On Average How Much Is Car Insurance Per Month

On Average How Much Is Car Insurance Per Month?

Car Insurance: An Overview

Car insurance is a financial product that provides protection for drivers and their vehicles against the cost of unforeseen losses and damages. It typically covers the cost of repair or replacement of a vehicle, as well as legal fees, medical bills, and other expenses that may be incurred as a result of an accident. This type of insurance is required by law in most states and is an important part of being a responsible driver. In addition, car insurance can also provide peace of mind in the event of an accident or other unexpected event.

Factors That Affect Car Insurance Costs

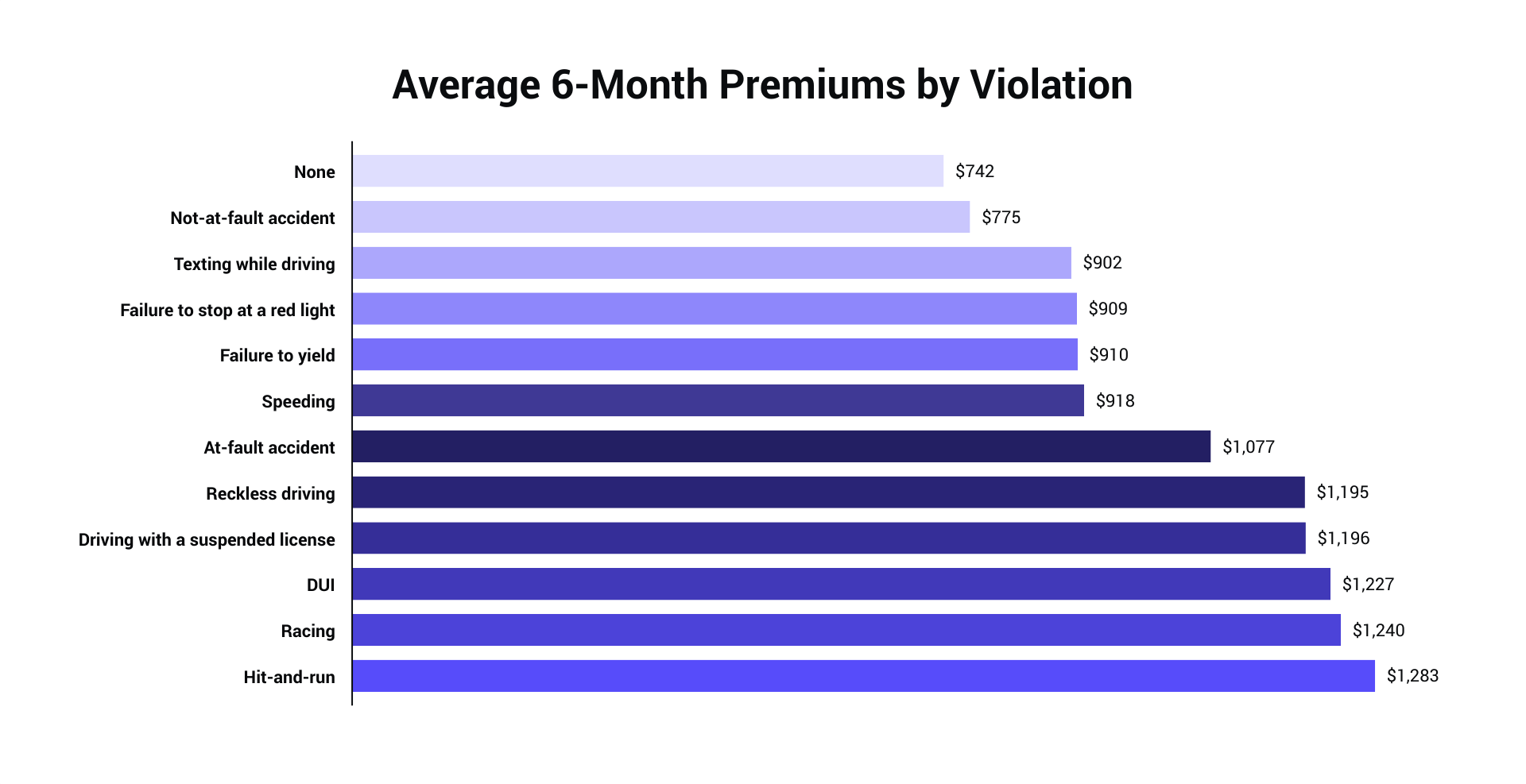

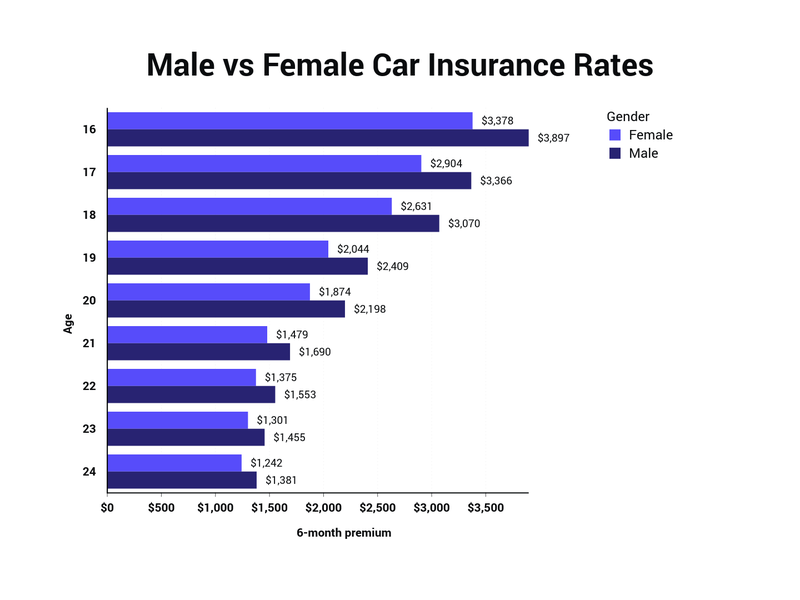

When it comes to determining how much car insurance costs per month, there are several factors that come into play. The type of car and its make and model, the age and driving history of the driver, their credit score, and the type of coverage they choose are all factors that can affect the cost of car insurance. Generally, the more expensive the car, the higher the insurance costs will be. Drivers with a good driving record and a high credit score may qualify for discounts on their insurance premiums.

Average Cost of Car Insurance per Month

The average cost of car insurance per month can vary depending on the above-mentioned factors. On average, however, a driver can expect to pay between $50 and $150 per month for a basic policy. This cost may be higher for drivers who choose more comprehensive coverage, such as collision or comprehensive coverage. Additionally, the cost of car insurance can vary depending on the state and insurer.

How to Get the Best Rate on Car Insurance

The best way to get the best rate on car insurance is to shop around and compare quotes from different insurers. It is important to compare coverage, deductibles, limits, and other features. Additionally, drivers should consider bundling their policies with other types of insurance, such as home or life insurance, to get the best possible rate.

Tips for Saving Money on Car Insurance

There are several ways to save money on car insurance. Drivers can take advantage of discounts such as those for being a safe driver, having multiple policies with the same insurer, or having a good credit score. Additionally, drivers should consider raising their deductibles, as this can lead to lower premiums. Lastly, drivers should make sure to keep their driving record clean, as this can help to keep their premiums low.

Bottom Line

The average cost of car insurance per month can vary depending on the type of car, the driver's age and driving history, and the type of coverage chosen. By shopping around, drivers can get the best rate on their car insurance. Additionally, they can take advantage of discounts, raise their deductibles, and keep their driving record clean in order to save money on their premiums.

Average Cost Of Car Insurance For 19 Year Old Female - Car Retro

Average Price Of Car Insurance Per Month - designby4d

ALL You Need to Know About the Average Car Insurance Cost

Car Insurance Rates By Age And Gender - Average Cost of UK Car

How Much Is Car Insurance In Nyc Per Month - New York City Car