How Much Is Insurance For Tesla Model 3

Insurance Cost for Tesla Model 3

Tesla Model 3 Overview

The Tesla Model 3 is one of the most popular electric vehicles on the market. It has a sleek and stylish design, great performance, and a range of features that make it a great choice for drivers. The Model 3 is available in both rear-wheel drive and all-wheel drive options, as well as a variety of battery sizes and range options. It also has some of the most advanced tech features, like autonomous driving and sophisticated safety systems. But with all these great features comes a high cost, so many drivers are wondering how much insurance for Tesla Model 3 will be.

Factors Affecting Insurance Cost

When it comes to insurance cost, there are a few factors that can affect it. The first and most important factor is the driver's driving record. Drivers with a good driving record are likely to get a better rate than those with a bad driving record. The second factor is the type of coverage the driver is looking for. Comprehensive coverage is usually more expensive than basic coverage, so if a driver is looking for the best coverage possible, they should expect to pay more. The location of the vehicle is also a factor, as insurance companies take into account the area's crime rate and likelihood of damage or theft. Finally, the age of the Tesla Model 3 can affect the cost. Newer vehicles typically have higher insurance premiums, as they are more expensive to repair or replace.

Average Insurance Cost for Tesla Model 3

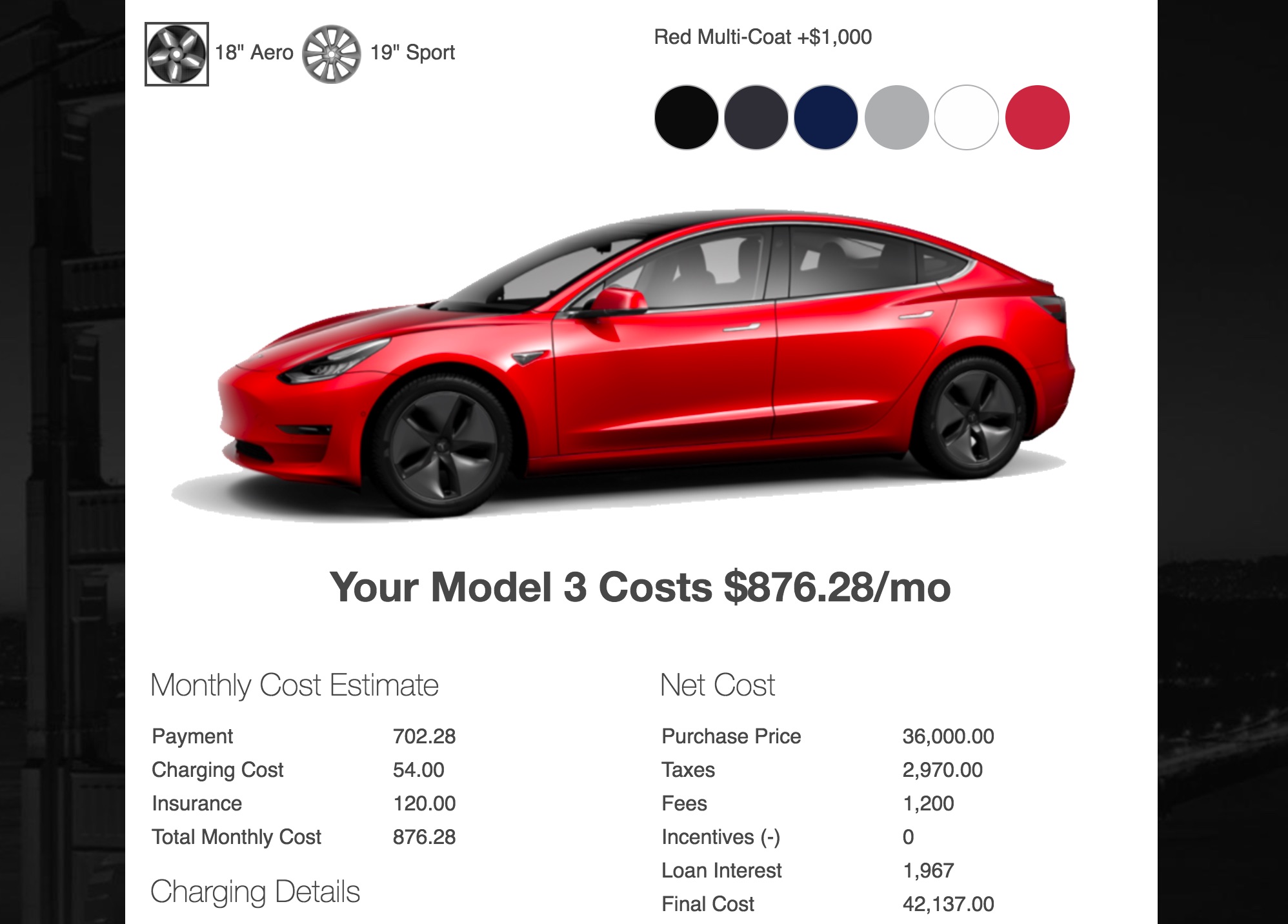

The average insurance cost for a Tesla Model 3 depends on a variety of factors. However, most drivers can expect to pay around $2,000 per year for comprehensive coverage. This includes liability and collision coverage, as well as personal injury protection and uninsured/underinsured motorist coverage. Of course, drivers with a higher risk profile may pay more, while those with a better driving record may pay less. Additionally, drivers who opt for less coverage or higher deductibles may be able to get cheaper insurance rates.

Other Factors to Consider

When it comes to insurance for Tesla Model 3, there are a few other factors to consider. First, drivers should make sure their insurance company offers the right coverage for their needs. Many companies offer discounts for drivers who bundle multiple coverage options, such as home and auto insurance, so it pays to shop around. Additionally, drivers should make sure their insurance company offers roadside assistance, as this can be invaluable if their Tesla Model 3 ever needs a tow or other emergency service. Finally, drivers should be sure to check their insurance company's claims process, as this can make a big difference if they ever need to make a claim.

Conclusion

Insuring a Tesla Model 3 can be expensive, but it is important to make sure you are getting the right coverage at the right price. Drivers should shop around and compare rates from different companies to make sure they get the best deal. Additionally, they should make sure their insurance company offers the right coverage and features for their needs. With a little bit of research, drivers can find the right insurance for their Tesla Model 3 and enjoy its many features without breaking the bank.

Insurance HOW MUCH on a Tesla Model 3 Performance?! - YouTube

how much does it cost to fill a tesla model 3 - www.summafinance.com

Tesla Model 3 | TRUE Cost of Ownership | Price, Insurance, Maintenance

Here's How Tesla Model 3 Is Cheaper To Own Than Toyota Camry

eBay My Garage Has Everything Your Tesla Model 3 Needs