Cost Of Medicare Gap Insurance

What is Medicare Gap Insurance and What Does it Cost?

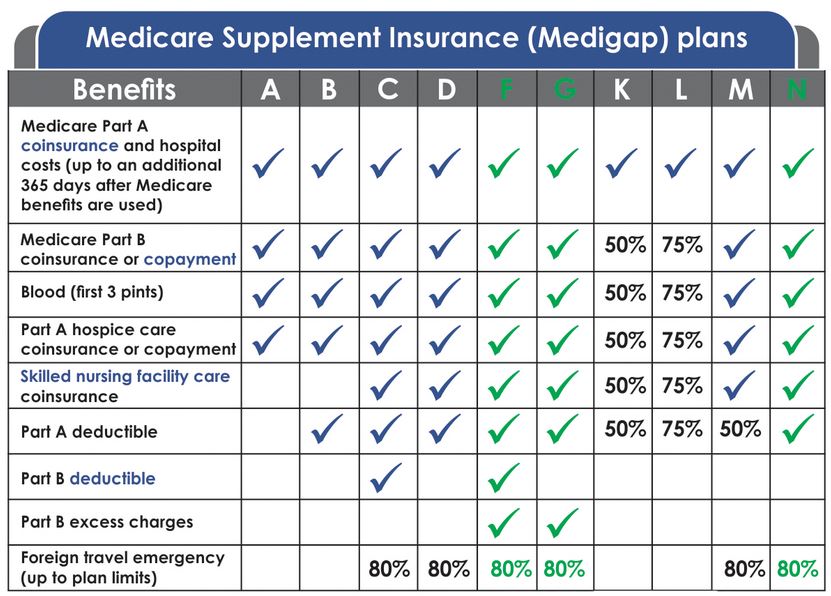

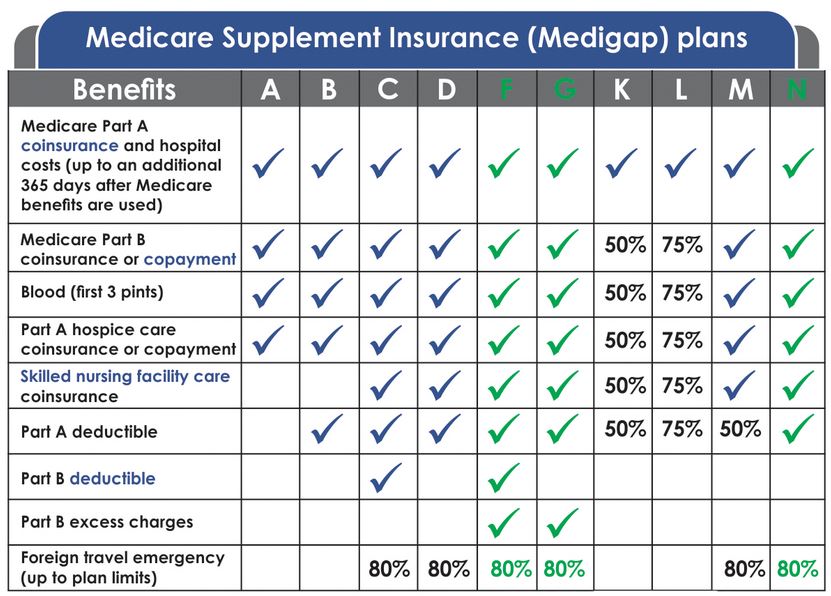

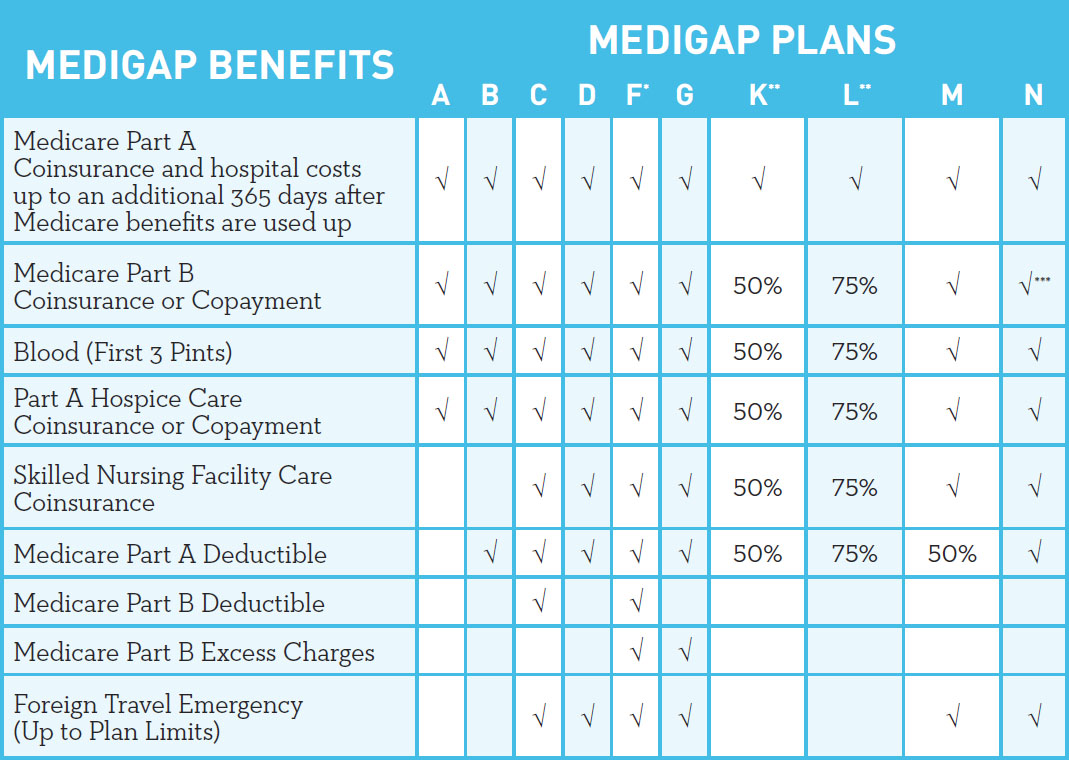

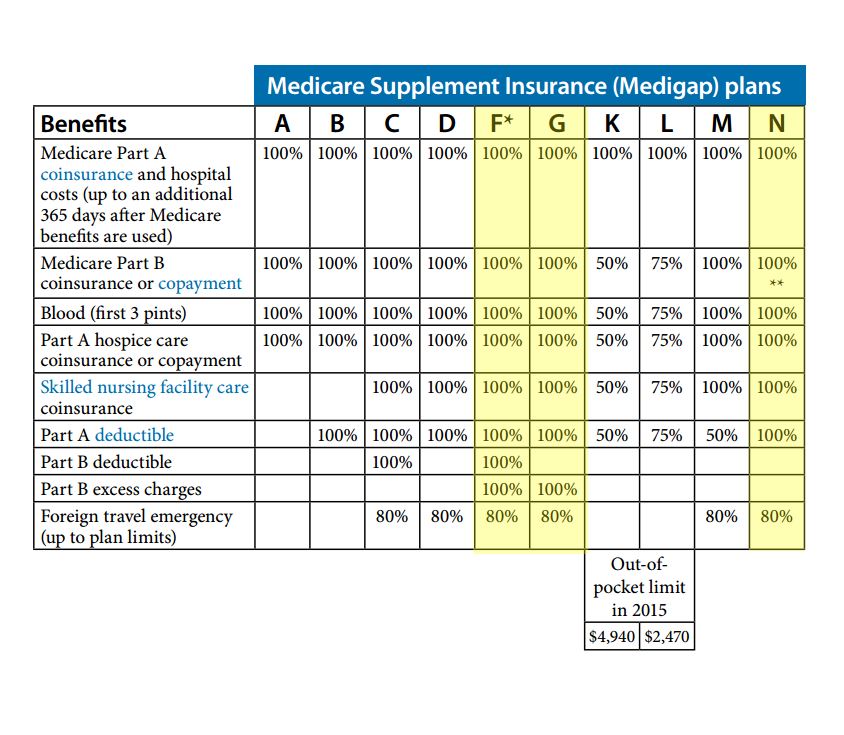

Medicare gap insurance is a type of supplemental insurance that is designed to cover the costs of medical care not covered by the standard Medicare insurance policies. As with any type of insurance, the cost of gap insurance will depend on a variety of factors, and the cost will vary from plan to plan. However, in general, gap insurance can be extremely affordable, and even the most expensive plans tend to be much less expensive than traditional health insurance policies.

Gap insurance is an important type of coverage for anyone who is enrolled in Medicare. Medicare is the government-funded health insurance program for people over the age of 65, and for those with disabilities. Medicare is designed to cover many of the essential costs associated with healthcare, such as hospital stays, doctor visits, and prescription medications. However, there are certain costs that are not covered by the standard Medicare policies, such as the cost of long-term care, and certain types of medical equipment. This is where gap insurance comes in.

How Much Does Medicare Gap Insurance Cost?

The cost of gap insurance can vary significantly depending on the type of policy you choose and the provider you use. Generally speaking, the cost of a gap policy will depend on the extent of the coverage you choose, as well as any additional riders or benefits you add. For example, some policies may include coverage for long-term care, which will increase the cost of the policy. Additionally, some policies may include riders that allow you to increase the amount of coverage you receive, which could also increase the cost of the policy.

In addition to the cost of the coverage, there may also be additional fees associated with the policy. For example, some policies may require a deductible, which is an upfront fee that you must meet before the policy will begin to pay out. Additionally, there may be other fees associated with the policy, such as a monthly or annual premium. These fees will vary depending on the provider, so it is important to shop around and compare different policies before making a decision.

Is Medicare Gap Insurance Worth the Cost?

In most cases, gap insurance is worth the cost. Gap insurance can provide you with financial protection against the costs of medical care not covered by Medicare. This can be especially helpful for those who are enrolled in Medicare and have a limited income, as gap insurance can help to reduce the financial burden associated with medical care. Additionally, gap insurance can also provide peace of mind, as it can help you to be more prepared for any unexpected medical expenses that may arise.

Ultimately, the decision of whether or not to purchase gap insurance is a personal one. Before making a decision, it is important to consider the cost of the policy and the extent of the coverage, as well as any additional fees associated with the policy. Additionally, it is important to compare different policies and providers to ensure you are getting the best coverage and the best value for your money.

What Is The Cost Of Supplemental Medicare Insurance

2019 Medicare Supplement (Medigap) Plans - Maine's Health Insurance

Medicare Gap Insurance Cost / How Much Does a Medicare Supplement

What Medicare Plan Do I Have

Costs of the Medicare Part D - Wisconsin Medicare Plans