Price Of Third Party Car Insurance

Thursday, August 22, 2024

Edit

The Cost Of Third Party Car Insurance

An Overview Of Third Party Car Insurance

Third party car insurance is a type of insurance policy that provides coverage for any losses or damages that are sustained by a third party in an accident caused by the insured driver. It is one of the most common types of car insurance policies available in the market today. Third party car insurance provides coverage for any bodily injury or property damage sustained by a third party as a result of an accident caused by the insured driver. This type of insurance policy does not provide coverage for any losses or damages sustained by the insured driver or their vehicle. It is important to note that third party car insurance does not cover any damage caused by an uninsured driver.

Third party car insurance is typically required for most vehicles that are registered in the United Kingdom. It is important to note that the cost of third party car insurance can vary depending on the type of coverage that is purchased. The amount of coverage purchased will also determine the cost of the insurance policy.

The Cost of Third Party Car Insurance

The cost of third party car insurance will depend on several factors such as the type of coverage purchased, the make and model of the vehicle, the age and driving record of the insured, and the area where the vehicle is registered. The cost of third party car insurance can range from a few hundred pounds to several thousand pounds, depending on the level of coverage purchased and the risk factors associated with the insured driver.

It is important to note that third party car insurance is typically cheaper than comprehensive car insurance. This is because it only provides coverage for third party losses and damages and does not provide coverage for the insured driver or their vehicle. As a result, the premiums for third party car insurance are generally lower than those for comprehensive car insurance policies.

Factors That Affect The Cost Of Third Party Car Insurance

There are several factors that can affect the cost of third party car insurance. The make and model of the vehicle, the age and driving record of the insured, and the area where the vehicle is registered can all affect the cost of the policy. The type and amount of coverage purchased can also affect the cost of third party car insurance.

The age of the insured driver is one of the most important factors in determining the cost of third party car insurance. Younger drivers are typically seen as higher risk and therefore may pay higher premiums than older and more experienced drivers.

The driving record of the insured driver will also affect the cost of third party car insurance. Drivers who have had multiple moving violations or have been involved in serious accidents will typically pay higher premiums than those with a clean driving record.

How To Find The Best Third Party Car Insurance Deals

The best way to find the best third party car insurance deals is to shop around and compare quotes from different insurance providers. Many insurance providers offer discounts for drivers who have a good driving record and may offer additional discounts for drivers who purchase more than one type of insurance policy from the same provider.

It is also important to remember that the cost of third party car insurance will depend on the level of coverage purchased. Drivers should make sure that they purchase the right level of coverage to protect themselves and their vehicle in the event of an accident.

Conclusion

Third party car insurance is an important type of insurance policy that provides coverage for any losses or damages that are sustained by a third party in an accident caused by the insured driver. The cost of third party car insurance can vary depending on the type of coverage that is purchased, the make and model of the vehicle, the age and driving record of the insured, and the area where the vehicle is registered. Shopping around and comparing quotes from different insurance providers is the best way to find the best third party car insurance deals.

Third Party Insurance Price Uae - akuapprovesing

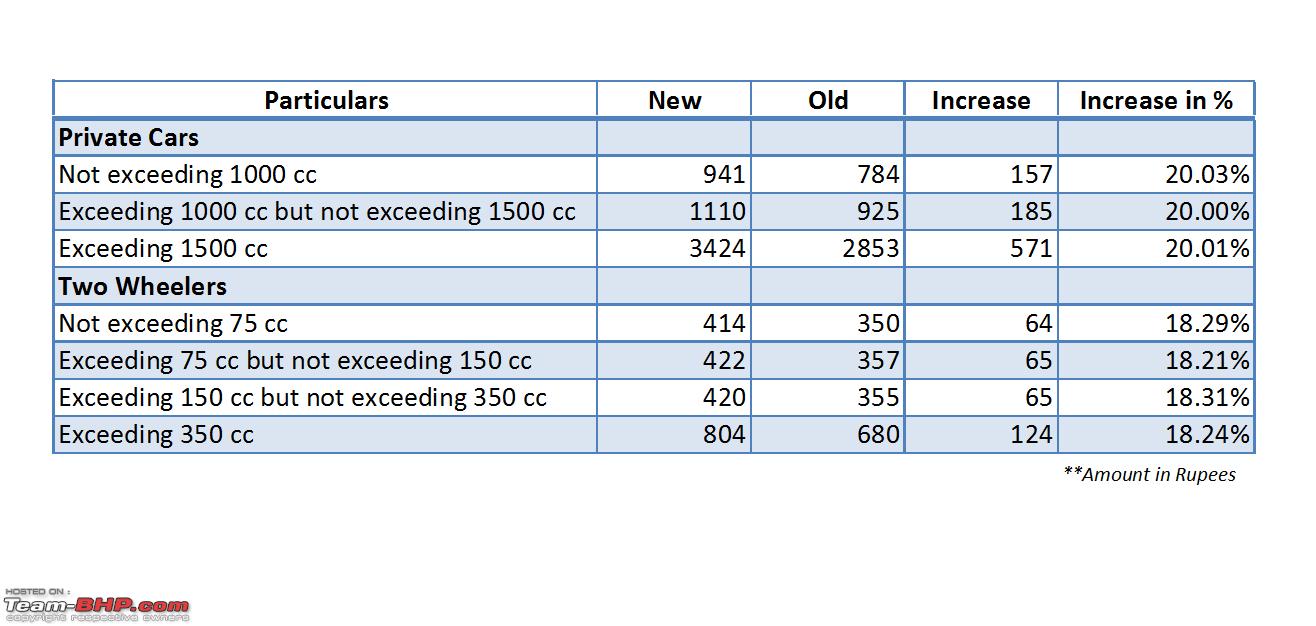

Third Party Insurance Premium to go up W.e.f 1st April 2013 - Team-BHP

Third Party Property Car Insurance | iSelect