Hdfc Ergo Motor Insurance Two Wheeler

HDFC ERGO Motor Insurance Two Wheeler: Best Insurance for Your Vehicle

What is HDFC ERGO Motor Insurance?

HDFC ERGO Motor Insurance is one of the leading providers of two wheeler insurance in India. This insurance helps you protect your vehicle from any kind of damage or loss. HDFC ERGO offers you a comprehensive two wheeler insurance policy which covers all the risks associated with your vehicle. It provides protection to your vehicle against external damage, theft, third-party liabilities, personal accident cover and much more. It also provides coverage for your legal liabilities which can arise due to accidents or any other mishaps.

Benefits of HDFC ERGO Motor Insurance

HDFC ERGO Motor Insurance provides a wide range of benefits to its customers. It provides coverage for a wide range of vehicles including two wheelers, four wheelers, commercial vehicles and much more. It also offers a wide range of discounts and cashback offers to its customers. The discounts can be availed on the purchase of the policy, renewal of the policy and also on the claim settlement. The cashback offers are applicable on the purchase of the policy and also on the renewal of the policy. HDFC ERGO Motor Insurance also offers a free roadside assistance facility to its customers in case of any kind of breakdown or accident.

What Are the Types of Coverage Offered by HDFC ERGO Motor Insurance?

HDFC ERGO Motor Insurance offers a wide range of coverage to its customers. The coverage includes third party liability, own damage, personal accident cover and much more. The third-party liability coverage provides protection to the policyholder against any legal liabilities that may arise due to accidents or other mishaps. The own damage coverage provides coverage for any damages that may occur to the vehicle due to any external factor like theft, accidents, natural calamities, etc. The personal accident cover provides protection to the policyholder against any personal injury or death that may occur due to accidents.

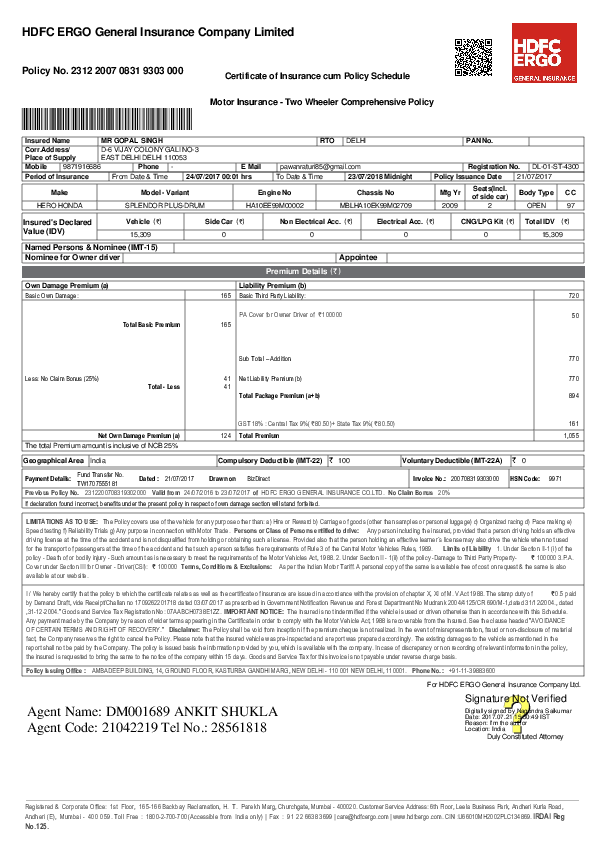

What Are the Documents Required for HDFC ERGO Motor Insurance Policy?

The documents required for HDFC ERGO Motor Insurance policy are ID proof, address proof, vehicle registration certificate, driving license, PUC certificate and other relevant documents. The policyholder needs to submit these documents in order to get the policy. The documents will be verified by the insurer before the policy is issued.

Where Can You Buy HDFC ERGO Motor Insurance?

HDFC ERGO Motor Insurance can be purchased online or offline. The policy can be purchased directly from the insurer or through the insurance brokers. For online purchase, the customer needs to fill an online application form and submit the required documents. The premium can be paid online using a credit card or through net banking. The customer can also buy the policy offline by visiting the nearest branch of the insurer. The customer needs to provide the required documents and the premium can be paid using cash or cheque.

Conclusion

HDFC ERGO Motor Insurance is a great option for vehicle owners looking for a comprehensive two wheeler insurance policy. It provides a wide range of coverage, discounts and cashback offers to its customers. The policy can be purchased online or offline and the customer needs to submit the required documents in order to get the policy. The policy provides a great value for money and can help the customer protect their vehicle from any kind of damage or loss.

HDFC ERGO Two-Wheeler Insurance : Radio Commercial - YouTube

HDFC Ergo Two Wheeler Insurance- Inclusions and Exclusions | Policy

HDFC ergo policy download | hdfc ergo two wheeler insurance policy copy

Car Insurance Hdfc Ergo - Cars Models

(PDF) Motor Insurance -Two Wheeler Comprehensive Policy T 0 | Pradeep