Sbi General Car Insurance Policy Status

SBI General Car Insurance Policy Status

What is SBI General Car Insurance Policy?

SBI General Car Insurance Policy is a comprehensive car insurance policy offered by SBI General Insurance Company Limited to protect your car against financial losses due to accidental damages, theft and other unforeseen events. It provides a wide range of coverage and benefits to ensure that you are taken care of financially in the event of an accident or other mishap. The policy also provides a wide range of add-on covers and discounts to suit your specific needs and budget.

Benefits of SBI General Car Insurance Policy

The SBI General car insurance policy provides several benefits, such as:

- Cashless repair facility at network garages

- 24x7 customer support

- Zero depreciation cover

- Accidental cover for co-passengers

- Third-party liability cover

- Coverage for personal belongings

- Cover for medical expenses

- Cover for electrical/non-electrical accessories

- Discounts on the premium amount

Eligibility Criteria for SBI General Car Insurance

To be eligible for the SBI General car insurance policy, you must meet the following criteria:

- You must be aged between 18 and 65 years

- You must possess a valid driving license

- You must have a valid registration certificate of the vehicle

- You must possess a valid third-party liability certificate

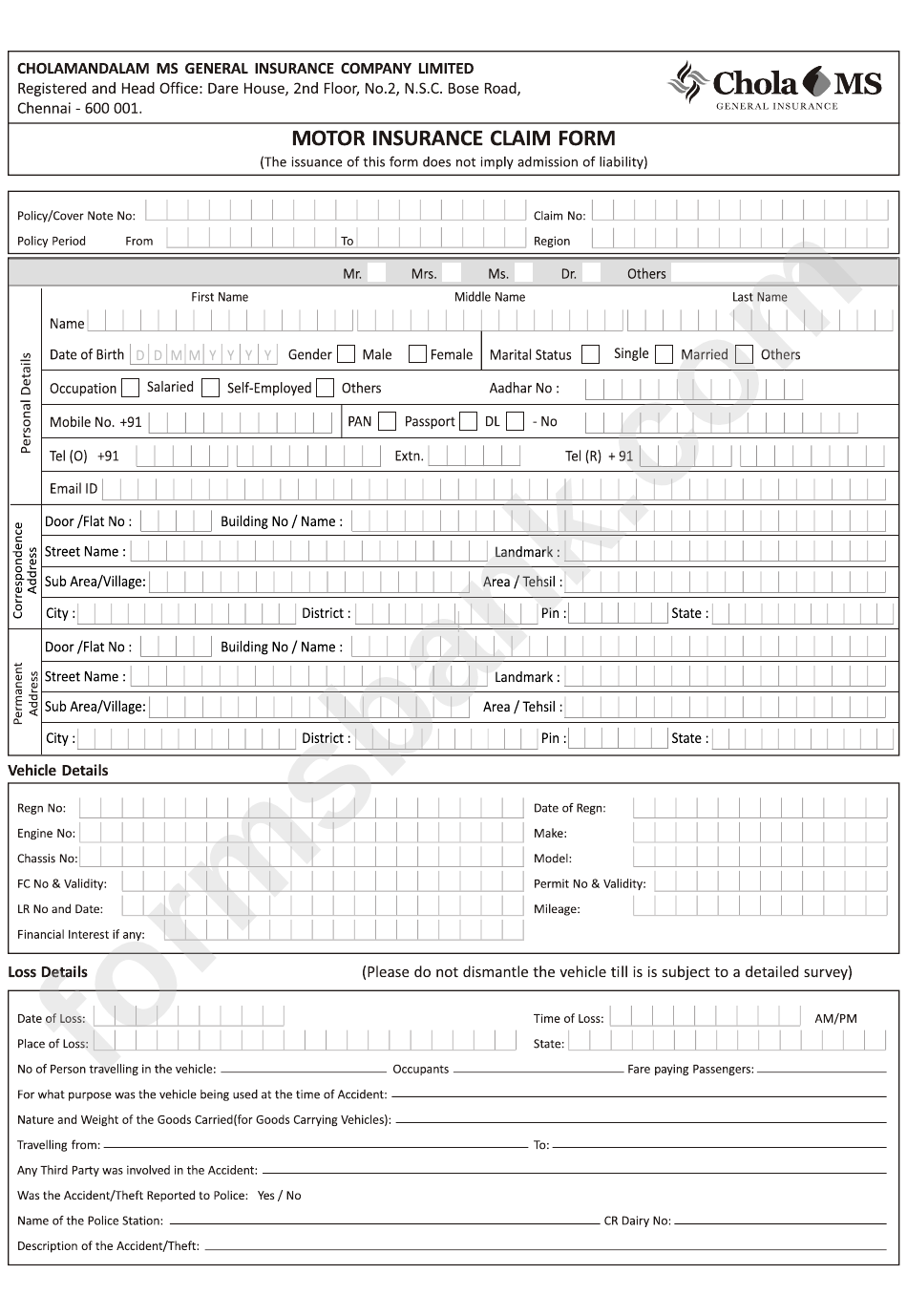

Documents Required for SBI General Car Insurance Policy

The following documents are required to apply for the SBI General car insurance policy:

- Duly-filled proposal form

- Copy of the registration certificate of the vehicle

- Copy of the driving license of the owner

- Copy of the valid third-party liability certificate

- Address proof of the owner

- Age proof of the owner

- Previous insurance policy details, if any

Claim Procedure for SBI General Car Insurance Policy

You can register a claim for your SBI General car insurance policy either online or by calling the toll-free number. When you register the claim, you need to provide the following information:

- Name of the policyholder

- Policy number

- Date and time of the incident

- Place of the incident

- Details of the incident

- Estimated repair cost

- Contact details

Once the claim is registered, the insurance company will assign a surveyor to examine the vehicle and assess the damage. The surveyor will also check the documents submitted and verify the policy details. Once the claim is approved, the insurance company will settle the claim and the repair work will be done at the network garage. The claim amount will be directly credited to the bank account of the policyholder.

Conclusion

The SBI General car insurance policy is a comprehensive car insurance policy that provides a wide range of coverage and benefits. It also provides several discounts and add-on covers to suit your specific needs and budget. The policy provides cashless repair facility at network garages and 24x7 customer support. The policy also has a hassle-free claim process. So, if you are looking for a comprehensive car insurance policy, the SBI General car insurance policy is the ideal choice.

Sbi General Insurance Claim Status - Awesome

Sbi General Insurance Claim Status - Awesome

Sbi Car Insurance Claim Form

[PDF] SBI Motor Private Car Insurance Brochure PDF Download – InstaPDF

![Sbi General Car Insurance Policy Status [PDF] SBI Motor Private Car Insurance Brochure PDF Download – InstaPDF](https://instapdf.in/wp-content/uploads/pdf-thumbnails/sbi-motor-private-car-insurance-brochure-2520.jpg)

SBI Online Payment | SBI General Insurance Pay Premium, Policy renewal