Insurance Cost For Electric Car

What is the Cost of Insuring an Electric Car?

Electric cars are becoming more popular as people become more conscious of their environmental impact. As electric cars become more common, it's important to understand the cost of insuring them. There are a few factors that can affect the cost of insurance for an electric car, including the type of car you choose, the coverage you select, and your driving record. In this article, we'll take a look at some of the factors that can influence the cost of insurance for an electric car.

Type of Electric Car

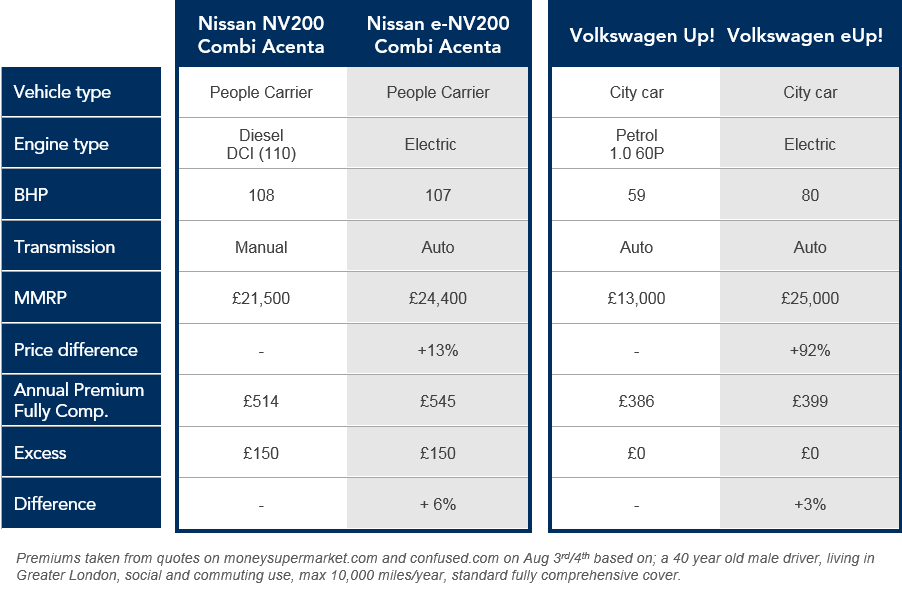

The type of electric car you choose can affect the cost of your insurance. Generally, electric cars tend to be more expensive to insure than their gas-powered counterparts. This is because electric cars are more expensive to repair, as the parts are more specialized and often not available in all locations. This can drive up the cost of your insurance premiums.

Coverage Options

The coverage you select for your electric car can also affect the cost of your insurance. Comprehensive coverage, which covers damage to your car caused by something other than a collision, can be more expensive than collision coverage, which only covers damage to your car caused by a collision. It is important to consider the type of coverage you need when selecting insurance for an electric car, as this will affect the cost.

Driving Record

Your driving record can also have an impact on the cost of insuring an electric car. If you have a clean driving record, your insurance premiums will likely be lower than if you have a few moving violations or accidents on your record. This is because insurance companies view a clean driving record as a sign that you are a safe and reliable driver.

Credit Score

Your credit score can also affect the cost of your insurance premiums. Insurance companies use your credit score to assess your risk as a driver and they may charge you higher premiums if you have a lower credit score. It is important to keep an eye on your credit score, as this can affect the cost of your insurance.

Location

The location you live in can also have an effect on the cost of your insurance. Insurance rates can vary from state to state, so it is important to research the insurance rates in your area before purchasing a policy. In some states, electric cars may be eligible for discounts or other incentives, which could lower the cost of your insurance.

Understanding the cost of insuring an electric car is important when considering making the switch from gas-powered vehicles. The type of car, coverage options, driving record, credit score, and location can all affect the cost of insurance for an electric car. By taking these factors into consideration, you can make an informed decision about the right insurance policy for your electric car.

Average Cost of Electric Car Insurance UK 2020 | NimbleFins

The real cost of running an electric vehicle

Electric Cars cost $400 more to be Insured on Average compared to a

Electric cars ranked by the cost of autonomy

Buying an Electric Car? For Savings, Time Could Be of the Essence