Home Owner Insurance Claim More Than Bill

Tuesday, April 2, 2024

Edit

Homeowner Insurance Claim More Than Bill

What Kind of Insurance is Homeowner Insurance?

Homeowner insurance is a type of property insurance that covers a property owner’s belongings and liability in the event of an accident or damage to the property. It is typically offered to those who own homes, condos, and townhomes, and can also be used to cover rental homes. Homeowners insurance covers a wide range of damages, including fire, theft, flooding, and natural disasters. Homeowner insurance also provides liability coverage for any bodily injury that may occur on the premises.

How Does Homeowner Insurance Work?

Homeowner insurance works by protecting the insured from financial losses due to damages to their property or the belongings within it. The insurance company pays the homeowner a predetermined amount if the cost of repairs or replacement of the items is more than the policy’s limit. Homeowner insurance policies usually include a deductible, which is the amount the insured must pay out of pocket before the insurance company will pay for the rest of the claim. The insured is also protected from liability if someone is injured on the property.

How Does a Homeowner File a Claim?

When filing a homeowner insurance claim, the insured will need to provide proof of the damage. This can include photographs, receipts, and other documents. The insurance company will then assess the damage and determine if the cost of repairs or replacement of the items is more than the policy’s limit. If it is, the insurance company will reimburse the homeowner for the difference. The homeowner may also need to provide proof of ownership of the items if they’re not covered by the policy.

What Happens if the Claim is More Than the Policy Limit?

If the cost of repairs or replacement of the items is more than the policy’s limit, the homeowner may be responsible for paying the difference. It’s important to note that the insurance company may deny a claim if the homeowner does not have sufficient proof of ownership or damage. In this case, the homeowner may need to pursue legal action in order to receive a payout.

What Are the Benefits of Homeowner Insurance?

Homeowner insurance provides financial protection against a variety of damages, including fire, theft, flooding, and natural disasters. It also provides liability coverage for any bodily injury that may occur on the premises. Additionally, homeowner insurance can help to cover the cost of repairs or replacement of items if the claim is more than the policy’s limit.

Conclusion

Homeowner insurance is a type of property insurance that covers a property owner’s belongings and liability in the event of an accident or damage to the property. When filing a homeowner insurance claim, the insured will need to provide proof of the damage. If the cost of repairs or replacement of the items is more than the policy’s limit, the homeowner may be responsible for paying the difference. Homeowner insurance provides financial protection against a variety of damages, as well as liability coverage for any bodily injury that may occur on the premises.

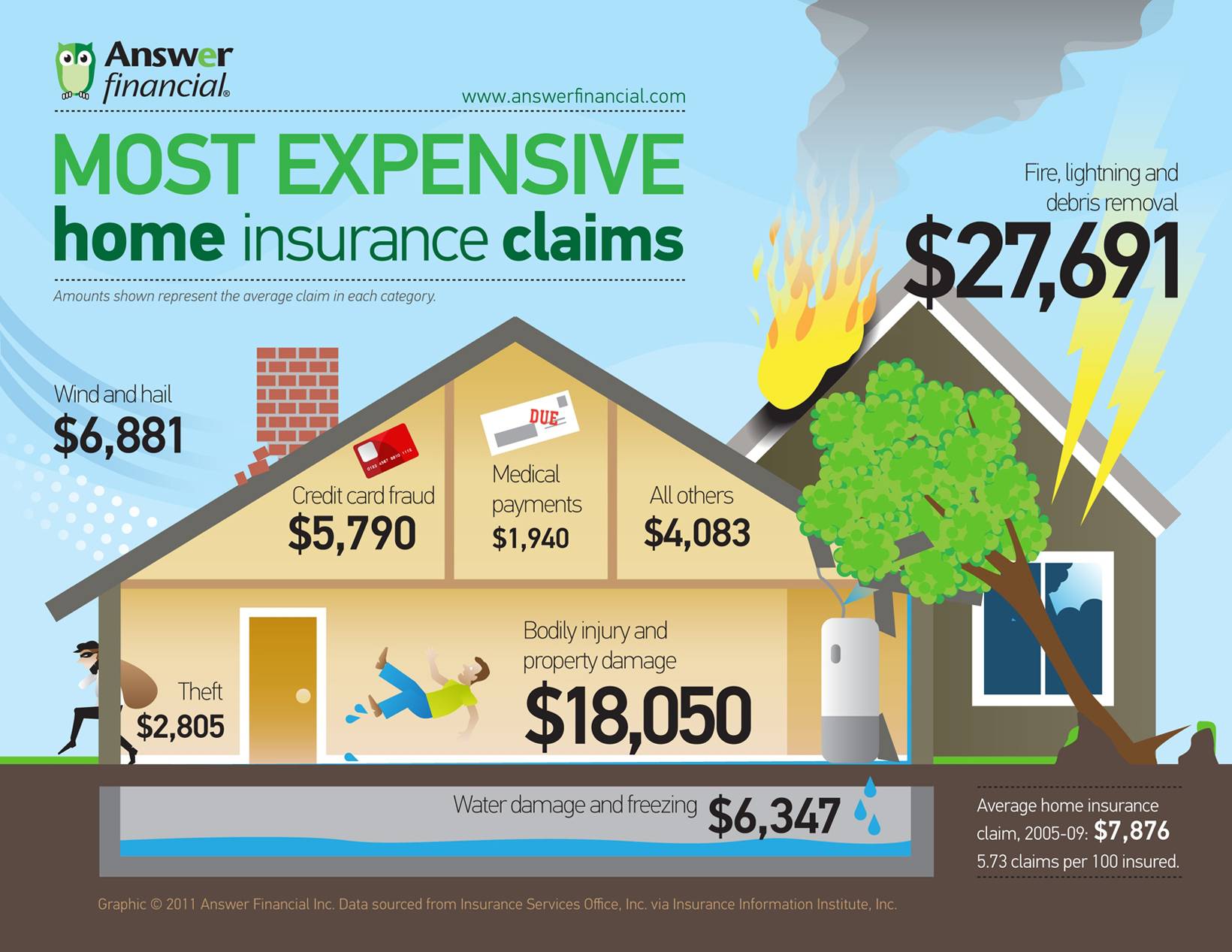

Most Expensive Home Insurance Claims [Infographic] | Insurance Center

![Home Owner Insurance Claim More Than Bill Most Expensive Home Insurance Claims [Infographic] | Insurance Center](https://www.answerfinancial.com/insurance-center/wp-content/uploads/2011/09/Most-Expensive-Homeowners-Insurance-Claims.jpg)

Homeowners Insurance: Reasons why homeowners claims get denied

Apartment Utility Breakdown: What Apartment Life Costs Beyond the Rent

Assessing Your Home Insurance Coverage - Compass Insurance Agency