What States Have No Fault Insurance

What Is No Fault Insurance?

No-fault insurance, sometimes called personal injury protection (PIP) insurance, is a type of coverage that helps you pay for medical and other expenses related to an accident – no matter who caused the accident. It is a form of auto insurance that is required in some states and optional in others. No-fault insurance laws vary from state to state, so it's important to know what type of coverage is required in your state.

What States Have No Fault Insurance?

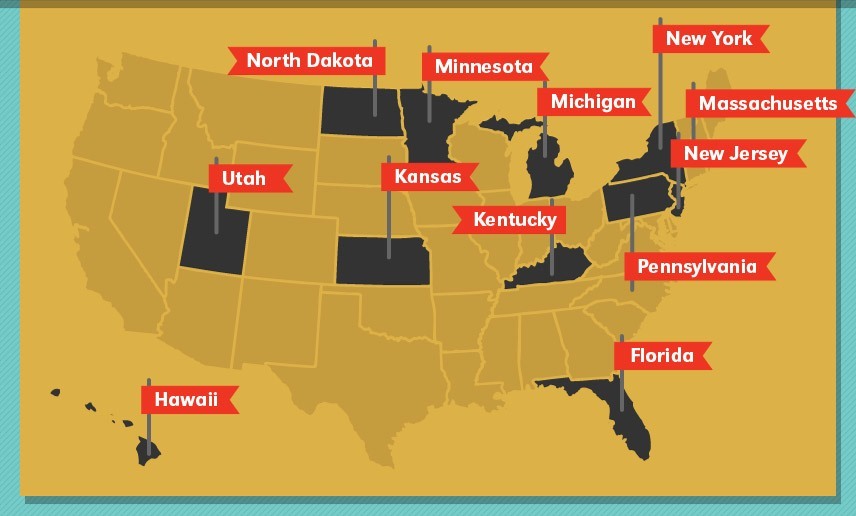

No-fault insurance is required in 12 states: Florida, Hawaii, Kansas, Kentucky, Massachusetts, Michigan, Minnesota, New Jersey, New York, North Dakota, Pennsylvania and Utah. In these states, drivers must carry no-fault insurance in order to legally drive. The type of coverage required and the minimum amount of coverage varies from state to state. In some states, drivers must carry medical payments coverage in addition to no-fault insurance. In other states, drivers must carry uninsured/underinsured motorist coverage in addition to no-fault insurance.

What Does No Fault Insurance Cover?

No-fault insurance typically covers medical expenses, lost wages, and other costs associated with accidents. In some states, it also covers property damage. The coverage limits vary from state to state, so it's important to know what type of coverage is required in your state. Generally, no-fault insurance does not cover damage to another person's vehicle, as that is typically covered by the other driver's liability insurance. In addition, no-fault insurance does not cover intentional damages, as those are typically covered by the other driver's comprehensive insurance.

Why Is No Fault Insurance Important?

No-fault insurance provides important protection to drivers in the event of an accident. It helps cover medical expenses, lost wages, and other costs associated with accidents, regardless of who caused the accident. In some states, it also covers property damage. The coverage limits vary from state to state, so it's important to know what type of coverage is required in your state. No-fault insurance is an important protection for drivers and should be considered when purchasing auto insurance.

Do I Need No Fault Insurance?

If you live in a state that requires no-fault insurance, then you must purchase it. In other states, no-fault insurance is optional but recommended. Even if you don't live in a state that requires no-fault insurance, it is still a good idea to purchase it. It provides important protection in the event of an accident and can help cover medical expenses, lost wages, and other costs associated with accidents.

Where Can I Get No Fault Insurance?

No-fault insurance is available from most major auto insurance companies. You can contact your current insurance provider to inquire about no-fault insurance or you can shop around for the best rates. It's important to compare rates and coverage options before purchasing no-fault insurance. Be sure to read the policy carefully before signing on the dotted line.

Ultimate Guide to No-Fault Auto Insurance

Can Someone Sue you for a Car Accident if you Have Insurance - Honest

How Do "No Fault" Laws Affect Your Personal Injury Case? | McKay Law

Divorce in No-Fault States | South Denver Law

Cheap No Fault Auto Insurance Quotes - Which States and What it Means