Cheap Liability Car Insurance Indiana

Cheap Liability Car Insurance in Indiana

The Basics of Liability Car Insurance

When shopping for car insurance, liability car insurance is one of the most important types of coverage you can buy. Liability car insurance is a type of coverage that you are legally required to have in most states. It covers the expenses of someone else if you cause an accident. It pays for the medical expenses and property damage of the other person involved in the accident. In most cases, this is the only type of coverage you are legally required to have.

Liability car insurance is the most basic type of insurance you can buy. It is also the most affordable type of insurance, as it only covers the expenses of another person if you cause an accident. It does not cover your own medical expenses or property damage. It also does not cover any other types of damages, such as pain and suffering or lost wages.

Indiana's Liability Insurance Requirements

In Indiana, drivers are required to have liability car insurance with a minimum coverage of $25,000 per person, $50,000 per accident, and $10,000 in property damage. This is referred to as 25/50/10 coverage. This means that if you are the cause of an accident, your insurance will pay up to $25,000 in medical expenses per person, up to $50,000 in total medical expenses, and $10,000 in property damage.

In addition to these minimum requirements, many drivers choose to purchase higher levels of coverage. This is because if you cause an accident that results in more than the minimum coverage, you will be liable for any additional expenses. For example, if you cause an accident that results in $30,000 in medical expenses, you will be liable for the additional $5,000 if you only have the minimum coverage.

Cheap Liability Car Insurance in Indiana

Fortunately, there are many ways to get cheap liability car insurance in Indiana. One of the best ways to get cheap liability car insurance is to shop around. There are many different companies that offer car insurance, and each company will have different rates and different levels of coverage. By shopping around and comparing rates, you can find the best deal for your needs.

In addition to shopping around, there are other ways to get cheap liability car insurance in Indiana. Some insurance companies offer discounts for good driving records, and some offer discounts for taking a defensive driving course. Furthermore, some insurance companies offer discounts for being a member of certain organizations or associations.

Finally, another way to get cheap liability car insurance in Indiana is to bundle your insurance policies. Many insurance companies offer discounts for buying multiple types of insurance, such as home and auto insurance, from the same company. By bundling your policies, you can save money on your car insurance and get the coverage you need.

Finding Cheap Liability Car Insurance in Indiana

Finding cheap liability car insurance in Indiana is possible if you take the time to shop around. By comparing rates and taking advantage of discounts, you can find an affordable policy that meets your needs. Furthermore, by bundling your insurance policies, you can save even more money on your car insurance. With the right coverage, you can protect yourself and your loved ones in the event of an accident.

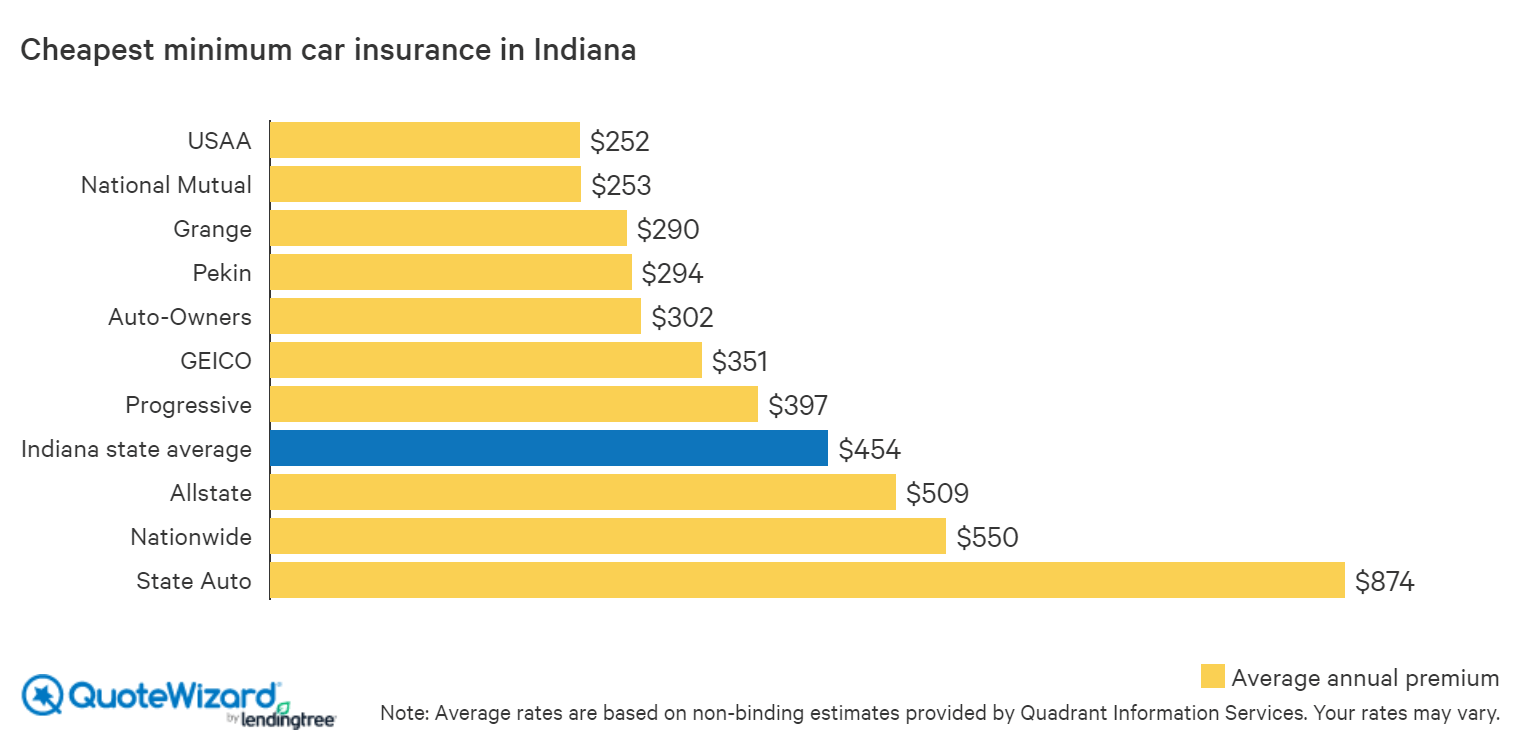

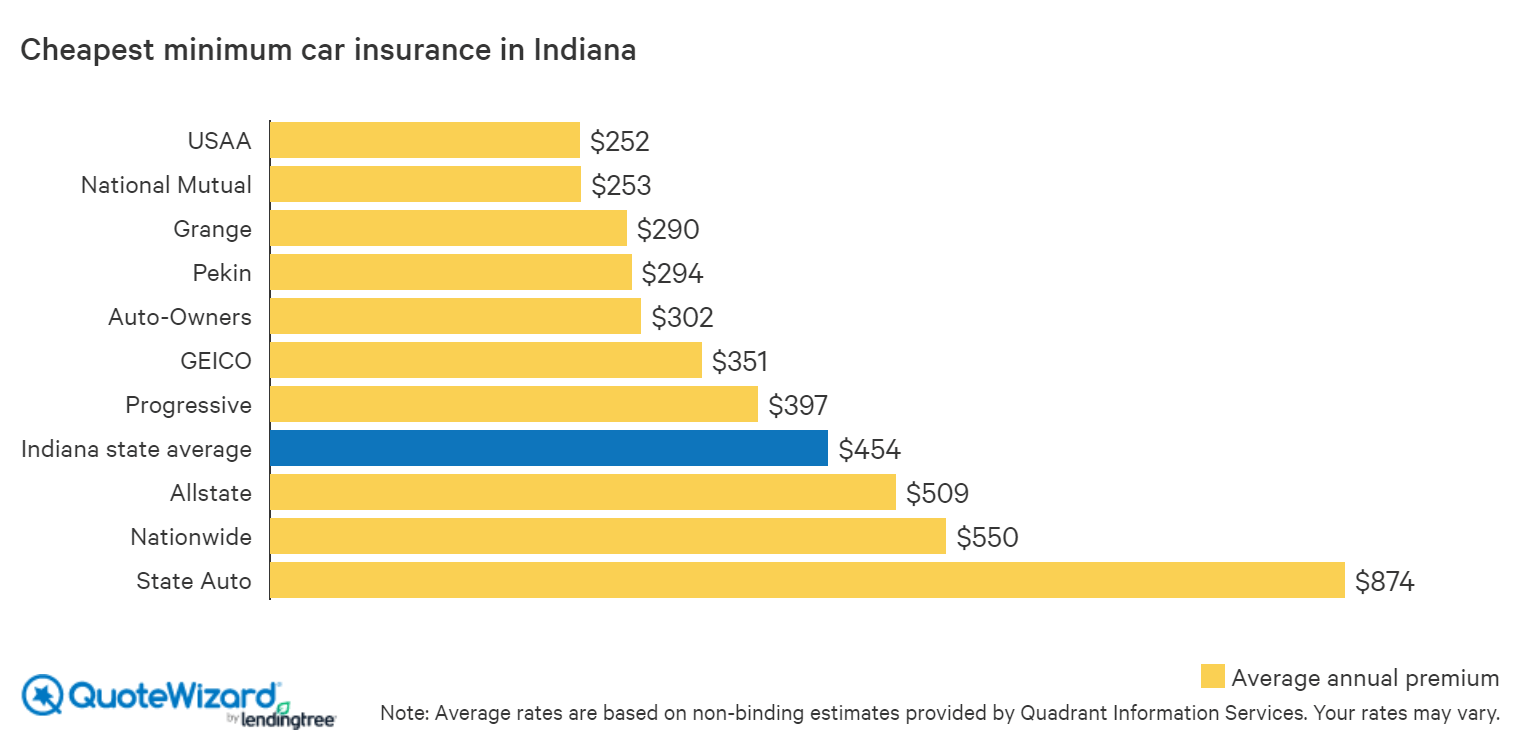

Where to Get Cheap Car Insurance in Indiana | QuoteWizard

Who Has the Cheapest Auto Insurance Quotes in Indiana?

Which Is The Cheapest Car Insurance In India - Dream Wedding Ideas

Allstate Vs Usaa Home Insurance - lyondesignsstudio

How to-find-cheap-car-insurance-indiana-region