How Much Is Tesla Insurance For Model 3

Friday, January 27, 2023

Edit

Tesla Model 3 Insurance: What You Need to Know

Tesla’s Model 3 is one of the most sought-after electric vehicles on the market. It offers a range of features and benefits that make the car attractive to many people. But, like any other car, it needs insurance to protect it from potential damage or liability claims. So, how much is Tesla Model 3 insurance?

Factors That Affect Tesla Model 3 Insurance Rates

Insurance rates for a Tesla Model 3 depend on a variety of factors. The first factor is the make and model of the car. The Tesla Model 3 is a high-end vehicle that has a higher value than a traditional gas-powered car. This means that insurance costs will be higher than the average car.

The second factor is the age and driving history of the driver. Insurance companies take into consideration the age, driving record, and other factors to determine the risk of insuring a particular driver. If the driver has a good driving record and is a responsible driver, the insurance rate will likely be lower.

The third factor is the location where the car will be driven. Insurance rates vary from state to state, so it’s important to research the insurance rates in the area where the car will be driven. In addition, insurance rates may be higher in some areas due to a higher risk of accidents.

Tesla Model 3 Insurance Cost

The cost of insurance for a Tesla Model 3 will vary from driver to driver, depending on the factors listed above. On average, the cost of insurance for a Tesla Model 3 is about $1,000 per year. However, this cost can be higher or lower depending on the factors mentioned above.

It’s also important to remember that insurance companies will also take into account the age of the car and the type of coverage that is chosen. If the driver chooses a higher level of coverage, the cost of insurance will be higher.

How to Find the Best Insurance Rate for a Tesla Model 3

The best way to find the best insurance rate for a Tesla Model 3 is to shop around. Insurance companies offer different rates and policies, so it’s important to compare rates and policies. It’s also a good idea to speak with an insurance agent to get a better understanding of the different types of coverage that are available.

In addition, it’s important to look for discounts. Many insurance companies offer discounts for a variety of reasons, including good driving records, age, and loyalty. It’s important to ask about these discounts to get the best rate possible.

Conclusion

Tesla Model 3 insurance can be expensive, but it’s important to make sure that the car is protected from potential damage or liability claims. It’s important to shop around and compare rates and policies to get the best rate possible. It’s also important to look for discounts to get the most affordable rate. By taking the time to research and compare rates, drivers can save money and make sure that their car is protected.

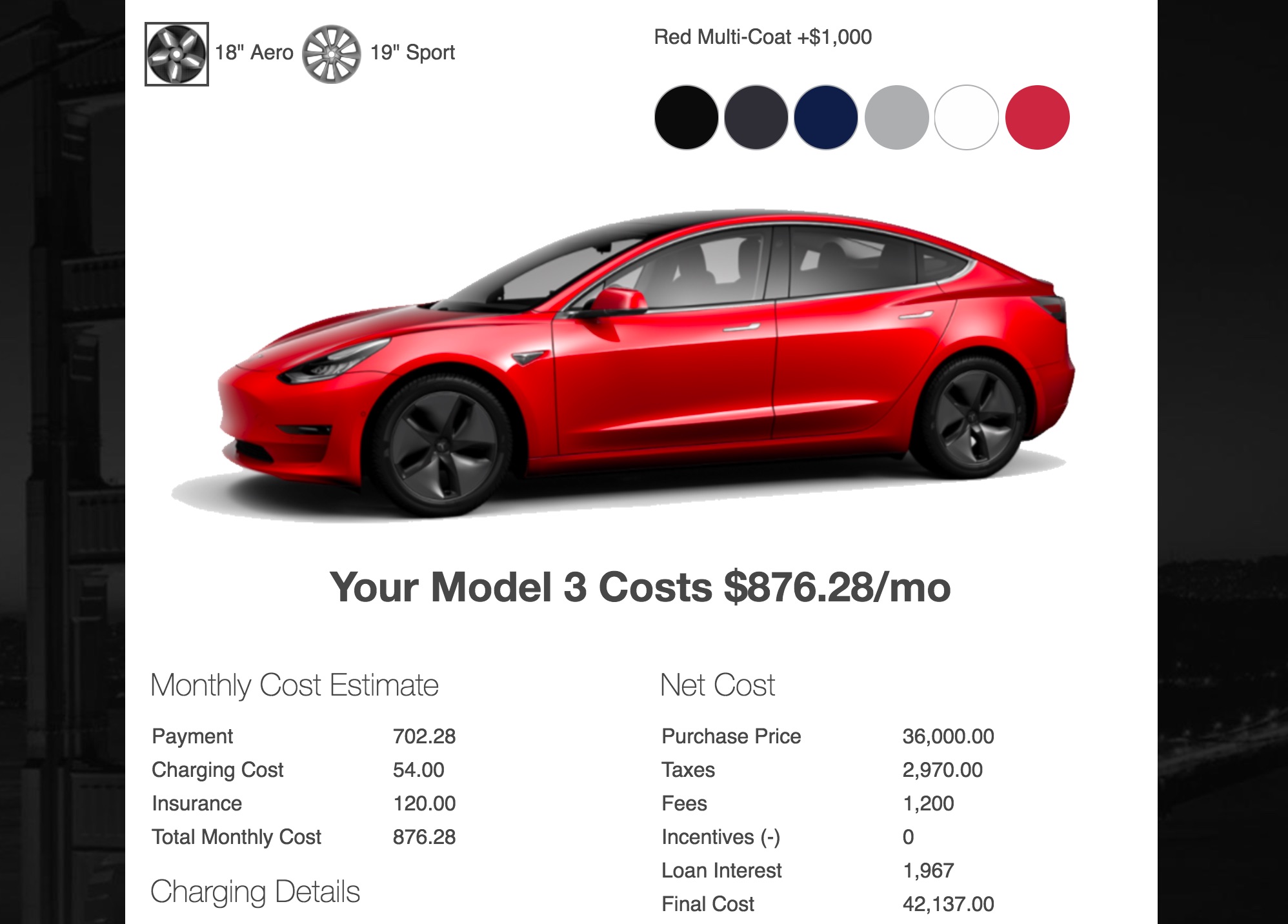

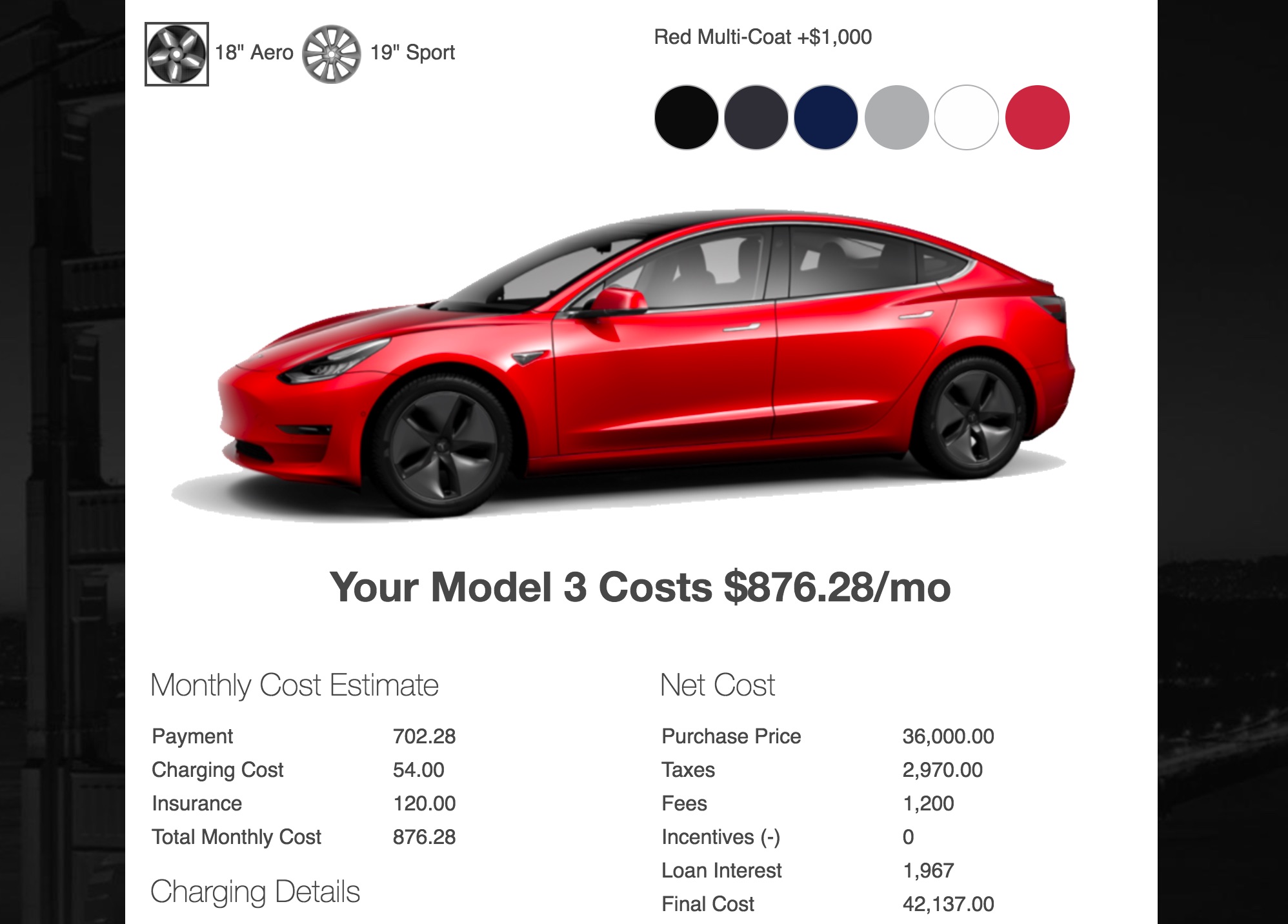

Tesla Model 3 monthly payment after tax, fees, insurance, and charging

Insurance HOW MUCH on a Tesla Model 3 Performance?! - YouTube

Tesla Model 3 Insurance Cost for 2021 [Rates + Free Comparison Quotes]

![How Much Is Tesla Insurance For Model 3 Tesla Model 3 Insurance Cost for 2021 [Rates + Free Comparison Quotes]](https://mk0insuravizcom0fmqo.kinstacdn.com/wp-content/uploads/dataviz/model-3-insurance-summary-cid81837.png)

Tesla Model 3 Insurance Cost Puts It on This List of the Cheapest Cars

Tesla Model 3 Insurance Massachusetts - The 10 Most Expensive Cars To