Can I Get Gap Insurance Through Geico

Can I Get Gap Insurance Through Geico?

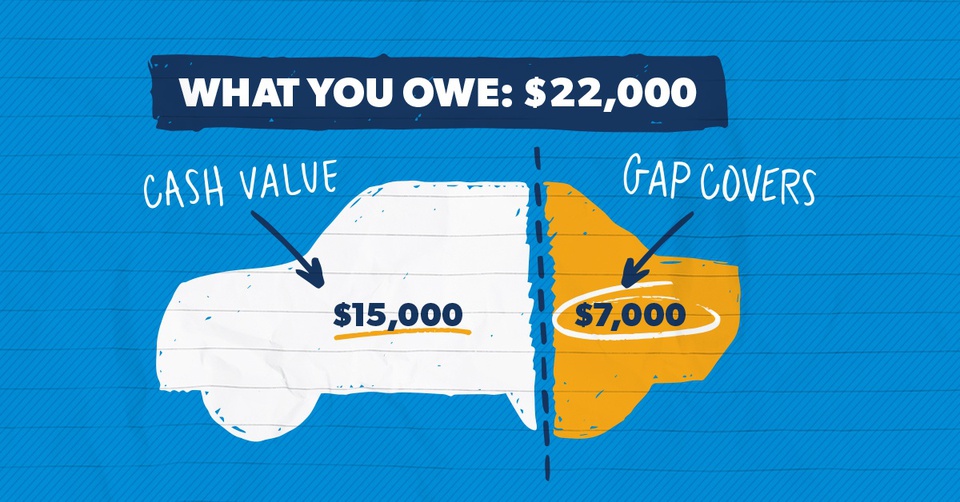

Gap insurance is an extra layer of insurance that can help fill the gap between what you owe on your car loan and what your car is worth. Geico is an auto insurance provider that offers gap insurance as an add-on to its auto insurance policy. The cost of the gap insurance will depend on the type of car you have and the amount of coverage you want. Here’s what you need to know about getting gap insurance through Geico.

What Is Gap Insurance?

Gap insurance is a type of coverage that pays the difference between the actual cash value (ACV) of a car and the amount that you still owe on the car loan. The ACV is determined by the market value of your car, minus any depreciation. In some cases, the ACV of a car can be lower than the amount that you still owe on the car loan. Gap insurance helps cover the difference between the ACV and the loan amount.

How Does Geico Gap Insurance Work?

Geico offers gap insurance as an add-on to its auto insurance policy. This means that you will need to have an existing auto insurance policy with Geico in order to purchase the gap insurance. The cost of the gap insurance will depend on the type of car you have and the amount of coverage you want. In most cases, gap insurance will cost a few hundred dollars per year.

What Does Geico Gap Insurance Cover?

Geico’s gap insurance will cover the difference between the ACV and the loan amount in the event that your car is totaled or stolen. It will also cover the cost of any taxes and fees that are due on the car loan. Additionally, Geico’s gap insurance will cover the cost of any late fees or additional finance charges that may be due if you are unable to make payments on the car loan.

What Does Geico Gap Insurance Not Cover?

Geico’s gap insurance does not cover the cost of any repairs to your car. Additionally, it does not cover any personal items that may have been inside the car at the time of the accident or theft. It also does not cover any towing or storage fees that may be due after the accident or theft.

Conclusion

Gap insurance can be a helpful way to ensure that you are not left with a large financial burden in the event of an accident or theft. Geico offers gap insurance as an add-on to its auto insurance policies, and the cost of the coverage will depend on the type of car you have and the amount of coverage you want. Gap insurance can help cover the difference between the ACV and the loan amount, as well as any taxes, fees, late fees, and finance charges that may be due. However, it does not cover any repairs to the car or the cost of any personal items that may have been inside the car at the time of the accident or theft.

Gap Insurance: 10 Massive Things you can accomplish with it

What Is Gap Auto Insurance? Is It Worth It? and Should You Finance It

Understanding Auto Insurance "Gap Coverage"

There’s another type of GAP Insurance?

What Is GAP Insurance And What Does It Cover?