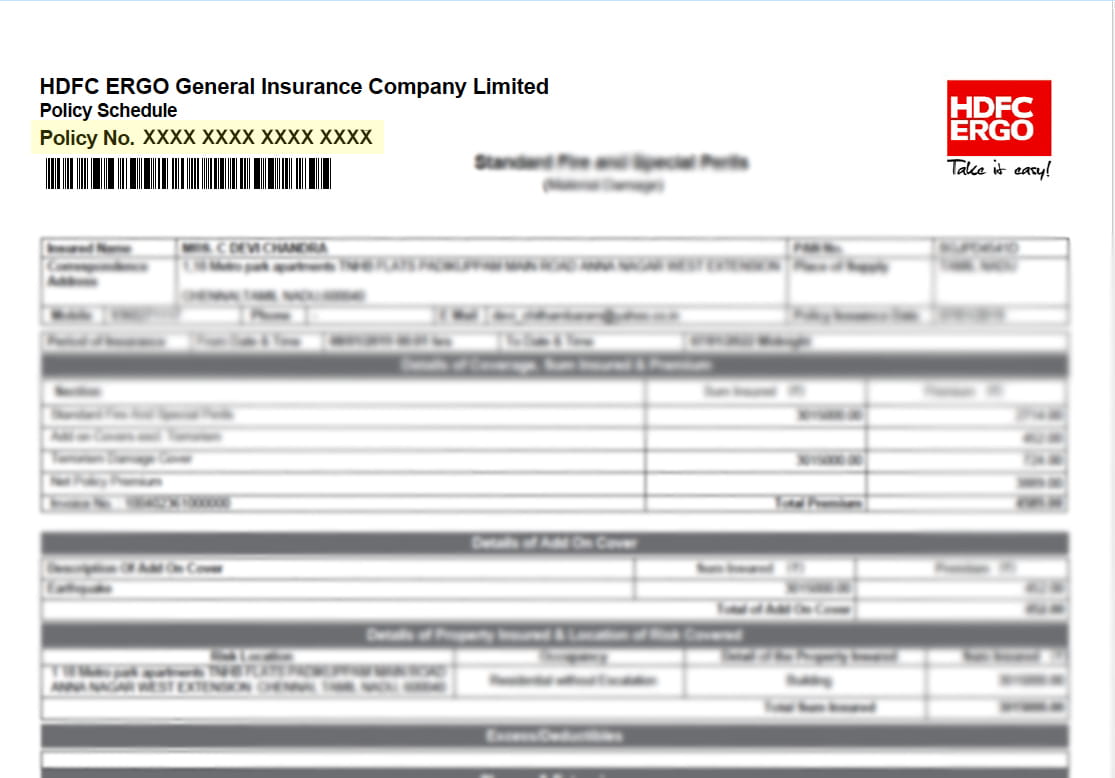

The HDFC ERGO Motor Insurance Claim Form is a document that is used to request a claim for any losses or damages that may have occurred due to an accident, theft, fire, vandalism, or any other unexpected event. This form is typically used when filing a claim with your insurance company in order to receive compensation for any losses or damages that occurred. The form contains information about the vehicle, the incident, and the damages that occurred.

What Information is Required on the HDFC ERGO Motor Insurance Claim Form?

The HDFC ERGO Motor Insurance Claim Form requires information about the vehicle, the incident, and the damages that occurred. This information includes the vehicle’s make, model, and year, as well as its registration number. It also requires information about the incident, such as the date, time, and location of the incident, as well as a description of what happened. Finally, the form requires information about the damages that occurred, such as the cost of repairs or the estimated value of the vehicle.

How to Fill Out the HDFC ERGO Motor Insurance Claim Form?

Filling out the HDFC ERGO Motor Insurance Claim Form is quite simple. First, gather all of the information that is required in order to complete the form. This includes the vehicle’s make, model, and year, as well as its registration number. Next, fill out the information about the incident, such as the date, time, and location of the incident, as well as a description of what happened. Finally, provide information about the damages that occurred, such as the cost of repairs or the estimated value of the vehicle. Once you have filled out all of the necessary information, submit the form to your insurance company.

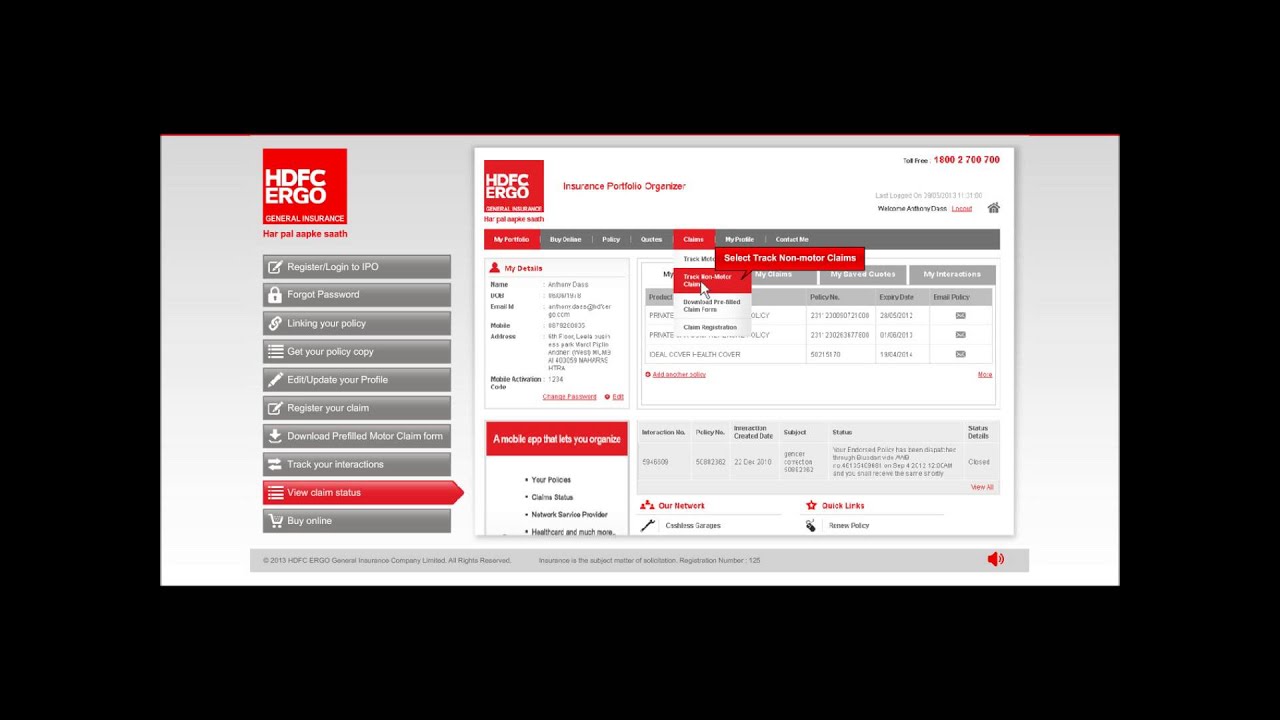

What Happens After Submitting the HDFC ERGO Motor Insurance Claim Form?

After submitting the HDFC ERGO Motor Insurance Claim Form, your insurance company will review the form and contact you for additional information if needed. Once the form has been reviewed and all of the necessary information is provided, your insurance company will determine if the claim is approved and how much compensation will be provided. If the claim is approved, the compensation will be paid out according to the terms of your policy.

Conclusion

HDFC ERGO Motor Insurance Claim Form is an important document that is used to request compensation for any losses or damages that may have occurred due to an accident, theft, fire, vandalism, or any other unexpected event. It is important to fill out the form correctly and provide all of the necessary information in order to receive the proper compensation. Once the form has been submitted, the insurance company will review the form and determine if the claim is approved and how much compensation will be provided.

[PDF] HDFC ERGO Motor Car Insurance Form PDF Download in English – InstaPDF

![Hdfc Ergo Motor Insurance Claim Form [PDF] HDFC ERGO Motor Car Insurance Form PDF Download in English – InstaPDF](https://instapdf.in/wp-content/uploads/pdf-thumbnails/hdfc-ergo-motor-car-insurance-form-1361.jpg)

Hdfc Ergo Health Insurance Claim Form

Hdfc Ergo Car Insurance Certificate Download : HDFC ERGO Insurance App

Watch How To Track Your Insurance Claims On HDFC ERGO IPO - YouTube

Hdfc Insurance Claim Form Pdf