Hdfc Ergo Motor Insurance Policy Wording

HDFC ERGO Motor Insurance Policy Wording

Why You Need a Motor Insurance?

It is not only mandatory to have a motor insurance policy in India but it is also essential to protect you from any financial loss in the event of an accident, theft or natural calamity. An insurance policy helps you to secure your car from any unforeseen circumstances. Having a motor insurance policy from HDFC ERGO not only covers your car against any damage but also offers additional benefits like cashless claim settlement, 24/7 customer service, and hassle-free claim process. You can also opt for the add-on covers to enhance the coverage of your policy.

Key Benefits of HDFC ERGO Motor Insurance Policy

HDFC ERGO’s motor insurance policy not only provides you with all the basic benefits that a motor insurance policy offers but also provides you with some additional benefits like:

- Cashless claim settlement at network garages

- Online payment and renewal facility

- 24/7 customer service

- Hassle-free claim process

- Add-on covers to enhance your policy

What Does HDFC ERGO Motor Insurance Policy Cover?

HDFC ERGO Motor Insurance Policy covers you against any financial loss arising from an accident, theft or natural calamity. The policy covers the following:

- Liability to Third party property damage

- Liability to Third party bodily injury

- Own damage or loss of vehicle due to natural calamities

- Own damage or loss of vehicle due to man-made calamities

- Personal Accident cover for the insured and co-passengers

What Are the Optional Add-On Covers?

HDFC ERGO offers a range of add-on covers that you can opt for to enhance the coverage of your motor insurance policy. The add-on covers available are:

- Zero Depreciation Cover

- Engine Protector Cover

- Invoice Shield Cover

- Return to Invoice Cover

- Roadside Assistance Cover

- Consumables Cover

- Passenger Assistance Cover

How to Renew HDFC ERGO Motor Insurance Policy?

HDFC ERGO Motor Insurance Policy can be renewed online through their website or through the HDFC ERGO mobile app. To renew the policy, you need to enter the following details:

- Name of the policyholder

- Policy number

- Vehicle registration number

- Date of expiry of the policy

- Premium amount

Once all the details have been entered, you can make the payment online and your policy will get renewed instantly.

Hdfc Insurance Claim Form Pdf

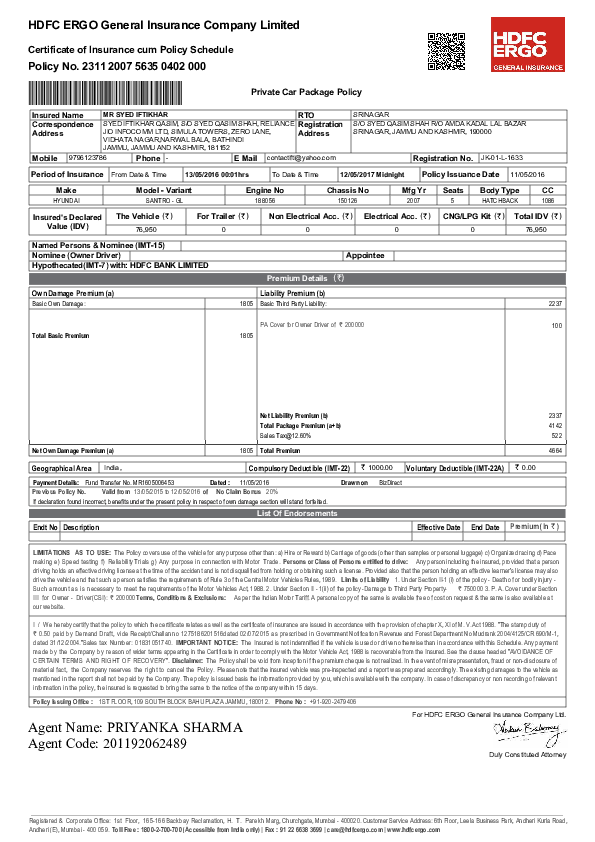

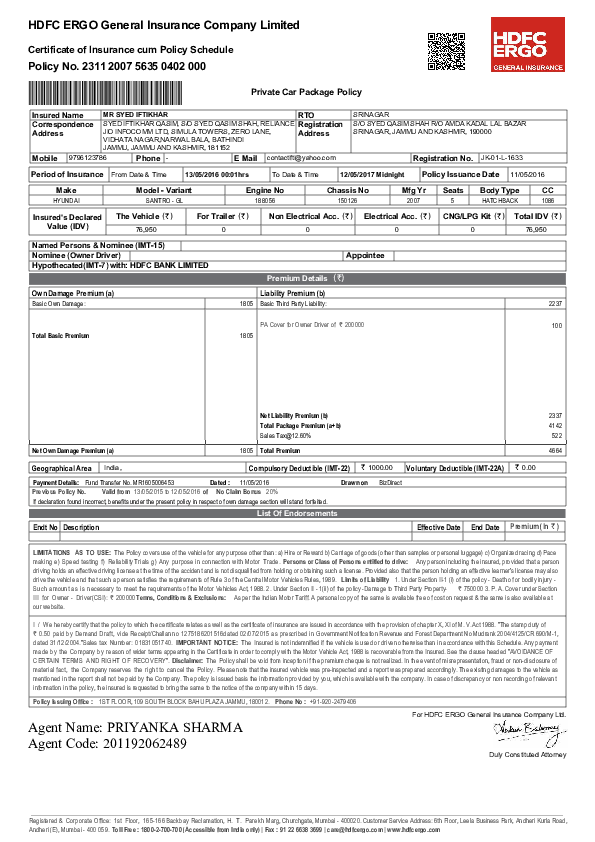

[PDF] HDFC ERGO Insurance Claim Form PDF Download in English – InstaPDF

![Hdfc Ergo Motor Insurance Policy Wording [PDF] HDFC ERGO Insurance Claim Form PDF Download in English – InstaPDF](https://instapdf.in/wp-content/uploads/pdf-thumbnails/motorclaimform-pdf-244.jpg)

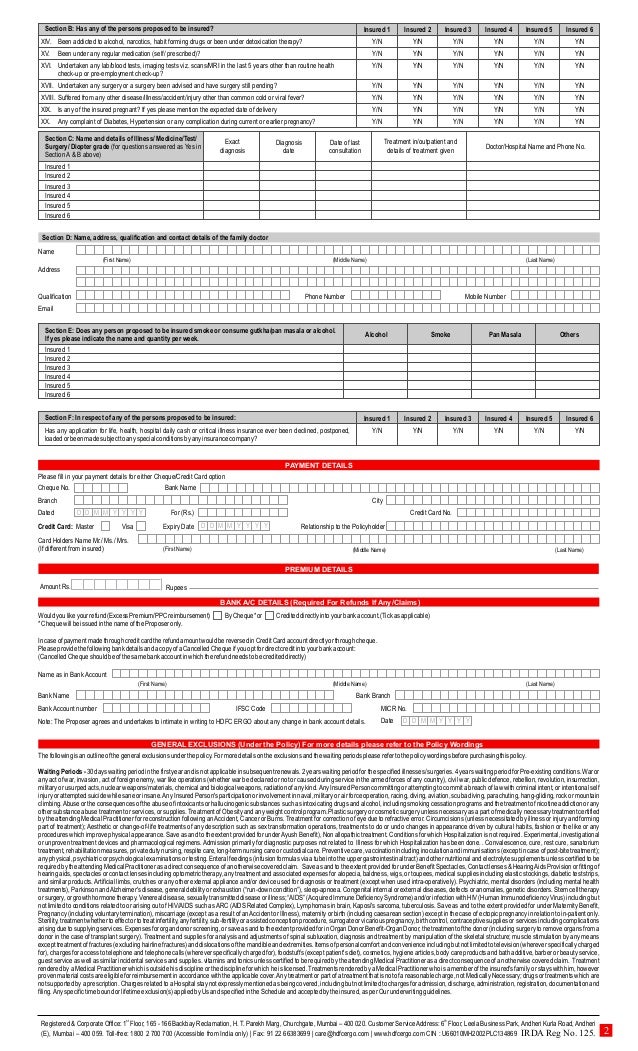

HDFC ERGO Health Suraksha Proposal Form

Hdfc Ergo General Insurance Logo : Visit Hdfcergo Com Hdfc Ergo General

Health policy my policy number is GMC0000475000100 - HDFC ERGO GENERAL