Is Florida A No Fault Car Insurance State

Is Florida A No Fault Car Insurance State?

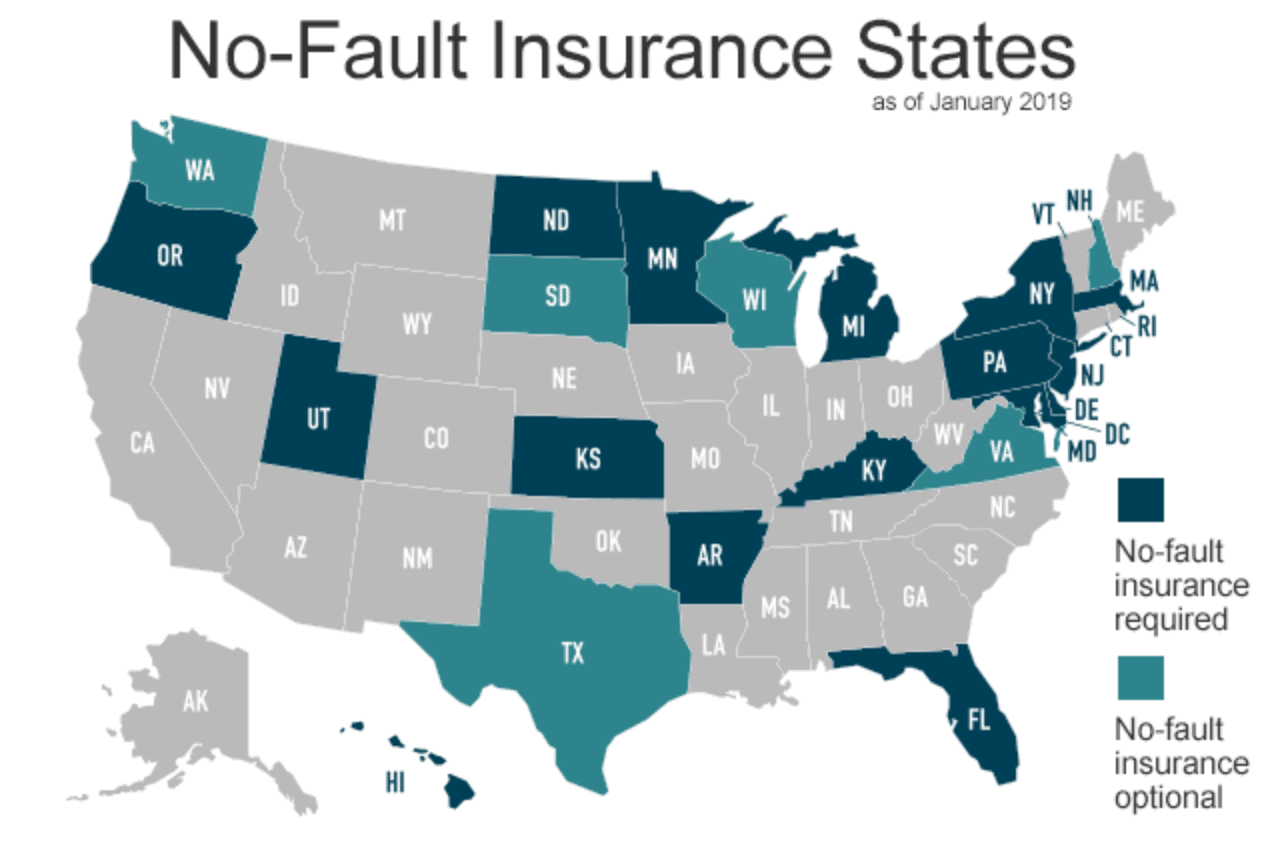

Florida is one of the few states in the US that has adopted no fault car insurance laws. This means that when an accident occurs, each driver's insurance company covers the medical expenses associated with the accident regardless of who is at fault. While no fault insurance can be beneficial in certain situations, it can also be more costly than traditional car insurance.

What Are The Benefits of No Fault Car Insurance in Florida?

The main benefit of no fault car insurance in Florida is that it eliminates the need for drivers to take legal action against each other in the case of an accident. This means that drivers won't have to worry about long and expensive court battles in order to recover damages from the other driver. Additionally, no fault insurance can also help to reduce the overall cost of car insurance premiums since the insurance company doesn't have to worry about defending itself in court.

What Are The Drawbacks of No Fault Car Insurance in Florida?

As with any type of insurance, there are some drawbacks to no fault car insurance in Florida. One of the main drawbacks is that it can be more expensive than traditional car insurance. This is because the insurance company has to pay for all of the medical bills associated with an accident regardless of who is at fault. Additionally, no fault insurance can also be more difficult to obtain than traditional car insurance as some insurance companies may be hesitant to provide the coverage.

Are There Any Exceptions To The No Fault Car Insurance Law In Florida?

There are some exceptions to the no fault car insurance law in Florida. One exception is if an injury is considered to be a “serious injury”. In this case, the responsible driver may be held liable for the medical expenses of the other driver. Additionally, if a driver is deemed to be “at fault” for an accident, then they may be held liable for damages to the other driver's vehicle as well as any medical bills incurred.

Is No Fault Car Insurance Required in Florida?

No fault car insurance is not required in Florida, however it is recommended. While no fault insurance can be more expensive than traditional car insurance, it can help to protect drivers in the case of an accident. Additionally, no fault insurance can also provide drivers with peace of mind knowing that they will be able to recover damages in the event of an accident.

Conclusion

No fault car insurance is a type of insurance that is available in Florida, however it is not required by law. While no fault insurance can be more expensive than traditional car insurance, it can provide drivers with peace of mind knowing that they will be able to recover damages in the event of an accident. Additionally, no fault insurance can also help to reduce the overall cost of car insurance premiums since the insurance company doesn't have to worry about defending itself in court.

What No Fault Car Insurance Is?

Out of State Visitors Hurt in Car Accidents in Florida (Settlements)

Florida No-Fault Auto Insurance Under Annual Review | Terrell • Hogan

Is Florida a No Fault State? - Corless Barfield Trial Group

Is It the End of Florida’s No-Fault Auto Insurance System? - Corless