12 States With No Fault Insurance

Saturday, August 17, 2024

Edit

12 States With No Fault Insurance

What is No Fault Insurance?

No Fault Insurance is a type of insurance policy that provides coverage regardless of fault in an accident. In other words, the insurance company pays for damages and injuries regardless of who is at fault. This type of insurance is found most often in states that have adopted the no fault provisions of the Uniform Motor Vehicle Accidents Compensation Act (UMVACA). No Fault Insurance is also known as Personal Injury Protection (PIP).

Which states have No Fault Insurance?

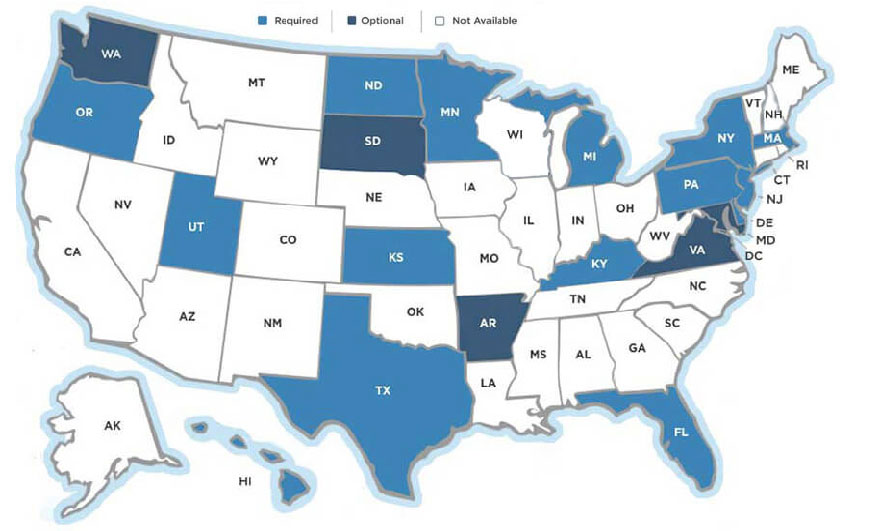

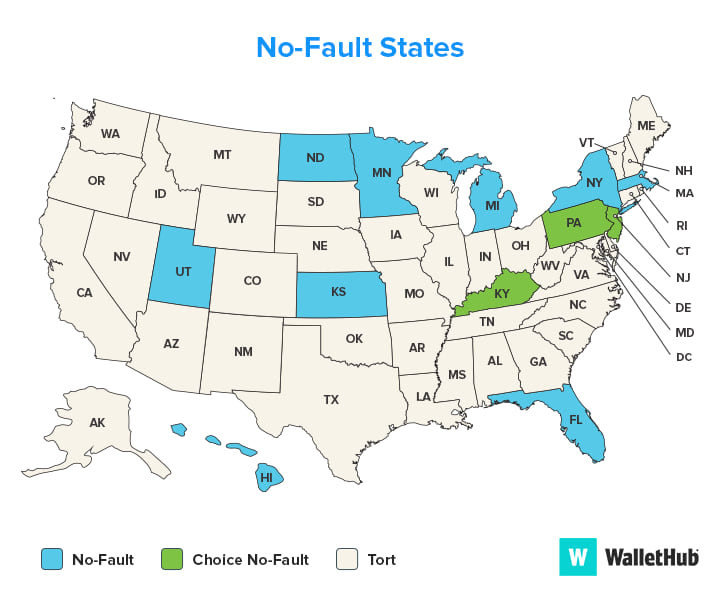

Currently, twelve states have adopted No Fault Insurance laws: Florida, Hawaii, Kansas, Kentucky, Massachusetts, Michigan, Minnesota, New Jersey, New York, North Dakota, Pennsylvania, and Utah. Each of these states has enacted its own version of No Fault Insurance regulations, but all of them share the same core concept: an insured person’s own insurance company pays for medical expenses and lost wages, regardless of fault in an accident.

What does No Fault Insurance typically cover?

No Fault Insurance typically covers medical expenses, lost wages, and in some cases, death benefits. It may also cover other related expenses, such as funeral costs and rehabilitation services. However, some states have imposed limits on the amount of coverage that may be provided. Different states also have different rules regarding how claims are handled and who is responsible for paying them.

What are the advantages of No Fault Insurance?

The primary advantage of No Fault Insurance is that it simplifies the claims process. Instead of determining fault in an accident, the insurance company pays for the losses regardless of fault. This removes the need for a lengthy legal battle, and allows for a faster resolution of the claim. This type of insurance also reduces the number of lawsuits that arise from accidents, since the insurance companies are responsible for paying the claim.

What are the disadvantages of No Fault Insurance?

The main disadvantage of No Fault Insurance is that it does not always provide sufficient coverage for the costs associated with an accident. Since the insurance company pays regardless of fault, the amount of coverage may not be enough to fully compensate the victim for all of their losses. Additionally, the no fault system can lead to higher insurance rates, since the insurance companies must pay out claims regardless of fault.

Conclusion

No Fault Insurance is a type of insurance policy that is found in twelve states. This type of insurance simplifies the claims process and reduces the number of lawsuits that may arise from an accident. However, it can also lead to higher insurance rates and may not always provide sufficient coverage for the costs associated with an accident.

Ultimate Guide to No-Fault Auto Insurance

No-fault Insurance Ny Phone Number - allintohealth

Did Your Car Accident Happen in a No-Fault State? - Dailey Law Firm

No Fault States: A Guide to Auto Insurance Regulations

No-Fault States | No-Fault Insurance States | The Hartford