Car Insurance For Own Damage

Sunday, August 11, 2024

Edit

Car Insurance For Own Damage – What do You Need to Know?

What is Own Damage Cover?

Own damage cover is a type of car insurance policy that covers financial losses in the event of an accident or other damages to your vehicle. It can also cover damage to third-party vehicles, as well as medical expenses for those who have been injured. It is an essential form of car insurance that can provide financial protection for drivers in the event of an accident.

What Does Own Damage Cover Include?

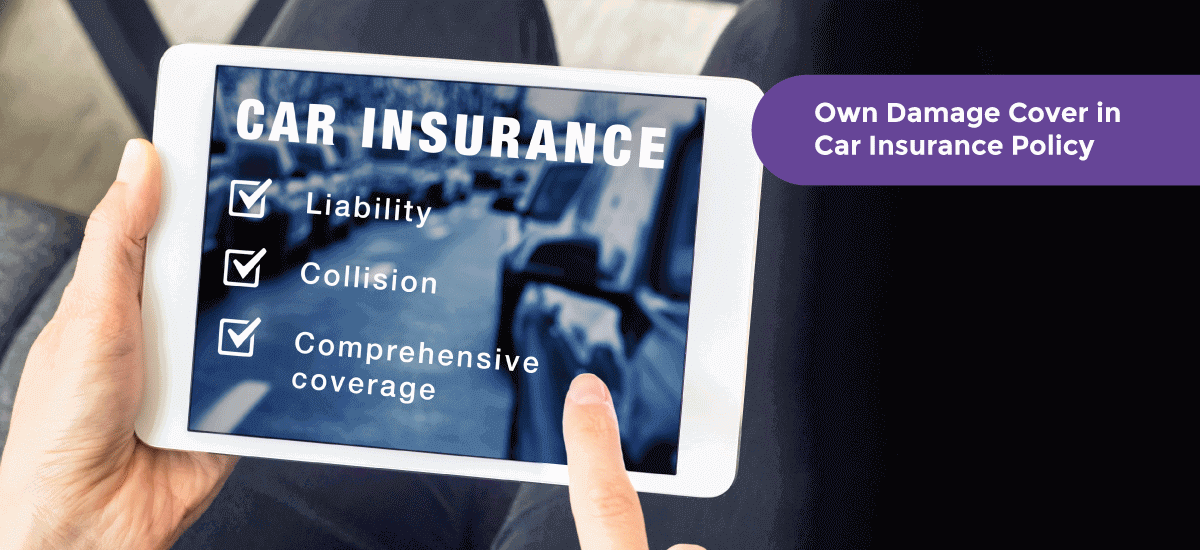

Own damage cover typically includes a variety of different types of coverage. These can include collision coverage, which covers damages to your vehicle resulting from a collision with another vehicle or object; comprehensive coverage, which covers damages to your vehicle resulting from theft, vandalism, or certain types of weather-related damages; and liability coverage, which covers damages to another person or property as a result of an accident. In addition, some policies may also include medical payments coverage, which covers medical expenses for people who have been injured in an accident.

What Are the Benefits of Own Damage Cover?

Own damage cover can provide drivers with a number of different benefits. Firstly, it can provide financial protection in the event of an accident. This can be especially helpful for those who have limited resources and may not be able to afford the cost of repairing or replacing their vehicle. In addition, it can also provide protection for third-party vehicles and medical expenses for those injured in an accident.

How Much Does Own Damage Cover Cost?

The cost of own damage cover varies depending on the type of coverage and the value of the vehicle. Generally, the higher the value of the vehicle, the higher the cost of the cover. In addition, the type of car, the driver’s age and driving record, and the amount of coverage purchased can all affect the price of the policy. It is important to shop around and compare quotes from different insurers to find the best deal.

How Do I Choose the Right Own Damage Cover?

When choosing the right own damage cover, it is important to consider all of the different types of coverage available. It is also important to consider the value of the vehicle and the amount of coverage you need. It is also important to consider the cost of the policy and the amount of excess you are willing to pay. Finally, it is important to compare quotes from different insurers to find the best deal.

Who Should Get Own Damage Cover?

Own damage cover is an essential form of car insurance that can provide financial protection in the event of an accident. It is important for all drivers to have this type of cover, regardless of the value of the vehicle. It is also important to remember that even if you are not at fault in an accident, you may still be liable for any damages that occur. Therefore, it is important to make sure you are covered in the event of an accident.

Own damage motor insurance can now be bought separately | Mint

Own Damage Cover in Car Insurance Policy

What is Own Damage Motor Insurance Policy? - Vehicle Insurance Basics

Auto Insurance Claim Guide | Ameriprise Auto & Home Insurance | Car

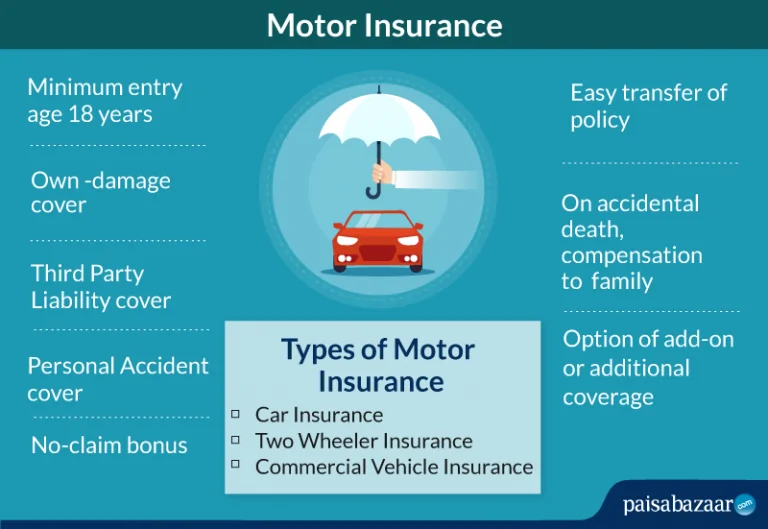

Motor Insurance in India: Types, Coverage, Claim & Renewal