What Is The Minimum Amount Of Liability Insurance Coverage Required

What Is The Minimum Amount Of Liability Insurance Coverage Required

What Is Liability Insurance Coverage?

Liability insurance coverage is an important form of insurance coverage that provides protection against financial losses caused by the negligence of an individual or business. This type of insurance is often required by law in certain industries and can help protect businesses, individuals, and other entities from the financial repercussions of a lawsuit, accident, or other incident. Liability insurance coverage typically covers the costs of legal fees, medical bills, and damages caused by the insured party.

What Does Liability Insurance Cover?

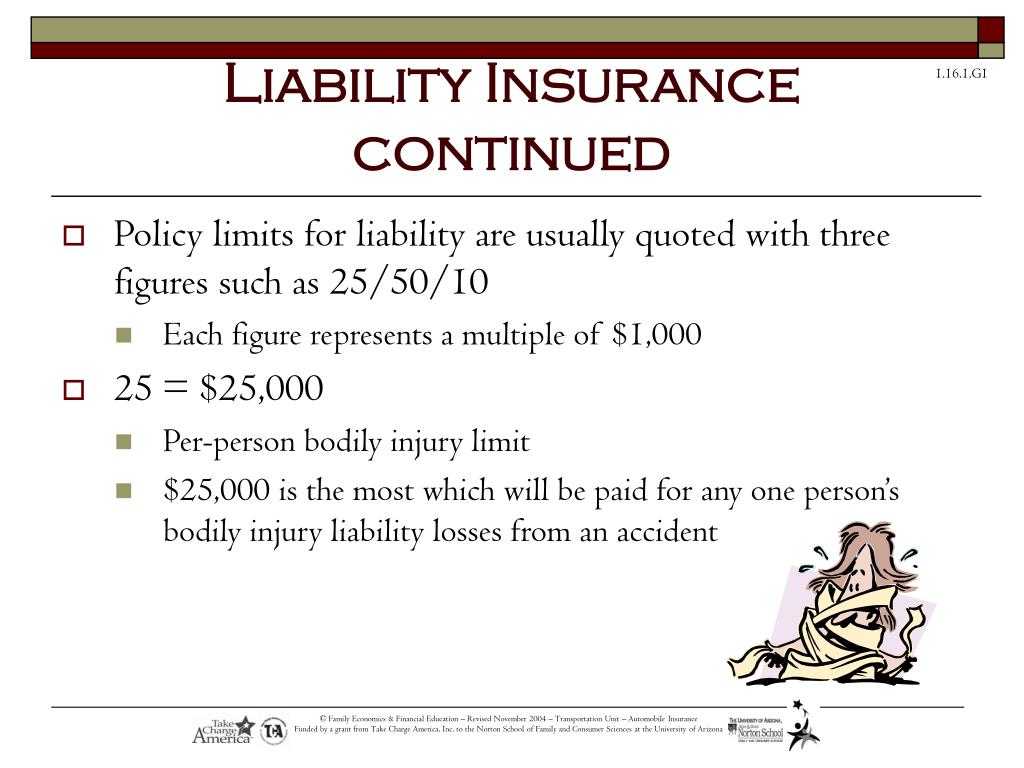

Liability insurance coverage generally covers any damages or legal costs resulting from an incident for which the insured party is found to be liable. This includes bodily injury, property damage, libel, slander, and other forms of liability. In some cases, liability insurance policies may also provide coverage for punitive damages, which are damages awarded to a plaintiff as punishment for an offense. Additionally, certain types of liability insurance policies provide coverage for legal defense costs, which are not typically covered by other types of insurance.

What Is The Minimum Amount Of Liability Insurance Coverage Required?

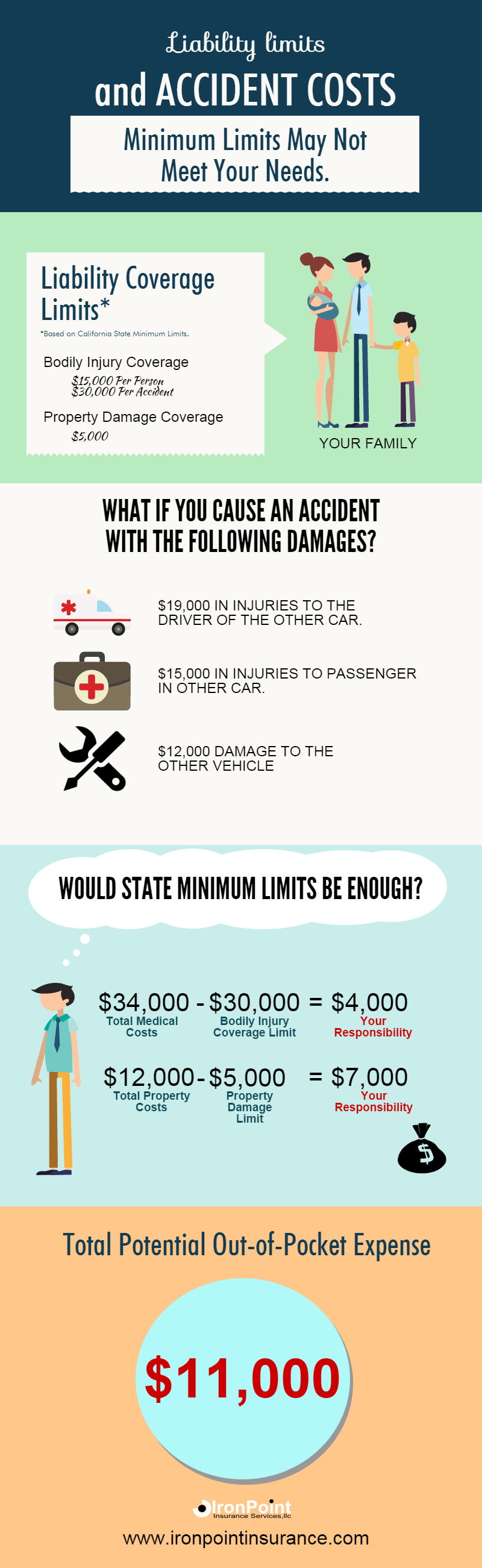

The amount of liability insurance coverage required varies from state to state and can also vary depending on the type of business. Generally, small businesses are required to carry at least $500,000 in liability insurance coverage. However, some states may require higher amounts, depending on the type of business or industry. Additionally, some businesses may be required to carry additional coverage depending on their particular situation.

Do I Need Additional Liability Insurance Coverage?

The amount of liability insurance coverage required by law may not be enough to fully protect you in the event of a lawsuit or other incident. Therefore, it is important to consider purchasing additional coverage if your business is exposed to greater potential losses. For example, a business that operates in a high-risk industry may need to purchase additional liability insurance coverage to protect against the potential for larger losses. Additionally, those who own valuable assets such as real estate or investments may want to consider additional coverage.

Where Can I Purchase Liability Insurance Coverage?

Liability insurance coverage can be purchased from a variety of sources, including insurance companies, brokers, and online providers. It is important to shop around and compare different policies to ensure you are getting the best coverage for your particular situation. Additionally, it is important to make sure the insurer is licensed and experienced in providing coverage for the type of business you operate.

Conclusion

Liability insurance coverage is an important form of insurance that can protect businesses, individuals, and other entities from the financial repercussions of a lawsuit, accident, or other incident. The amount of coverage required varies from state to state and can also vary depending on the type of business. Additionally, it is important to consider purchasing additional coverage if your business is exposed to greater potential losses. Liability insurance coverage can be purchased from a variety of sources, including insurance companies, brokers, and online providers.

All the Different Types of Car Insurance Coverage & Policies Explained

Should I buy minimum liability limits auto insurance?

Insightful Commentary on the State of Trucking Minimum Liability

The Best What Is The Minimum Amount Of Auto Insurance Required By Law

A Life Insurance Policy's Limit Of Liability Would Be - Higher Policy